Everyone’s version of wealth looks different, but setting clear financial goals gives your money a direction. The key is not to just work for money but to reach a point where your investments work for you. These goals are designed to create freedom, security, and options — not just a bigger paycheck.

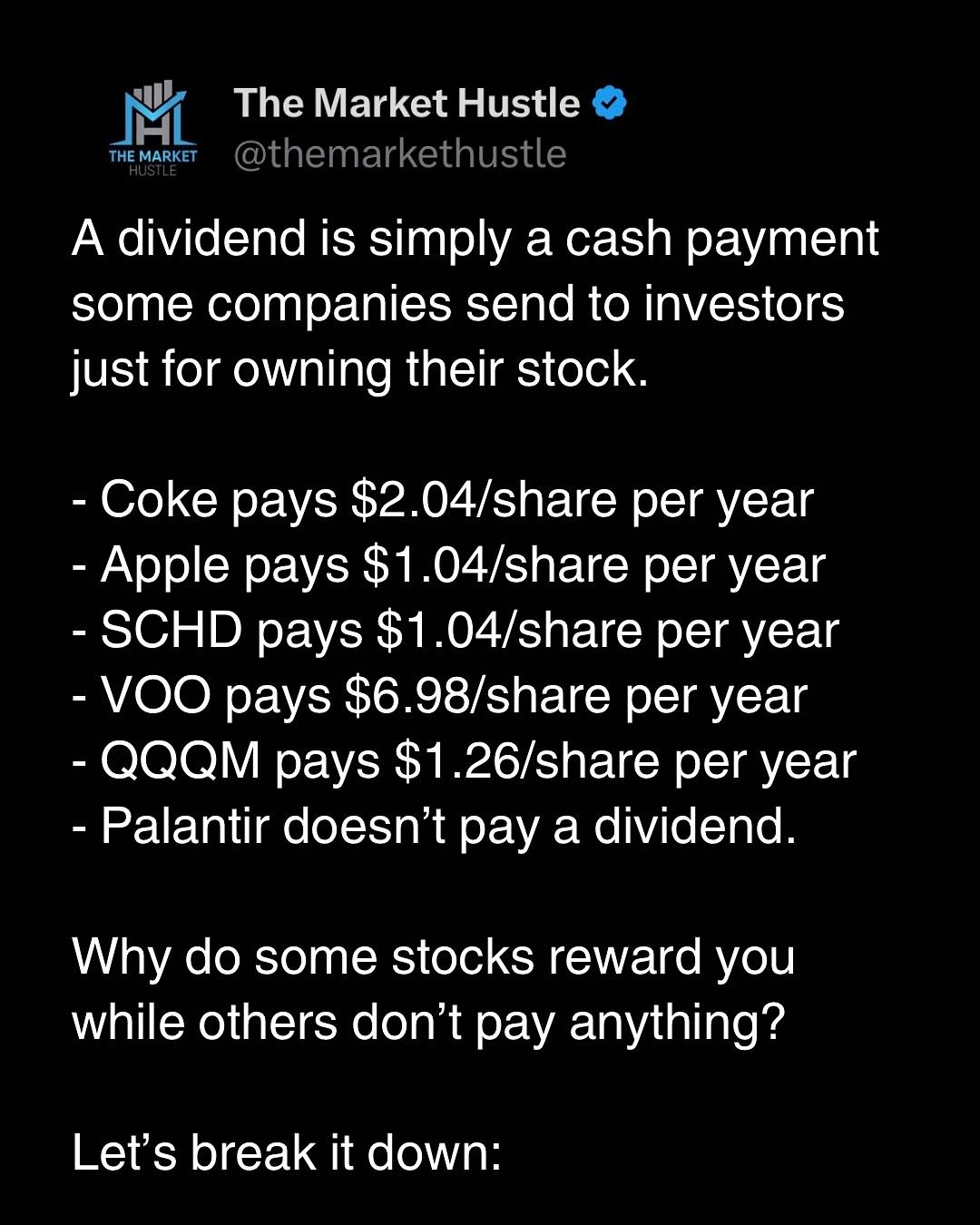

By 40, one goal is for investments to pay for at least two vacations a year. Imagine building enough passive income through dividends, real estate, or business profits that your lifestyle upgrades itself without extra hours worked. That’s what financial independence really looks like — earning while you rest.

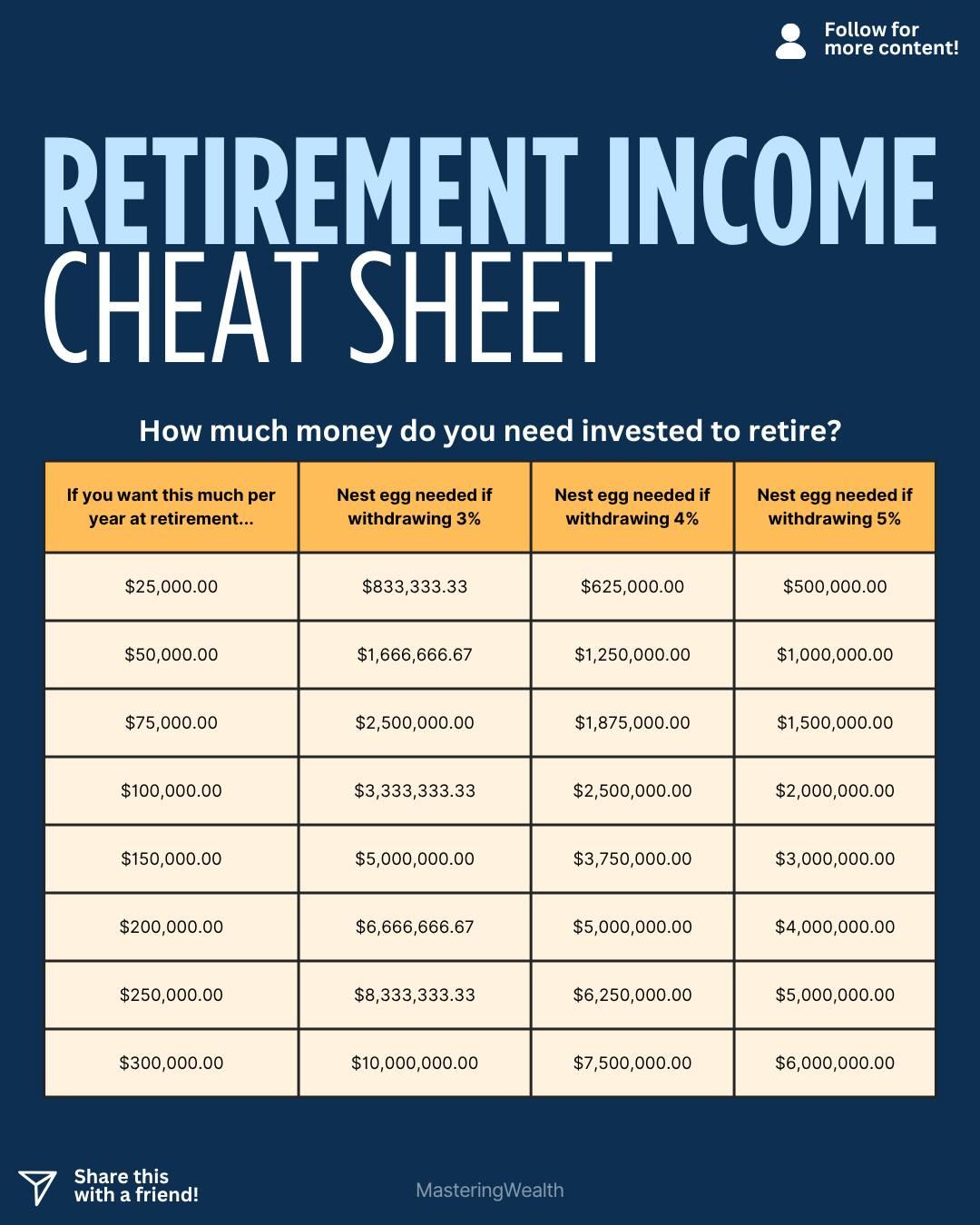

Another goal is to have 10 times your salary invested. If your annual income is $100,000, that means $1 million invested in assets that grow and compound over time. This level of investing can create a safety net that protects you against job loss, economic downturns, or unexpected expenses.

Real estate is another pillar of long-term wealth. Owning 8 or more rental units creates consistent cash flow while appreciating in value. Real estate can hedge against inflation and provide leverage for future investments.

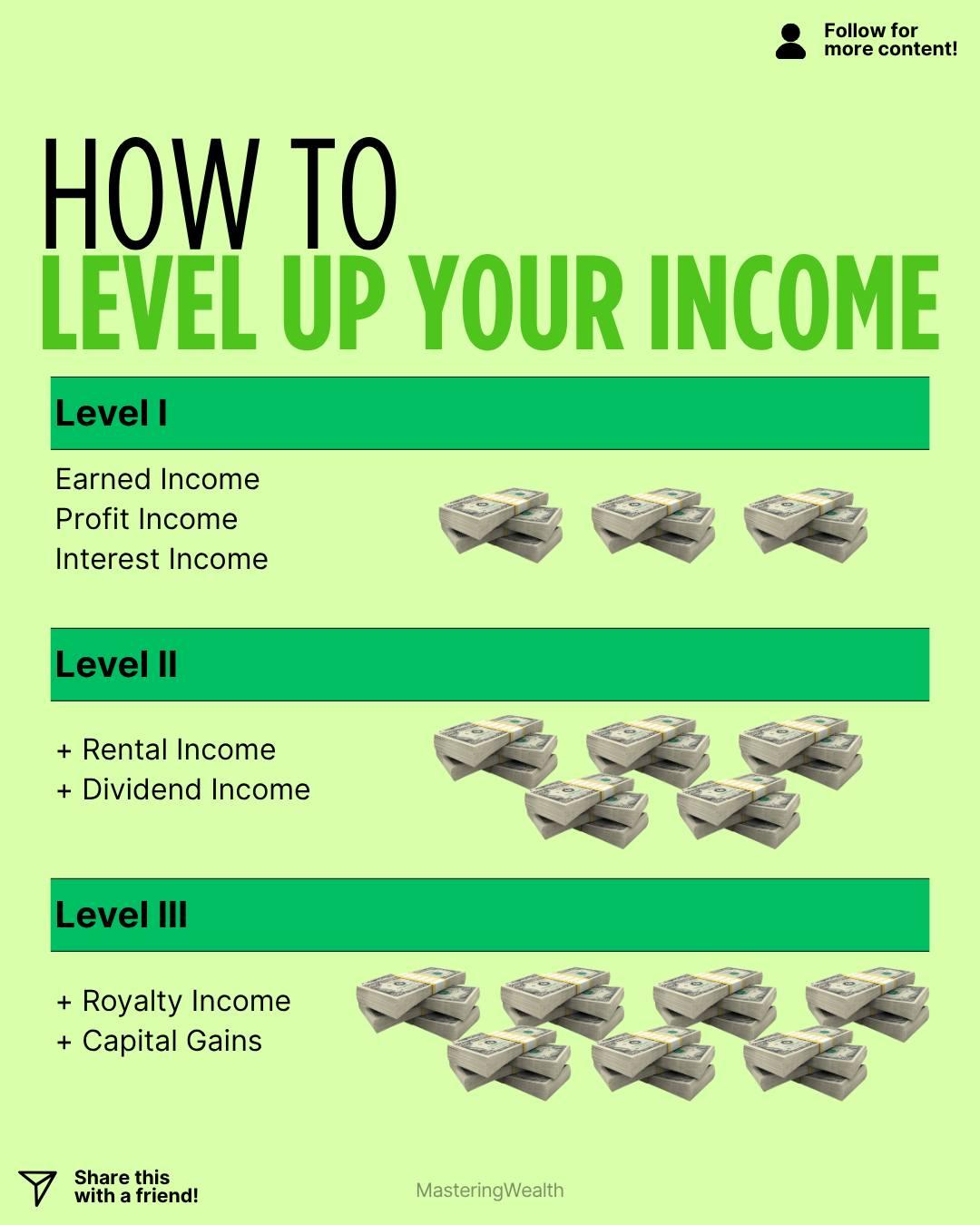

Multiple income streams are the final piece. Having 5 or more income sources — from stocks, business ventures, royalties, or real estate — makes your financial foundation more stable and resilient. The goal is to have money flowing from multiple directions so you’re never dependent on just one paycheck.

Building toward these goals takes time, consistency, and smart planning. Start by automating your savings, investing regularly, and reinvesting your returns. Wealth grows in silence but rewards those who stay patient and disciplined.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for consistent passive income.

What’s one financial goal you want to achieve by 40 or beyond?

Disclaimer: This content is for educational purposes only and not financial advice. Always do your own research or speak with a financial professional before making investment decisions.

By 40, one goal is for investments to pay for at least two vacations a year. Imagine building enough passive income through dividends, real estate, or business profits that your lifestyle upgrades itself without extra hours worked. That’s what financial independence really looks like — earning while you rest.

Another goal is to have 10 times your salary invested. If your annual income is $100,000, that means $1 million invested in assets that grow and compound over time. This level of investing can create a safety net that protects you against job loss, economic downturns, or unexpected expenses.

Real estate is another pillar of long-term wealth. Owning 8 or more rental units creates consistent cash flow while appreciating in value. Real estate can hedge against inflation and provide leverage for future investments.

Multiple income streams are the final piece. Having 5 or more income sources — from stocks, business ventures, royalties, or real estate — makes your financial foundation more stable and resilient. The goal is to have money flowing from multiple directions so you’re never dependent on just one paycheck.

Building toward these goals takes time, consistency, and smart planning. Start by automating your savings, investing regularly, and reinvesting your returns. Wealth grows in silence but rewards those who stay patient and disciplined.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for consistent passive income.

What’s one financial goal you want to achieve by 40 or beyond?

Disclaimer: This content is for educational purposes only and not financial advice. Always do your own research or speak with a financial professional before making investment decisions.

💰 Everyone’s version of wealth looks different, but setting clear financial goals gives your money a direction. The key is not to just work for money but to reach a point where your investments work for you. These goals are designed to create freedom, security, and options — not just a bigger paycheck.

By 40, one goal is for investments to pay for at least two vacations a year. Imagine building enough passive income through dividends, real estate, or business profits that your lifestyle upgrades itself without extra hours worked. That’s what financial independence really looks like — earning while you rest.

Another goal is to have 10 times your salary invested. If your annual income is $100,000, that means $1 million invested in assets that grow and compound over time. This level of investing can create a safety net that protects you against job loss, economic downturns, or unexpected expenses.

🏠 Real estate is another pillar of long-term wealth. Owning 8 or more rental units creates consistent cash flow while appreciating in value. Real estate can hedge against inflation and provide leverage for future investments.

Multiple income streams are the final piece. Having 5 or more income sources — from stocks, business ventures, royalties, or real estate — makes your financial foundation more stable and resilient. The goal is to have money flowing from multiple directions so you’re never dependent on just one paycheck.

📊 Building toward these goals takes time, consistency, and smart planning. Start by automating your savings, investing regularly, and reinvesting your returns. Wealth grows in silence but rewards those who stay patient and disciplined.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for consistent passive income.

🤔 What’s one financial goal you want to achieve by 40 or beyond?

⚠️ Disclaimer: This content is for educational purposes only and not financial advice. Always do your own research or speak with a financial professional before making investment decisions.

·126 Views

·0 önizleme