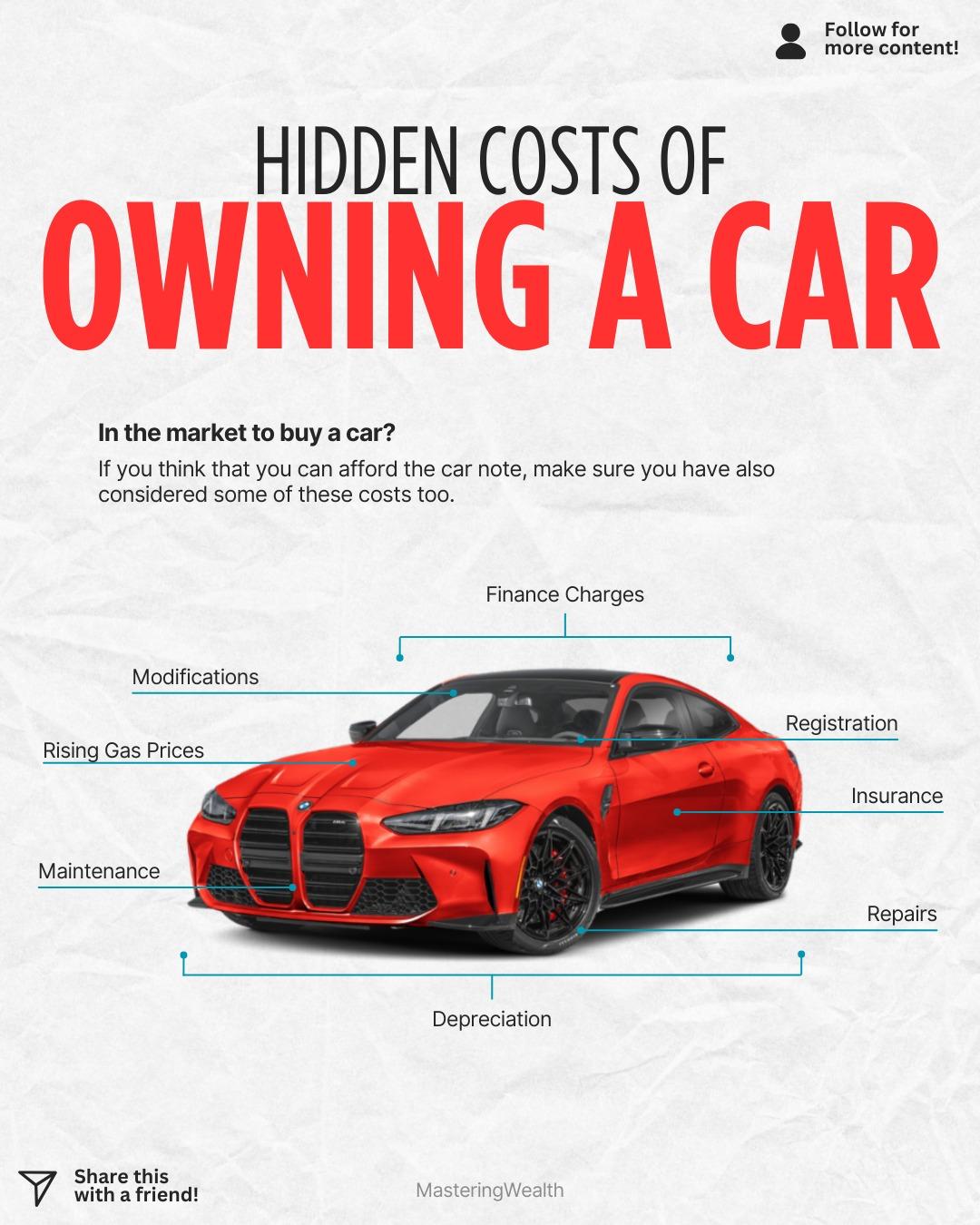

Many people think the only thing they need to afford when buying a car is the monthly payment, but the graphic shows that owning a car comes with many hidden expenses that can surprise you. These costs can add up quickly and take a bigger chunk of your budget than expected. Understanding the true cost of car ownership can help you make smarter financial decisions before signing that contract.

The most overlooked expense is depreciation which starts the moment you drive the car off the lot and continues every year. Even cars that hold value well still lose thousands of dollars over time. This loss is a silent cost because you do not feel it until the moment you try to sell or trade in the car.

Owning a car also comes with ongoing maintenance. Oil changes, tire replacements, brake pads, and fluids are normal parts of car ownership and these expenses can vary depending on the model you drive. Luxury cars or performance cars usually cost more to maintain because parts and service are more expensive.

Insurance is another major cost that depends on age, location, driving record, and the value of your vehicle. Many buyers underestimate how much insurance increases when they switch from an older car to a newer one. Registration fees, inspections, and taxes also add yearly expenses that people forget to plan for.

Gas prices can also shift your entire budget. When prices rise it affects daily driving, commuting, and family trips which can quickly add up depending on how much you drive. And if you enjoy modifications such as wheels, wrap, exhaust systems, or tuning, that becomes an extra financial layer that goes far beyond the original sticker price.

If you want to see the dividend portfolio I use to offset lifestyle costs and build long term wealth, comment “Stocks” and I will send you the link.

What hidden car expense surprised you the most when you bought your current vehicle?

This content is for educational purposes only and is not financial advice. Always do your own research or consult with a licensed professional before making financial decisions.

Many people think the only thing they need to afford when buying a car is the monthly payment, but the graphic shows that owning a car comes with many hidden expenses that can surprise you. These costs can add up quickly and take a bigger chunk of your budget than expected. Understanding the true cost of car ownership can help you make smarter financial decisions before signing that contract.

The most overlooked expense is depreciation which starts the moment you drive the car off the lot and continues every year. Even cars that hold value well still lose thousands of dollars over time. This loss is a silent cost because you do not feel it until the moment you try to sell or trade in the car.

Owning a car also comes with ongoing maintenance. Oil changes, tire replacements, brake pads, and fluids are normal parts of car ownership and these expenses can vary depending on the model you drive. Luxury cars or performance cars usually cost more to maintain because parts and service are more expensive.

Insurance is another major cost that depends on age, location, driving record, and the value of your vehicle. Many buyers underestimate how much insurance increases when they switch from an older car to a newer one. Registration fees, inspections, and taxes also add yearly expenses that people forget to plan for.

Gas prices can also shift your entire budget. When prices rise it affects daily driving, commuting, and family trips which can quickly add up depending on how much you drive. And if you enjoy modifications such as wheels, wrap, exhaust systems, or tuning, that becomes an extra financial layer that goes far beyond the original sticker price.

If you want to see the dividend portfolio I use to offset lifestyle costs and build long term wealth, comment “Stocks” and I will send you the link.

What hidden car expense surprised you the most when you bought your current vehicle?

⚠️ This content is for educational purposes only and is not financial advice. Always do your own research or consult with a licensed professional before making financial decisions.

·48 Просмотры

·0 предпросмотр