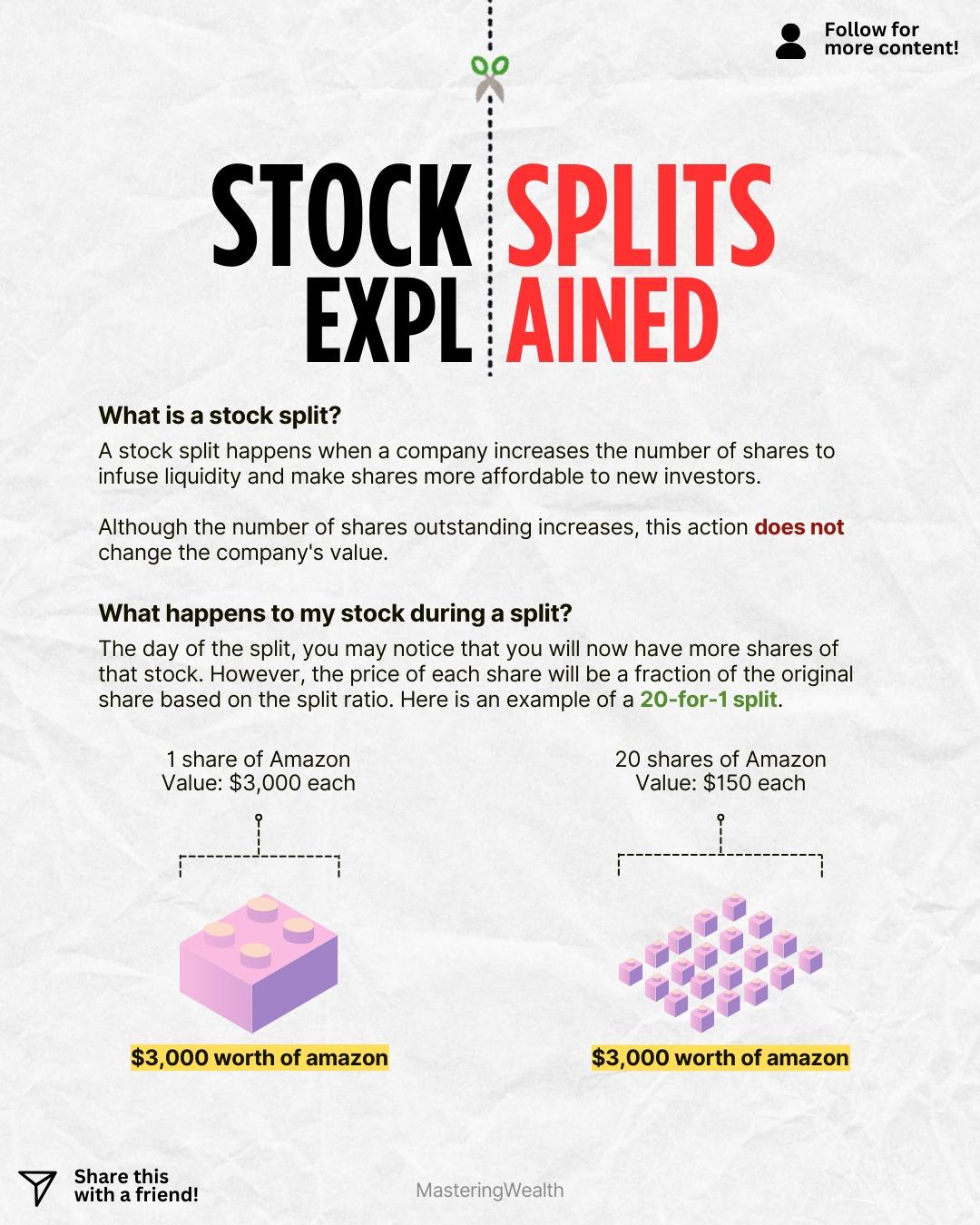

A stock split is one of those investing concepts that sounds confusing until you actually see it visually. The graphic shows exactly what happens during a stock split and why it does not change the total value of your investment. Companies use stock splits to make each share more affordable and to increase liquidity which allows more investors to participate.

When a company performs a stock split it increases the number of shares available but the total value of the company stays the same. This means your overall investment does not change even though the number of shares you hold increases. The price of each share is adjusted based on the split ratio which keeps the total value equal.

For example if you own one share of Amazon worth three thousand dollars and the company does a twenty for one split you end up with twenty shares worth one hundred fifty dollars each. Nothing about your total value changes because twenty shares at one hundred fifty dollars equals the same three thousand dollars. The split simply breaks the value into smaller parts.

Many companies like Apple, Tesla, Amazon and Nvidia have used stock splits in the past. They often choose to split their stock once the price becomes too high for new investors who may feel priced out. A split also sends a signal of confidence because companies usually perform them when their share prices have grown significantly.

Understanding stock splits helps you make smarter investing decisions. When you know that your value stays the same you avoid the confusion that comes from seeing your share count suddenly increase. You also recognize that a lower share price after a split does not mean the company is dropping in value.

If you want to see the dividend portfolio I use to build long term wealth, comment “Stocks” and I will send you the link.

For more easy to understand investing breakdowns and financial education visuals, follow @MasteringWealth for daily content that grows your money knowledge.

This content is for educational purposes only and is not financial advice. Always research carefully or consult with a licensed professional before making financial decisions.

A stock split is one of those investing concepts that sounds confusing until you actually see it visually. The graphic shows exactly what happens during a stock split and why it does not change the total value of your investment. Companies use stock splits to make each share more affordable and to increase liquidity which allows more investors to participate.

When a company performs a stock split it increases the number of shares available but the total value of the company stays the same. This means your overall investment does not change even though the number of shares you hold increases. The price of each share is adjusted based on the split ratio which keeps the total value equal.

For example if you own one share of Amazon worth three thousand dollars and the company does a twenty for one split you end up with twenty shares worth one hundred fifty dollars each. Nothing about your total value changes because twenty shares at one hundred fifty dollars equals the same three thousand dollars. The split simply breaks the value into smaller parts.

Many companies like Apple, Tesla, Amazon and Nvidia have used stock splits in the past. They often choose to split their stock once the price becomes too high for new investors who may feel priced out. A split also sends a signal of confidence because companies usually perform them when their share prices have grown significantly.

Understanding stock splits helps you make smarter investing decisions. When you know that your value stays the same you avoid the confusion that comes from seeing your share count suddenly increase. You also recognize that a lower share price after a split does not mean the company is dropping in value.

If you want to see the dividend portfolio I use to build long term wealth, comment “Stocks” and I will send you the link.

For more easy to understand investing breakdowns and financial education visuals, follow @MasteringWealth for daily content that grows your money knowledge.

⚠️ This content is for educational purposes only and is not financial advice. Always research carefully or consult with a licensed professional before making financial decisions.

·147 Views

·0 Vista previa