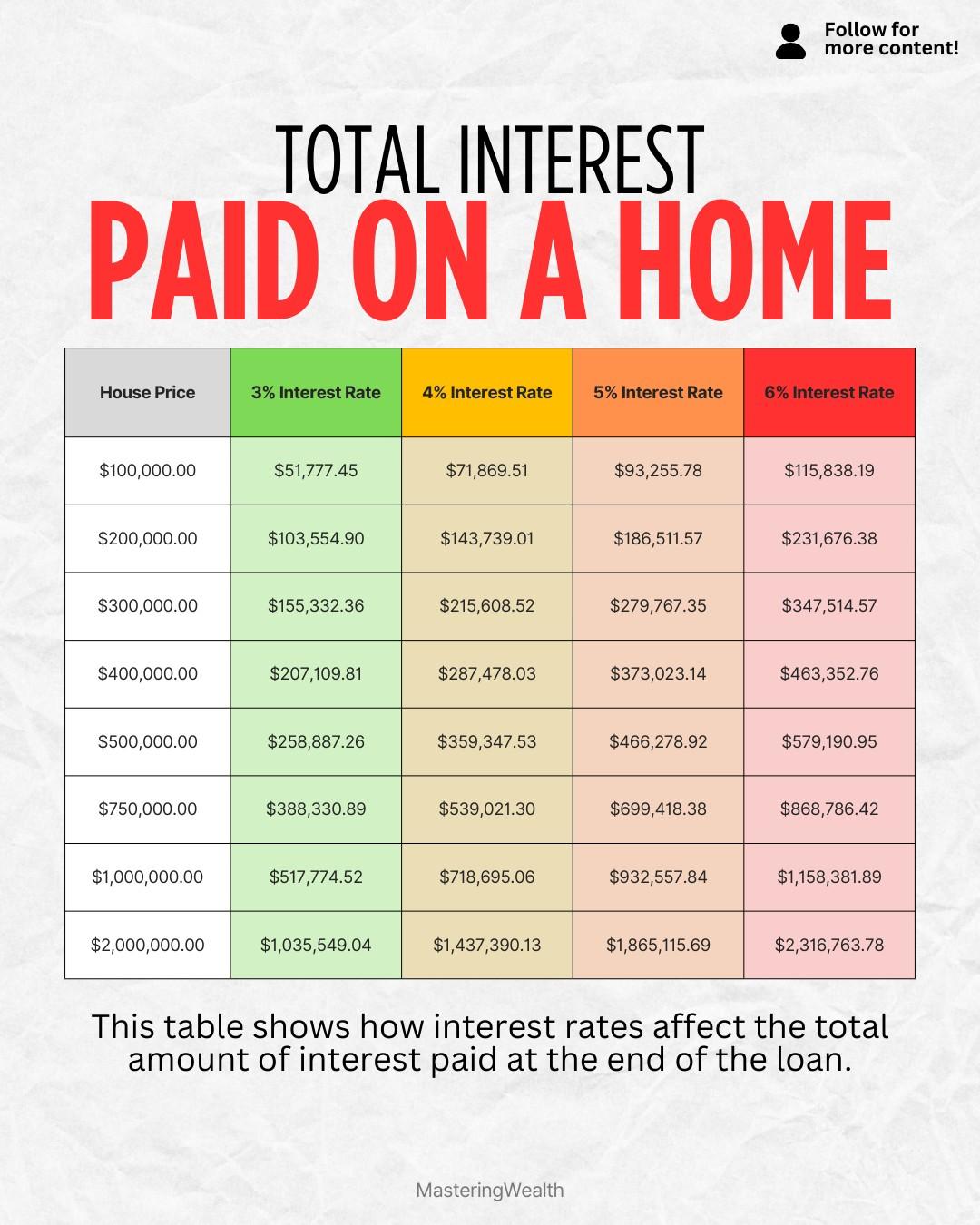

Buying a home is one of the biggest financial decisions you will ever make. The graphic shows how much total interest you pay on a mortgage depending on the interest rate and the price of the home. Many people only look at the monthly payment but the real cost of a home is hidden inside the interest you pay over the life of the loan.

A low interest rate can save you tens of thousands of dollars. For example a three percent rate on a three hundred thousand dollar home results in total interest of about one hundred fifty five thousand dollars over the loan period. At six percent that same home costs over three hundred forty seven thousand dollars in interest which is more than double.

The difference between rates becomes even more dramatic as the price increases. A five hundred thousand dollar home with a three percent rate creates around two hundred fifty eight thousand dollars of interest while a six percent rate results in more than five hundred seventy nine thousand dollars. When you look at million dollar homes the total interest can climb above one million dollars depending on the rate.

This is why timing and preparation matter in real estate. Improving your credit score, shopping around for lenders, and understanding mortgage options can help reduce the lifetime cost of owning a home. Even a small reduction in your interest rate can create a huge wealth advantage over time.

If you want to see my dividend portfolio which helps me build passive income while tackling goals like home ownership, comment “Stocks” and I will send you the link.

If you were buying a home today, would you choose a smaller home with a lower interest cost or stretch for a bigger home knowing the long term interest would be higher?

For more content that breaks down home loans, interest rates, investing strategies, and smart money decisions, follow @MasteringWealth for daily financial education.

This content is for educational purposes only and is not financial advice. Always consult a licensed professional before making major financial decisions.

A low interest rate can save you tens of thousands of dollars. For example a three percent rate on a three hundred thousand dollar home results in total interest of about one hundred fifty five thousand dollars over the loan period. At six percent that same home costs over three hundred forty seven thousand dollars in interest which is more than double.

The difference between rates becomes even more dramatic as the price increases. A five hundred thousand dollar home with a three percent rate creates around two hundred fifty eight thousand dollars of interest while a six percent rate results in more than five hundred seventy nine thousand dollars. When you look at million dollar homes the total interest can climb above one million dollars depending on the rate.

This is why timing and preparation matter in real estate. Improving your credit score, shopping around for lenders, and understanding mortgage options can help reduce the lifetime cost of owning a home. Even a small reduction in your interest rate can create a huge wealth advantage over time.

If you want to see my dividend portfolio which helps me build passive income while tackling goals like home ownership, comment “Stocks” and I will send you the link.

If you were buying a home today, would you choose a smaller home with a lower interest cost or stretch for a bigger home knowing the long term interest would be higher?

For more content that breaks down home loans, interest rates, investing strategies, and smart money decisions, follow @MasteringWealth for daily financial education.

This content is for educational purposes only and is not financial advice. Always consult a licensed professional before making major financial decisions.

Buying a home is one of the biggest financial decisions you will ever make. The graphic shows how much total interest you pay on a mortgage depending on the interest rate and the price of the home. Many people only look at the monthly payment but the real cost of a home is hidden inside the interest you pay over the life of the loan.

A low interest rate can save you tens of thousands of dollars. For example a three percent rate on a three hundred thousand dollar home results in total interest of about one hundred fifty five thousand dollars over the loan period. At six percent that same home costs over three hundred forty seven thousand dollars in interest which is more than double.

The difference between rates becomes even more dramatic as the price increases. A five hundred thousand dollar home with a three percent rate creates around two hundred fifty eight thousand dollars of interest while a six percent rate results in more than five hundred seventy nine thousand dollars. When you look at million dollar homes the total interest can climb above one million dollars depending on the rate.

This is why timing and preparation matter in real estate. Improving your credit score, shopping around for lenders, and understanding mortgage options can help reduce the lifetime cost of owning a home. Even a small reduction in your interest rate can create a huge wealth advantage over time.

If you want to see my dividend portfolio which helps me build passive income while tackling goals like home ownership, comment “Stocks” and I will send you the link.

If you were buying a home today, would you choose a smaller home with a lower interest cost or stretch for a bigger home knowing the long term interest would be higher?

For more content that breaks down home loans, interest rates, investing strategies, and smart money decisions, follow @MasteringWealth for daily financial education.

⚠️ This content is for educational purposes only and is not financial advice. Always consult a licensed professional before making major financial decisions.

·13 Views

·0 Vista previa