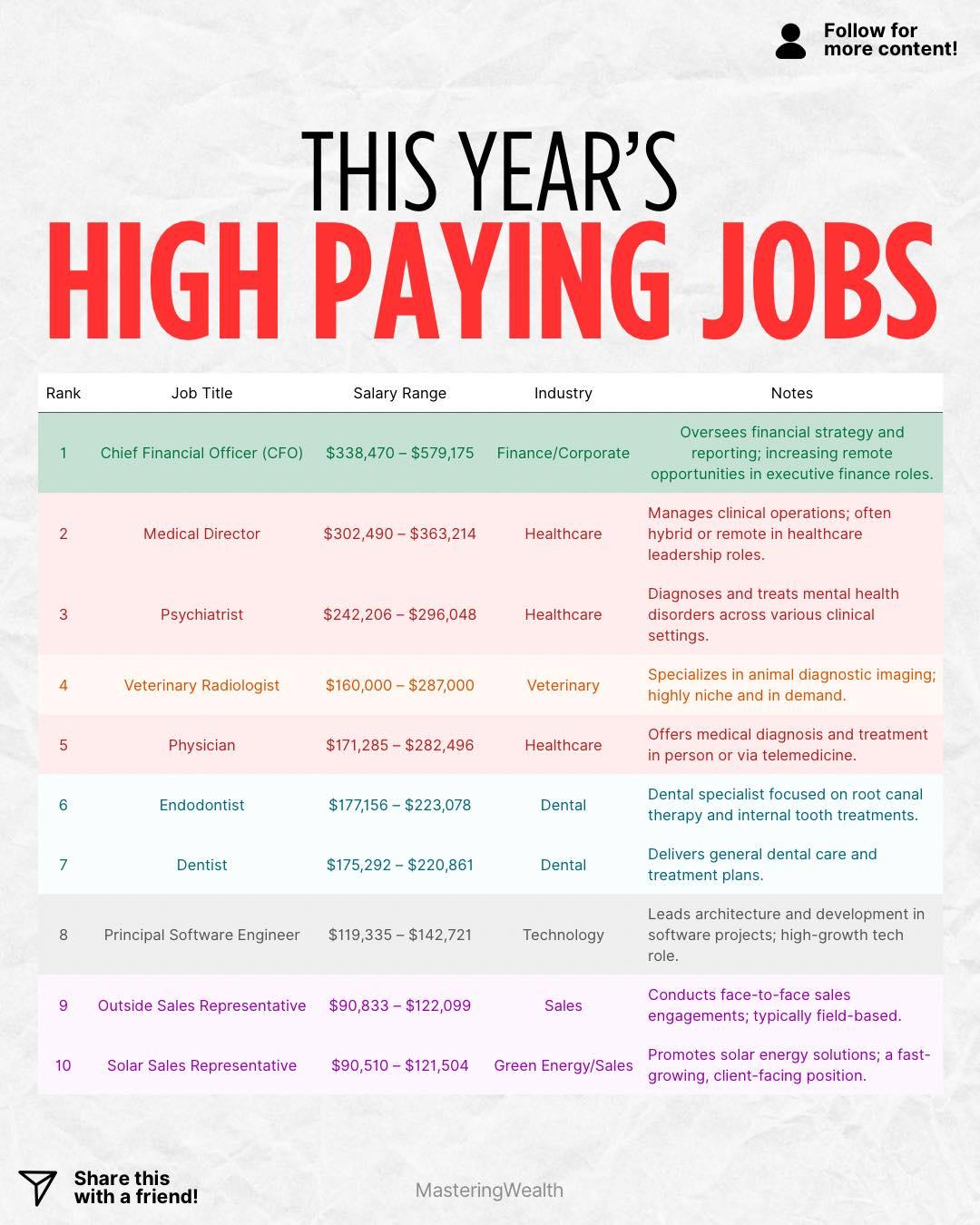

When people talk about building wealth, one of the first factors that often comes up is your income potential . While anyone can grow wealth over time through smart saving and investing, having access to a high paying career can accelerate the journey. This year’s list of top paying jobs highlights fields like healthcare, technology, sales, and corporate finance. For example, a Chief Financial Officer can earn between $338K and $579K per year, while physicians, psychiatrists, and dentists continue to command six figure incomes thanks to their specialized training and demand in the market. Even roles like software engineering or solar sales are proving that the right skills can lead to lucrative opportunities .

So why does this matter for personal finance? Because your income is the foundation of your financial strategy. A higher salary gives you more room to save, invest, and build passive income streams. However, it is not just about how much you make but how much you keep and grow . Plenty of high income earners live paycheck to paycheck because of lifestyle inflation. On the flip side, some people earning modest salaries build wealth by investing consistently and controlling expenses. This is why learning money management, investing in the stock market, and building multiple streams of income is so important.

If you want to see what I am investing in and how my portfolio is structured for growth, comment “Stocks” and I will send you the link .

Out of all the careers listed, which one surprises you the most with its earning potential? Or, if money was not a concern, which of these jobs would you choose to do?

For more insights on personal finance, investing, and wealth building, make sure to follow me here at @MasteringWealth for daily strategies that can help you get ahead .

Disclaimer: This content is for educational purposes only and is not financial advice.

So why does this matter for personal finance? Because your income is the foundation of your financial strategy. A higher salary gives you more room to save, invest, and build passive income streams. However, it is not just about how much you make but how much you keep and grow . Plenty of high income earners live paycheck to paycheck because of lifestyle inflation. On the flip side, some people earning modest salaries build wealth by investing consistently and controlling expenses. This is why learning money management, investing in the stock market, and building multiple streams of income is so important.

If you want to see what I am investing in and how my portfolio is structured for growth, comment “Stocks” and I will send you the link .

Out of all the careers listed, which one surprises you the most with its earning potential? Or, if money was not a concern, which of these jobs would you choose to do?

For more insights on personal finance, investing, and wealth building, make sure to follow me here at @MasteringWealth for daily strategies that can help you get ahead .

Disclaimer: This content is for educational purposes only and is not financial advice.

When people talk about building wealth, one of the first factors that often comes up is your income potential 💼. While anyone can grow wealth over time through smart saving and investing, having access to a high paying career can accelerate the journey. This year’s list of top paying jobs highlights fields like healthcare, technology, sales, and corporate finance. For example, a Chief Financial Officer can earn between $338K and $579K per year, while physicians, psychiatrists, and dentists continue to command six figure incomes thanks to their specialized training and demand in the market. Even roles like software engineering or solar sales are proving that the right skills can lead to lucrative opportunities 🌎💻.

So why does this matter for personal finance? Because your income is the foundation of your financial strategy. A higher salary gives you more room to save, invest, and build passive income streams. However, it is not just about how much you make but how much you keep and grow 📈. Plenty of high income earners live paycheck to paycheck because of lifestyle inflation. On the flip side, some people earning modest salaries build wealth by investing consistently and controlling expenses. This is why learning money management, investing in the stock market, and building multiple streams of income is so important.

If you want to see what I am investing in and how my portfolio is structured for growth, comment “Stocks” and I will send you the link 📩.

Out of all the careers listed, which one surprises you the most with its earning potential? Or, if money was not a concern, which of these jobs would you choose to do? 🤔

For more insights on personal finance, investing, and wealth building, make sure to follow me here at @MasteringWealth for daily strategies that can help you get ahead 💡.

Disclaimer: This content is for educational purposes only and is not financial advice.

·397 Views

·0 Reviews