Feeling broke can be one of the most stressful experiences in life. You’re trying to stretch every dollar, make ends meet, and find a way out — but it feels like there’s no clear path. The truth is, financial freedom doesn’t start with wealth; it starts with a plan.

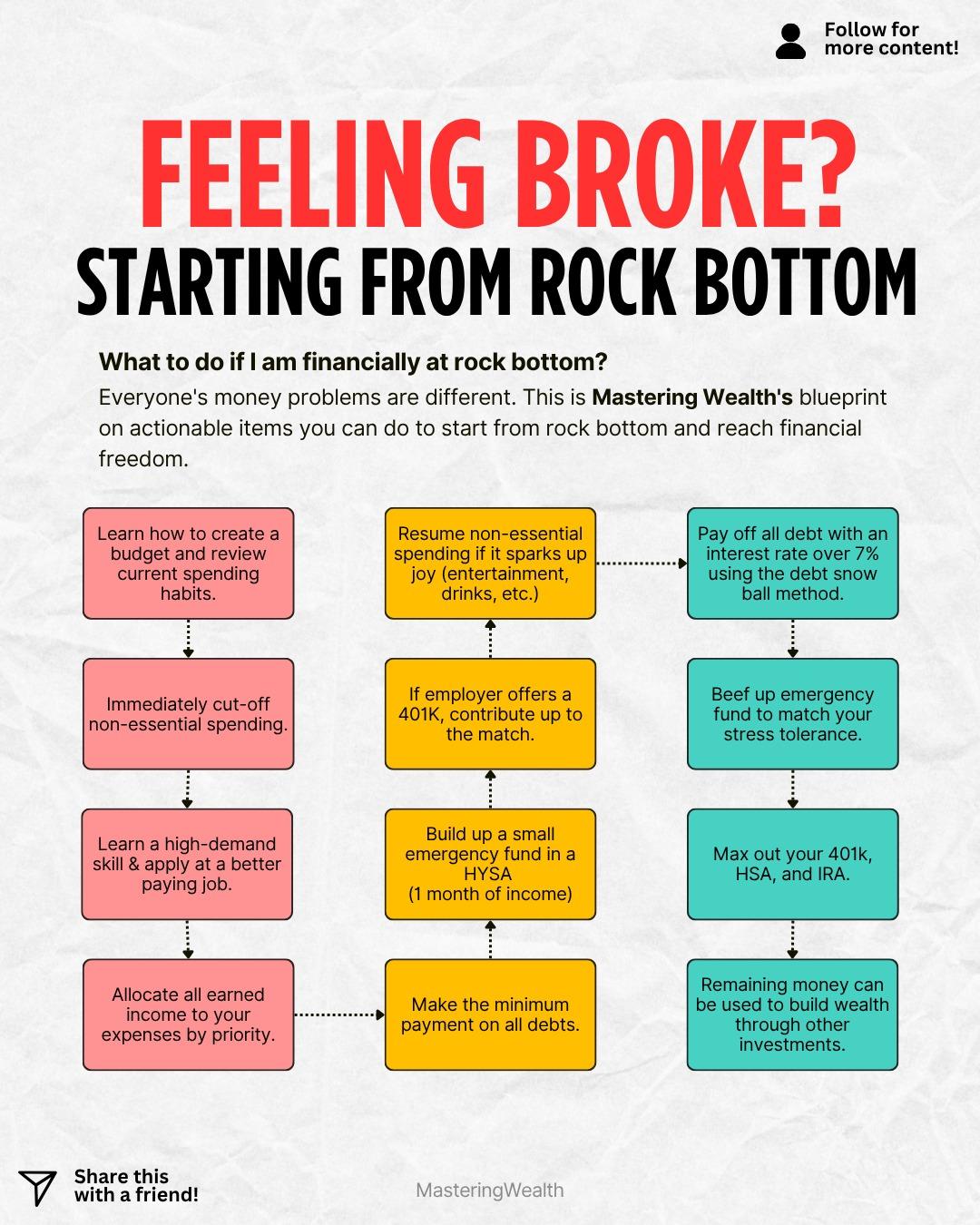

If you’re at rock bottom, the first step is clarity. Sit down and review your current spending habits. Identify where your money is going and what you can immediately cut off that isn’t essential. It’s not about punishment; it’s about taking control of the areas that are draining your cash flow.

Once you have the basics covered, focus on increasing income. That means learning a high-demand skill, applying for higher-paying jobs, or starting a side hustle that fits your schedule. Every extra dollar earned is fuel for your comeback.

From there, create a small emergency fund — one month of income is a good start. Store it in a high-yield savings account to earn interest while keeping it accessible. This small cushion is your safety net, so you don’t have to rely on credit cards for unexpected expenses.

When it comes to debt, pay only the minimums at first while you stabilize your situation. Once you’ve built momentum, start tackling high-interest debt using the snowball method. Knocking out those debts will free up money to invest and grow.

As your situation improves, contribute to your 401k up to the employer match, then grow your emergency fund to match your comfort level. Eventually, max out accounts like your 401k, HSA, and IRA. At this stage, you’re no longer surviving — you’re building wealth and creating financial freedom.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for long-term growth and passive income.

What’s one financial habit you wish you had started earlier in your life?

Follow @MasteringWealth for actionable tips, mindset shifts, and investing strategies to help you take control of your money and build real wealth.

Disclaimer: This content is for educational purposes only and not financial advice. Always research or consult a professional before making major financial decisions.

If you’re at rock bottom, the first step is clarity. Sit down and review your current spending habits. Identify where your money is going and what you can immediately cut off that isn’t essential. It’s not about punishment; it’s about taking control of the areas that are draining your cash flow.

Once you have the basics covered, focus on increasing income. That means learning a high-demand skill, applying for higher-paying jobs, or starting a side hustle that fits your schedule. Every extra dollar earned is fuel for your comeback.

From there, create a small emergency fund — one month of income is a good start. Store it in a high-yield savings account to earn interest while keeping it accessible. This small cushion is your safety net, so you don’t have to rely on credit cards for unexpected expenses.

When it comes to debt, pay only the minimums at first while you stabilize your situation. Once you’ve built momentum, start tackling high-interest debt using the snowball method. Knocking out those debts will free up money to invest and grow.

As your situation improves, contribute to your 401k up to the employer match, then grow your emergency fund to match your comfort level. Eventually, max out accounts like your 401k, HSA, and IRA. At this stage, you’re no longer surviving — you’re building wealth and creating financial freedom.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for long-term growth and passive income.

What’s one financial habit you wish you had started earlier in your life?

Follow @MasteringWealth for actionable tips, mindset shifts, and investing strategies to help you take control of your money and build real wealth.

Disclaimer: This content is for educational purposes only and not financial advice. Always research or consult a professional before making major financial decisions.

💰 Feeling broke can be one of the most stressful experiences in life. You’re trying to stretch every dollar, make ends meet, and find a way out — but it feels like there’s no clear path. The truth is, financial freedom doesn’t start with wealth; it starts with a plan.

If you’re at rock bottom, the first step is clarity. Sit down and review your current spending habits. Identify where your money is going and what you can immediately cut off that isn’t essential. It’s not about punishment; it’s about taking control of the areas that are draining your cash flow.

📉 Once you have the basics covered, focus on increasing income. That means learning a high-demand skill, applying for higher-paying jobs, or starting a side hustle that fits your schedule. Every extra dollar earned is fuel for your comeback.

From there, create a small emergency fund — one month of income is a good start. Store it in a high-yield savings account to earn interest while keeping it accessible. This small cushion is your safety net, so you don’t have to rely on credit cards for unexpected expenses.

💳 When it comes to debt, pay only the minimums at first while you stabilize your situation. Once you’ve built momentum, start tackling high-interest debt using the snowball method. Knocking out those debts will free up money to invest and grow.

📈 As your situation improves, contribute to your 401k up to the employer match, then grow your emergency fund to match your comfort level. Eventually, max out accounts like your 401k, HSA, and IRA. At this stage, you’re no longer surviving — you’re building wealth and creating financial freedom.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for long-term growth and passive income.

🤔 What’s one financial habit you wish you had started earlier in your life?

👉 Follow @MasteringWealth for actionable tips, mindset shifts, and investing strategies to help you take control of your money and build real wealth.

⚠️ Disclaimer: This content is for educational purposes only and not financial advice. Always research or consult a professional before making major financial decisions.

·211 Views

·0 Reviews