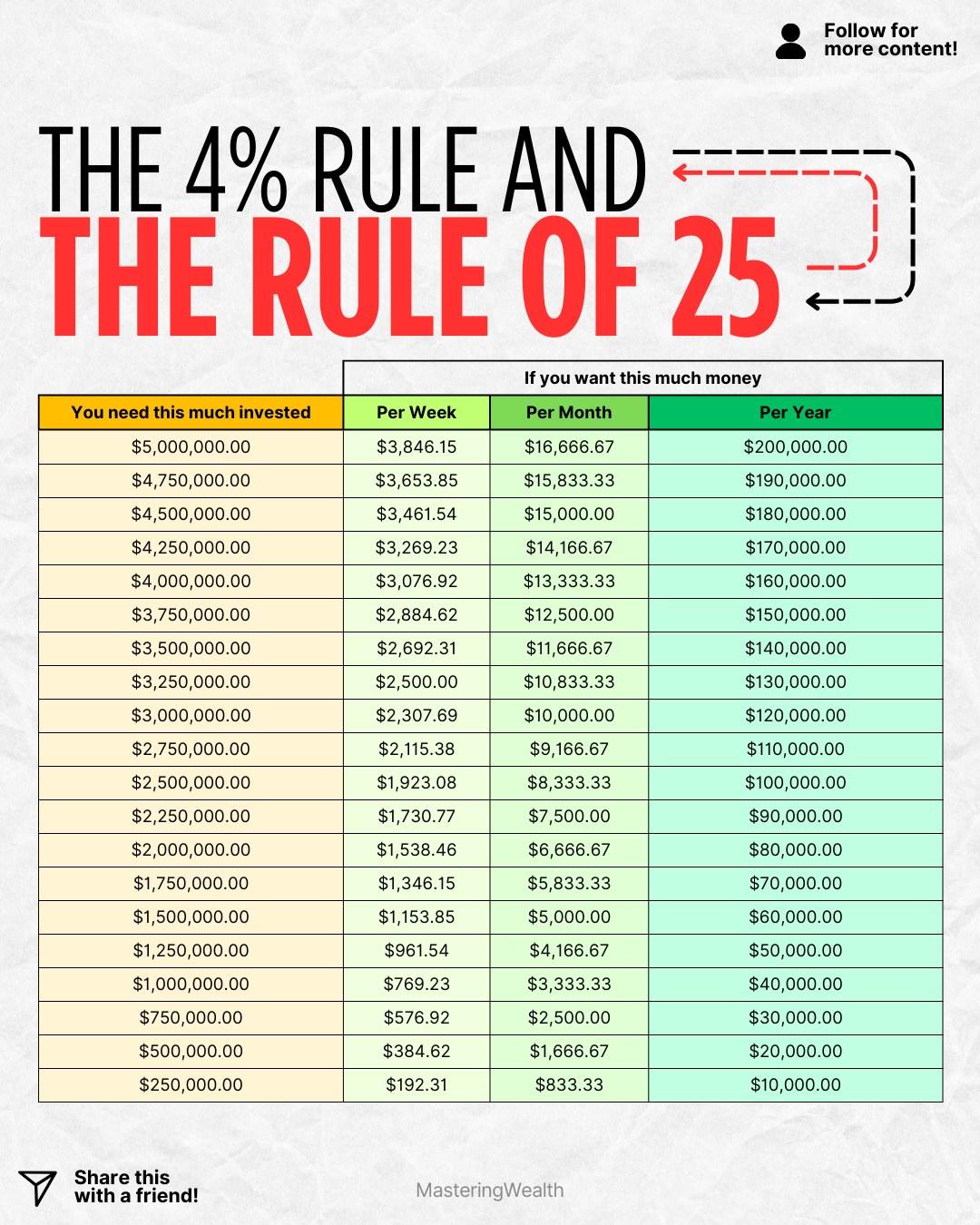

Planning for retirement becomes much easier when you understand the math behind how much money you need invested. The visual in this post shows the rule of twenty five which tells you how large your portfolio should be if you want to withdraw a certain amount each year. When you multiply your desired yearly income by twenty five, you get the total amount you need invested to retire with confidence.

The four percent rule is what connects the chart together. It is a guideline that suggests you can withdraw around four percent of your investments each year without running out of money too quickly. This rule helps simplify retirement planning because it gives you a clear target based on the lifestyle you want.

For example, if you want one hundred thousand dollars per year in retirement, you would need around two million five hundred thousand dollars invested. If you only want fifty thousand dollars per year, the target becomes one million two hundred fifty thousand dollars. The chart also breaks these numbers down weekly and monthly to help you visualize how much income your portfolio can realistically produce.

These calculations show why long term investing is so important. Savings alone cannot reach these levels without the help of compound interest. The earlier you start, the more time your investments have to grow into the numbers seen in the chart.

This cheat sheet is meant to give you clarity and direction, not pressure. Everyone starts in a different place and progresses at their own pace. What matters most is understanding the math so you can plan with intention instead of guessing.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I build passive income for my own retirement plan.

If you could choose any yearly retirement income from this chart, which amount would make you feel financially free and comfortable?

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

The four percent rule is what connects the chart together. It is a guideline that suggests you can withdraw around four percent of your investments each year without running out of money too quickly. This rule helps simplify retirement planning because it gives you a clear target based on the lifestyle you want.

For example, if you want one hundred thousand dollars per year in retirement, you would need around two million five hundred thousand dollars invested. If you only want fifty thousand dollars per year, the target becomes one million two hundred fifty thousand dollars. The chart also breaks these numbers down weekly and monthly to help you visualize how much income your portfolio can realistically produce.

These calculations show why long term investing is so important. Savings alone cannot reach these levels without the help of compound interest. The earlier you start, the more time your investments have to grow into the numbers seen in the chart.

This cheat sheet is meant to give you clarity and direction, not pressure. Everyone starts in a different place and progresses at their own pace. What matters most is understanding the math so you can plan with intention instead of guessing.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I build passive income for my own retirement plan.

If you could choose any yearly retirement income from this chart, which amount would make you feel financially free and comfortable?

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

Planning for retirement becomes much easier when you understand the math behind how much money you need invested. The visual in this post shows the rule of twenty five which tells you how large your portfolio should be if you want to withdraw a certain amount each year. When you multiply your desired yearly income by twenty five, you get the total amount you need invested to retire with confidence.

The four percent rule is what connects the chart together. It is a guideline that suggests you can withdraw around four percent of your investments each year without running out of money too quickly. This rule helps simplify retirement planning because it gives you a clear target based on the lifestyle you want.

For example, if you want one hundred thousand dollars per year in retirement, you would need around two million five hundred thousand dollars invested. If you only want fifty thousand dollars per year, the target becomes one million two hundred fifty thousand dollars. The chart also breaks these numbers down weekly and monthly to help you visualize how much income your portfolio can realistically produce.

These calculations show why long term investing is so important. Savings alone cannot reach these levels without the help of compound interest. The earlier you start, the more time your investments have to grow into the numbers seen in the chart.

This cheat sheet is meant to give you clarity and direction, not pressure. Everyone starts in a different place and progresses at their own pace. What matters most is understanding the math so you can plan with intention instead of guessing.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how I build passive income for my own retirement plan.

If you could choose any yearly retirement income from this chart, which amount would make you feel financially free and comfortable?

⚠️ This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

·161 Views

·0 Reviews