Want a Lamborghini Urus? It will cost you a lot more than the sticker price.

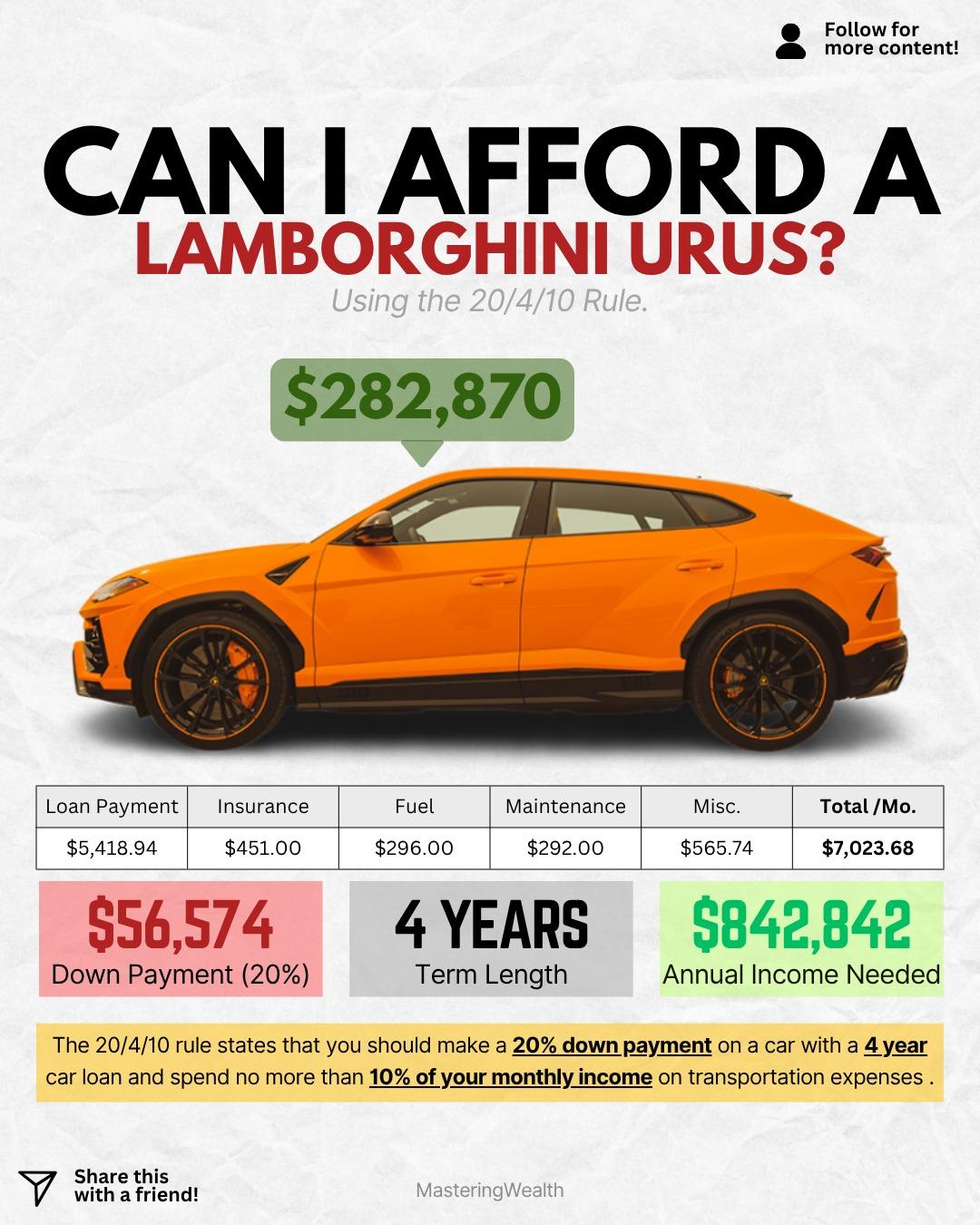

This breakdown uses the 20/4/10 rule to see if someone can realistically afford a $282,870 Lamborghini Urus. That rule says you should put 20 percent down, finance it over no more than 4 years, and keep your total monthly car expenses under 10 percent of your gross monthly income.

Let’s do the math. That means a $56,574 down payment upfront, and monthly expenses around $7,024. That includes your loan, insurance, fuel, maintenance, and other costs. To stay within that 10 percent threshold, your required income would need to be at least $842,842 per year

That’s not a typo. The monthly loan alone is over $5,400. Most people will never be in a position where this purchase makes financial sense.

This is where personal finance and building wealth become practical. Even if you have a high income, you still need discipline. Financial freedom is not about buying the flashiest car. It is about knowing when to say no so you can say yes to long term assets.

Millionaires often drive modest cars because they prioritize financial independence and cash flow over impressing strangers. If you invest money instead of spending it on luxury vehicles, those dollars can grow into future passive income through dividend stocks, real estate, or business equity

Want to see the dividend stocks I am investing in while avoiding lifestyle creep like this? Comment “Stocks” and I’ll send you the link to my portfolio

If you had $850K income per year, would you buy a car like this or put your money elsewhere? Be honest

Follow @MasteringWealth for more real numbers on what it really takes to afford the lifestyle most people dream about

Disclaimer: This is not financial advice. All content is for educational purposes only. Please do your own research or consult a licensed advisor before making any financial decisions.

This breakdown uses the 20/4/10 rule to see if someone can realistically afford a $282,870 Lamborghini Urus. That rule says you should put 20 percent down, finance it over no more than 4 years, and keep your total monthly car expenses under 10 percent of your gross monthly income.

Let’s do the math. That means a $56,574 down payment upfront, and monthly expenses around $7,024. That includes your loan, insurance, fuel, maintenance, and other costs. To stay within that 10 percent threshold, your required income would need to be at least $842,842 per year

That’s not a typo. The monthly loan alone is over $5,400. Most people will never be in a position where this purchase makes financial sense.

This is where personal finance and building wealth become practical. Even if you have a high income, you still need discipline. Financial freedom is not about buying the flashiest car. It is about knowing when to say no so you can say yes to long term assets.

Millionaires often drive modest cars because they prioritize financial independence and cash flow over impressing strangers. If you invest money instead of spending it on luxury vehicles, those dollars can grow into future passive income through dividend stocks, real estate, or business equity

Want to see the dividend stocks I am investing in while avoiding lifestyle creep like this? Comment “Stocks” and I’ll send you the link to my portfolio

If you had $850K income per year, would you buy a car like this or put your money elsewhere? Be honest

Follow @MasteringWealth for more real numbers on what it really takes to afford the lifestyle most people dream about

Disclaimer: This is not financial advice. All content is for educational purposes only. Please do your own research or consult a licensed advisor before making any financial decisions.

🚗 Want a Lamborghini Urus? It will cost you a lot more than the sticker price.

This breakdown uses the 20/4/10 rule to see if someone can realistically afford a $282,870 Lamborghini Urus. That rule says you should put 20 percent down, finance it over no more than 4 years, and keep your total monthly car expenses under 10 percent of your gross monthly income.

Let’s do the math. That means a $56,574 down payment upfront, and monthly expenses around $7,024. That includes your loan, insurance, fuel, maintenance, and other costs. To stay within that 10 percent threshold, your required income would need to be at least $842,842 per year 😳

That’s not a typo. The monthly loan alone is over $5,400. Most people will never be in a position where this purchase makes financial sense.

This is where personal finance and building wealth become practical. Even if you have a high income, you still need discipline. Financial freedom is not about buying the flashiest car. It is about knowing when to say no so you can say yes to long term assets.

Millionaires often drive modest cars because they prioritize financial independence and cash flow over impressing strangers. If you invest money instead of spending it on luxury vehicles, those dollars can grow into future passive income through dividend stocks, real estate, or business equity 🧠

Want to see the dividend stocks I am investing in while avoiding lifestyle creep like this? Comment “Stocks” and I’ll send you the link to my portfolio 📩

If you had $850K income per year, would you buy a car like this or put your money elsewhere? Be honest 💬

Follow @MasteringWealth for more real numbers on what it really takes to afford the lifestyle most people dream about 💸

📌 Disclaimer: This is not financial advice. All content is for educational purposes only. Please do your own research or consult a licensed advisor before making any financial decisions.

·306 Views

·0 Reviews