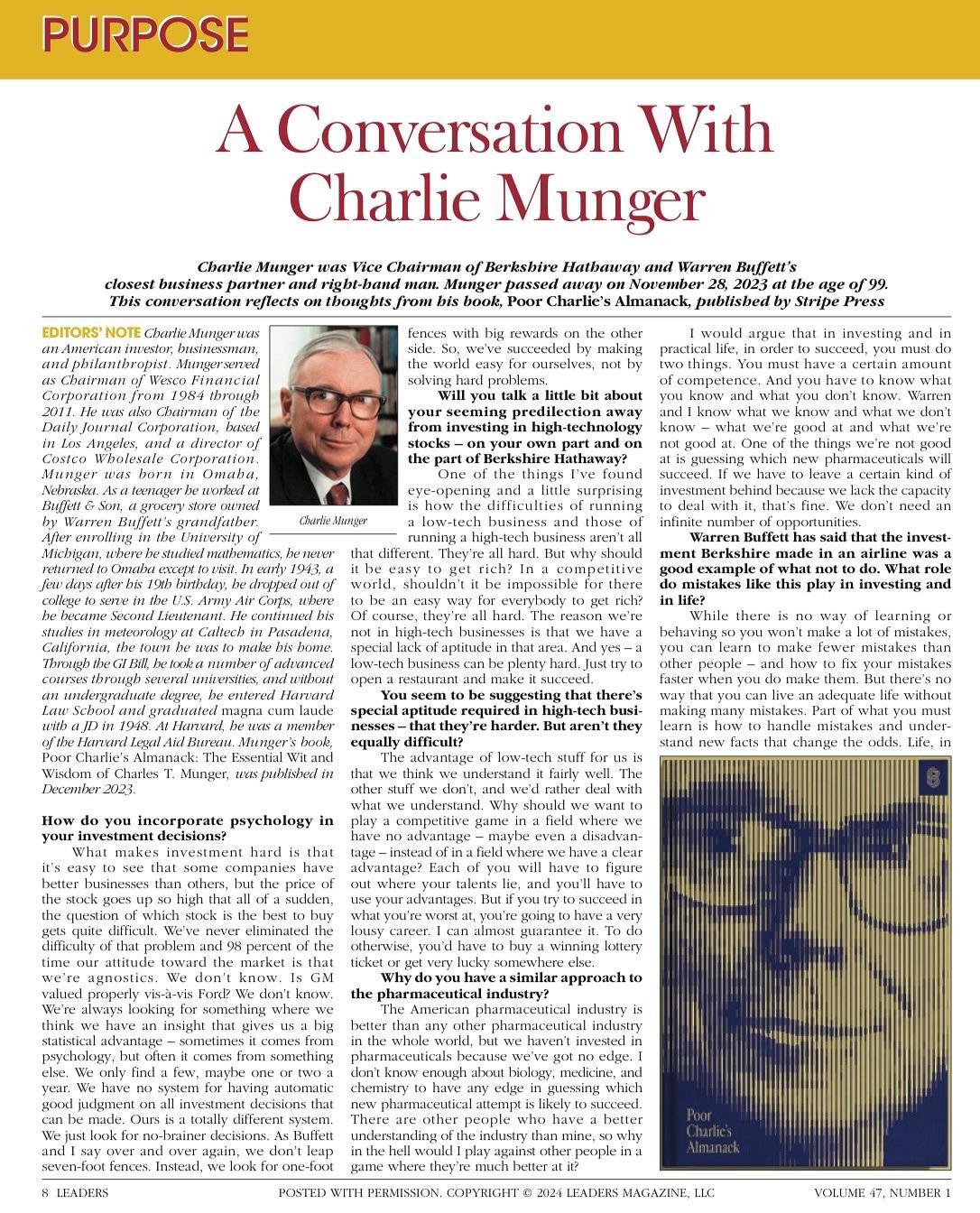

A Conversation with Charlie Munger is a timeless glimpse into the clarity, humility, and rigorous thinking that defined one of investing’s great minds.

Munger didn’t just invest capital he invested in understanding human behavior, multi-disciplinary thinking, and having the emotional discipline to do less, not more.

His advice? Know what you don’t know. Avoid ideologies. Stick to simplicity. Embrace long-term thinking. And above all, learn constantly because the world changes, and staying still is the surest way to fall behind.

This wasn’t just about stocks. It was a worldview.

#CharlieMunger #ValueInvesting #PoorCharliesAlmanack #InvestingWisdom #LongTermThinking #MentalModels #InvestorMindset #WarrenBuffett #BerkshireHathaway #FinancialEducation #WealthBuilding

Munger didn’t just invest capital he invested in understanding human behavior, multi-disciplinary thinking, and having the emotional discipline to do less, not more.

His advice? Know what you don’t know. Avoid ideologies. Stick to simplicity. Embrace long-term thinking. And above all, learn constantly because the world changes, and staying still is the surest way to fall behind.

This wasn’t just about stocks. It was a worldview.

#CharlieMunger #ValueInvesting #PoorCharliesAlmanack #InvestingWisdom #LongTermThinking #MentalModels #InvestorMindset #WarrenBuffett #BerkshireHathaway #FinancialEducation #WealthBuilding

A Conversation with Charlie Munger is a timeless glimpse into the clarity, humility, and rigorous thinking that defined one of investing’s great minds.

Munger didn’t just invest capital he invested in understanding human behavior, multi-disciplinary thinking, and having the emotional discipline to do less, not more.

His advice? Know what you don’t know. Avoid ideologies. Stick to simplicity. Embrace long-term thinking. And above all, learn constantly because the world changes, and staying still is the surest way to fall behind.

This wasn’t just about stocks. It was a worldview.

#CharlieMunger #ValueInvesting #PoorCharliesAlmanack #InvestingWisdom #LongTermThinking #MentalModels #InvestorMindset #WarrenBuffett #BerkshireHathaway #FinancialEducation #WealthBuilding

·369 Views

·0 önizleme