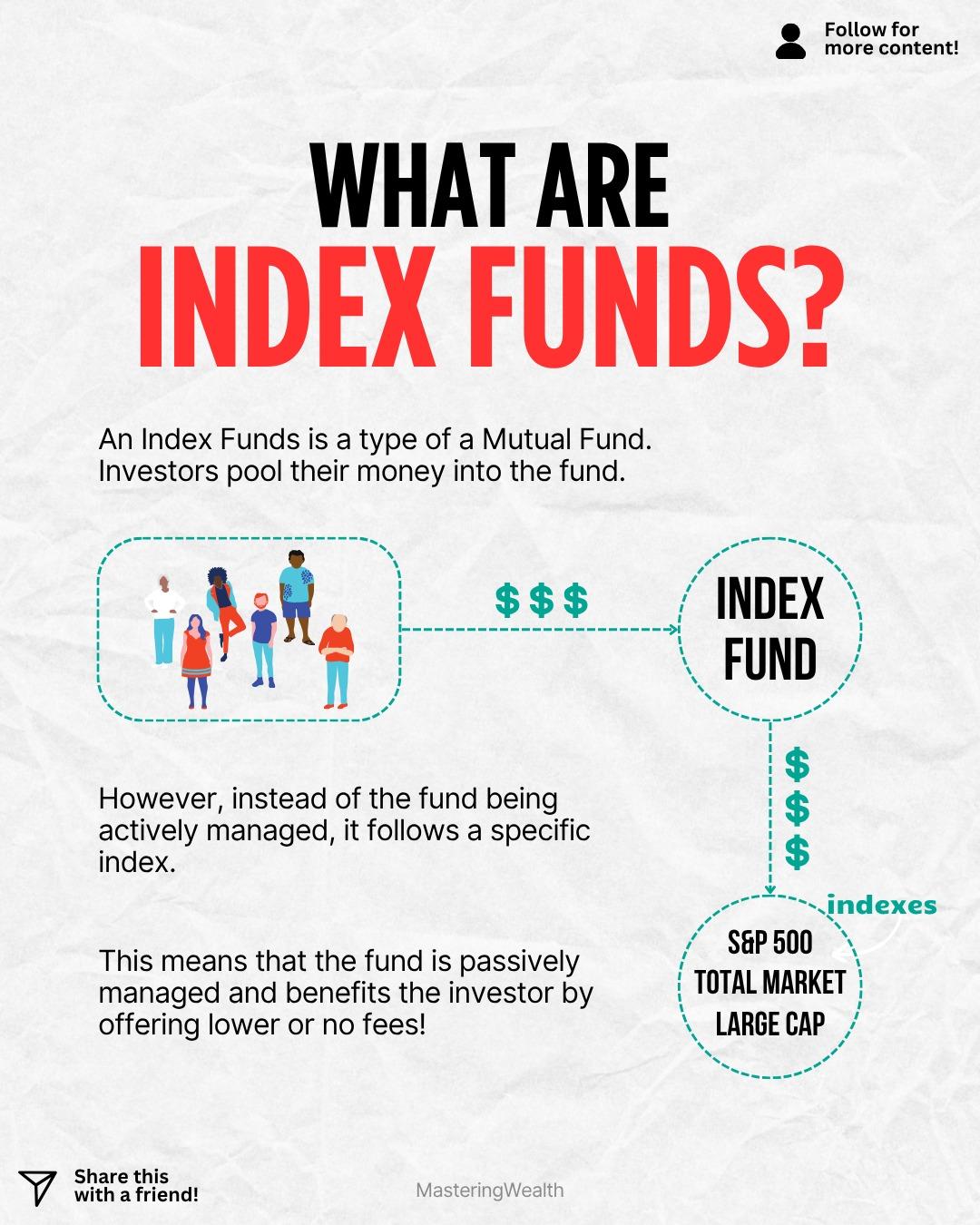

Index funds are one of the simplest and most powerful ways to start investing . At their core, an index fund is a type of mutual fund where investors pool money together. Instead of being actively managed by a professional who tries to beat the market, an index fund simply mirrors a specific index like the S&P 500, Total Market, or a Large Cap index. This makes it passive, efficient, and often much cheaper compared to other types of funds.

The magic of index funds lies in their low fees and diversification . Because they track an index, you are automatically spreading your money across hundreds of companies instead of betting on just one or two stocks. This reduces your risk while still giving you exposure to market growth. It is one of the main reasons why legendary investors like Warren Buffett recommend index funds for most people.

By avoiding the high management fees that come with actively managed funds, more of your money stays invested and compounds over time . Even a small difference in fees can mean thousands or even hundreds of thousands of dollars in the long run. Index funds are also incredibly accessible, making them a great first step for new investors who want to build long term wealth.

If you want to see the exact index funds and dividend stocks I am invested in, comment “Stocks” below and I will send you the link to my portfolio .

Do you currently invest in index funds, or do you prefer choosing individual stocks for your portfolio?

For more simple breakdowns on investing, building wealth, and financial independence, make sure you follow me @MasteringWealth .

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research or speak with a licensed financial professional before making investment decisions.

The magic of index funds lies in their low fees and diversification . Because they track an index, you are automatically spreading your money across hundreds of companies instead of betting on just one or two stocks. This reduces your risk while still giving you exposure to market growth. It is one of the main reasons why legendary investors like Warren Buffett recommend index funds for most people.

By avoiding the high management fees that come with actively managed funds, more of your money stays invested and compounds over time . Even a small difference in fees can mean thousands or even hundreds of thousands of dollars in the long run. Index funds are also incredibly accessible, making them a great first step for new investors who want to build long term wealth.

If you want to see the exact index funds and dividend stocks I am invested in, comment “Stocks” below and I will send you the link to my portfolio .

Do you currently invest in index funds, or do you prefer choosing individual stocks for your portfolio?

For more simple breakdowns on investing, building wealth, and financial independence, make sure you follow me @MasteringWealth .

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research or speak with a licensed financial professional before making investment decisions.

Index funds are one of the simplest and most powerful ways to start investing 📊. At their core, an index fund is a type of mutual fund where investors pool money together. Instead of being actively managed by a professional who tries to beat the market, an index fund simply mirrors a specific index like the S&P 500, Total Market, or a Large Cap index. This makes it passive, efficient, and often much cheaper compared to other types of funds.

The magic of index funds lies in their low fees and diversification 🌎. Because they track an index, you are automatically spreading your money across hundreds of companies instead of betting on just one or two stocks. This reduces your risk while still giving you exposure to market growth. It is one of the main reasons why legendary investors like Warren Buffett recommend index funds for most people.

By avoiding the high management fees that come with actively managed funds, more of your money stays invested and compounds over time ⏳. Even a small difference in fees can mean thousands or even hundreds of thousands of dollars in the long run. Index funds are also incredibly accessible, making them a great first step for new investors who want to build long term wealth.

If you want to see the exact index funds and dividend stocks I am invested in, comment “Stocks” below and I will send you the link to my portfolio 📈.

Do you currently invest in index funds, or do you prefer choosing individual stocks for your portfolio? 🤔

For more simple breakdowns on investing, building wealth, and financial independence, make sure you follow me @MasteringWealth 🚀.

Disclaimer: This content is for educational purposes only and is not financial advice. Always do your own research or speak with a licensed financial professional before making investment decisions.

·222 Visualizações

·0 Anterior