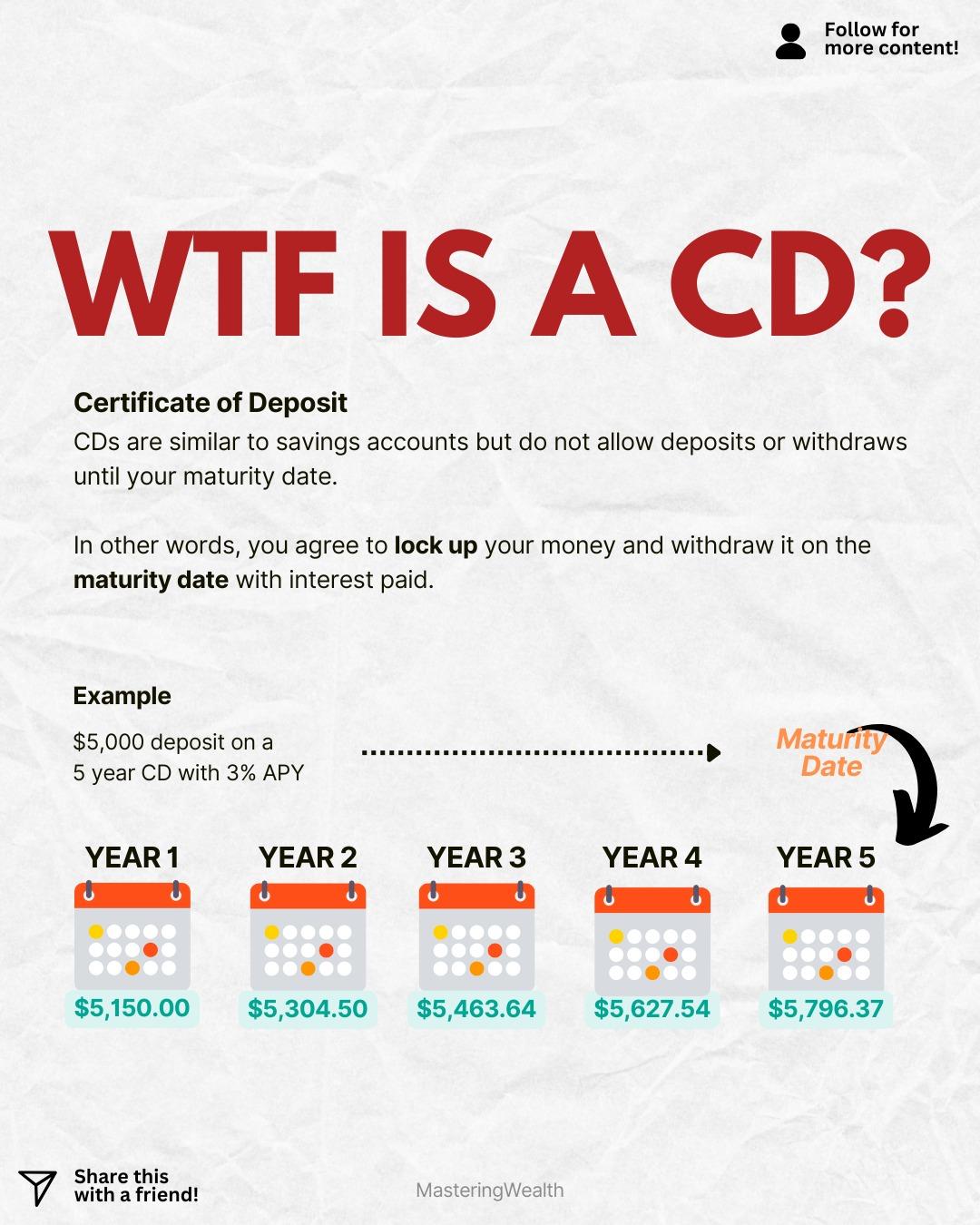

A Certificate of Deposit is one of the simplest financial tools you can use to grow your savings with predictable returns. The graphic shows how a CD works by locking your money for a set period and earning a fixed interest rate until the maturity date. This is different from a regular savings account because you cannot add or withdraw money until the term ends without paying a penalty.

CDs offer stability which makes them attractive for short term goals. You know exactly how much interest you will earn and when you will be able to access your money. This gives you a safe place to store cash while avoiding the risk of market fluctuations.

In the example shown you deposit five thousand dollars into a five year CD with a three percent APY. Each year your balance grows because interest is added and compounds on the new amount. By the end of year five your money grows to five thousand seven hundred ninety six dollars without needing to do anything extra.

CDs are great for people who want a guaranteed return. They are often used for emergency fund surplus, saving for a planned purchase, or holding money during uncertain market conditions. They typically offer higher interest rates than regular savings accounts which makes them a better option for money you do not need immediately.

When comparing CDs always check the APY, term length, and whether the CD is locked or flexible. Online banks sometimes offer higher CD rates than traditional banks which can give you better returns. CDs are also insured which adds another layer of safety for your savings.

If you want to see the dividend portfolio I use for long term investing and compounding, comment “Stocks” and I will send you the link.

Would you ever consider using a CD for part of your savings or do you prefer keeping everything in a regular savings account?

For more simple guides that help you understand interest rates, savings tools, and smart money decisions, follow @MasteringWealth for daily financial breakdowns.

This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

CDs offer stability which makes them attractive for short term goals. You know exactly how much interest you will earn and when you will be able to access your money. This gives you a safe place to store cash while avoiding the risk of market fluctuations.

In the example shown you deposit five thousand dollars into a five year CD with a three percent APY. Each year your balance grows because interest is added and compounds on the new amount. By the end of year five your money grows to five thousand seven hundred ninety six dollars without needing to do anything extra.

CDs are great for people who want a guaranteed return. They are often used for emergency fund surplus, saving for a planned purchase, or holding money during uncertain market conditions. They typically offer higher interest rates than regular savings accounts which makes them a better option for money you do not need immediately.

When comparing CDs always check the APY, term length, and whether the CD is locked or flexible. Online banks sometimes offer higher CD rates than traditional banks which can give you better returns. CDs are also insured which adds another layer of safety for your savings.

If you want to see the dividend portfolio I use for long term investing and compounding, comment “Stocks” and I will send you the link.

Would you ever consider using a CD for part of your savings or do you prefer keeping everything in a regular savings account?

For more simple guides that help you understand interest rates, savings tools, and smart money decisions, follow @MasteringWealth for daily financial breakdowns.

This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

A Certificate of Deposit is one of the simplest financial tools you can use to grow your savings with predictable returns. The graphic shows how a CD works by locking your money for a set period and earning a fixed interest rate until the maturity date. This is different from a regular savings account because you cannot add or withdraw money until the term ends without paying a penalty.

CDs offer stability which makes them attractive for short term goals. You know exactly how much interest you will earn and when you will be able to access your money. This gives you a safe place to store cash while avoiding the risk of market fluctuations.

In the example shown you deposit five thousand dollars into a five year CD with a three percent APY. Each year your balance grows because interest is added and compounds on the new amount. By the end of year five your money grows to five thousand seven hundred ninety six dollars without needing to do anything extra.

CDs are great for people who want a guaranteed return. They are often used for emergency fund surplus, saving for a planned purchase, or holding money during uncertain market conditions. They typically offer higher interest rates than regular savings accounts which makes them a better option for money you do not need immediately.

When comparing CDs always check the APY, term length, and whether the CD is locked or flexible. Online banks sometimes offer higher CD rates than traditional banks which can give you better returns. CDs are also insured which adds another layer of safety for your savings.

If you want to see the dividend portfolio I use for long term investing and compounding, comment “Stocks” and I will send you the link.

Would you ever consider using a CD for part of your savings or do you prefer keeping everything in a regular savings account?

For more simple guides that help you understand interest rates, savings tools, and smart money decisions, follow @MasteringWealth for daily financial breakdowns.

⚠️ This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

·63 Views

·0 önizleme