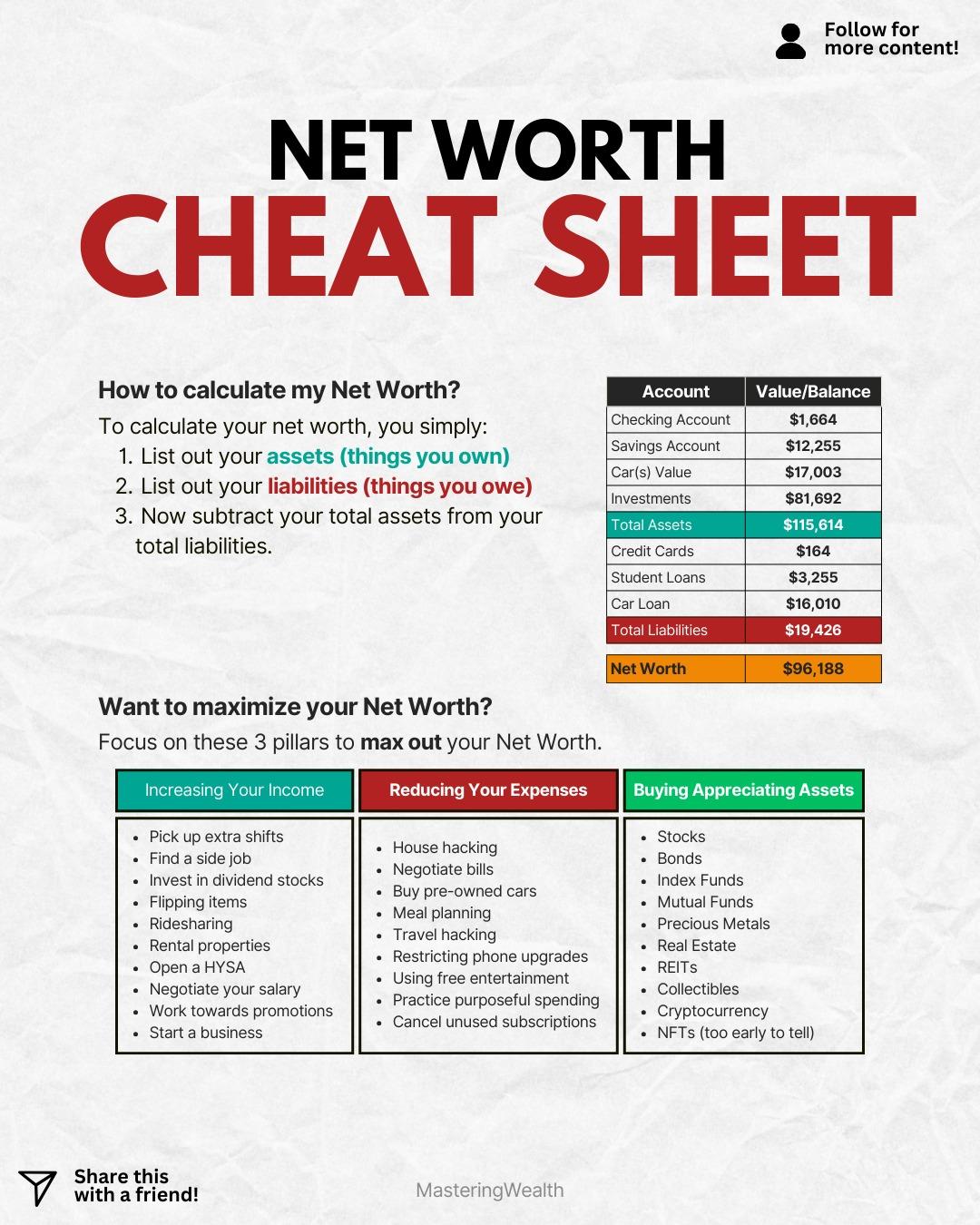

Your net worth is one of the clearest indicators of your financial health. It shows the full picture of what you own compared to what you owe. The visual in this post breaks down the steps to calculate it and gives you simple ways to increase it over time.

To calculate your net worth, start by listing all of your assets which includes cash, savings, investments, and the value of major items like a car. Then list all your liabilities which are debts such as credit cards, student loans, and car loans. Once you subtract your total liabilities from your total assets, the result is your net worth.

This number does not define your value as a person, but it does help you understand your financial progress. Tracking your net worth each month gives you clarity on whether you are moving forward or backward. It also helps you identify which areas need improvement.

There are three main ways to grow your net worth over time. The first is to increase your income which can be done through side jobs, promotions, skill building, or investing in dividend stocks or rental properties. The second is reducing expenses by negotiating bills, eliminating unused subscriptions, and making smarter spending decisions.

The third method is buying appreciating assets which grow in value such as stocks, bonds, index funds, real estate, precious metals, and mutual funds. When you consistently buy assets that rise in value, your net worth increases automatically. Small improvements in each of these areas compound into major long term results.

Understanding your net worth helps you stay in control of your financial journey. It gives you a clear target to improve and a way to measure your growth. The goal is not perfection but progress over time.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I use appreciating assets to increase my net worth.

Which pillar do you feel you need to focus on the most right now: increasing income, reducing expenses, or buying more assets?

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

To calculate your net worth, start by listing all of your assets which includes cash, savings, investments, and the value of major items like a car. Then list all your liabilities which are debts such as credit cards, student loans, and car loans. Once you subtract your total liabilities from your total assets, the result is your net worth.

This number does not define your value as a person, but it does help you understand your financial progress. Tracking your net worth each month gives you clarity on whether you are moving forward or backward. It also helps you identify which areas need improvement.

There are three main ways to grow your net worth over time. The first is to increase your income which can be done through side jobs, promotions, skill building, or investing in dividend stocks or rental properties. The second is reducing expenses by negotiating bills, eliminating unused subscriptions, and making smarter spending decisions.

The third method is buying appreciating assets which grow in value such as stocks, bonds, index funds, real estate, precious metals, and mutual funds. When you consistently buy assets that rise in value, your net worth increases automatically. Small improvements in each of these areas compound into major long term results.

Understanding your net worth helps you stay in control of your financial journey. It gives you a clear target to improve and a way to measure your growth. The goal is not perfection but progress over time.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I use appreciating assets to increase my net worth.

Which pillar do you feel you need to focus on the most right now: increasing income, reducing expenses, or buying more assets?

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

Your net worth is one of the clearest indicators of your financial health. It shows the full picture of what you own compared to what you owe. The visual in this post breaks down the steps to calculate it and gives you simple ways to increase it over time.

To calculate your net worth, start by listing all of your assets which includes cash, savings, investments, and the value of major items like a car. Then list all your liabilities which are debts such as credit cards, student loans, and car loans. Once you subtract your total liabilities from your total assets, the result is your net worth.

This number does not define your value as a person, but it does help you understand your financial progress. Tracking your net worth each month gives you clarity on whether you are moving forward or backward. It also helps you identify which areas need improvement.

There are three main ways to grow your net worth over time. The first is to increase your income which can be done through side jobs, promotions, skill building, or investing in dividend stocks or rental properties. The second is reducing expenses by negotiating bills, eliminating unused subscriptions, and making smarter spending decisions.

The third method is buying appreciating assets which grow in value such as stocks, bonds, index funds, real estate, precious metals, and mutual funds. When you consistently buy assets that rise in value, your net worth increases automatically. Small improvements in each of these areas compound into major long term results.

Understanding your net worth helps you stay in control of your financial journey. It gives you a clear target to improve and a way to measure your growth. The goal is not perfection but progress over time.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how I use appreciating assets to increase my net worth.

Which pillar do you feel you need to focus on the most right now: increasing income, reducing expenses, or buying more assets?

⚠️ This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making investment decisions.

·225 Ansichten

·0 Bewertungen