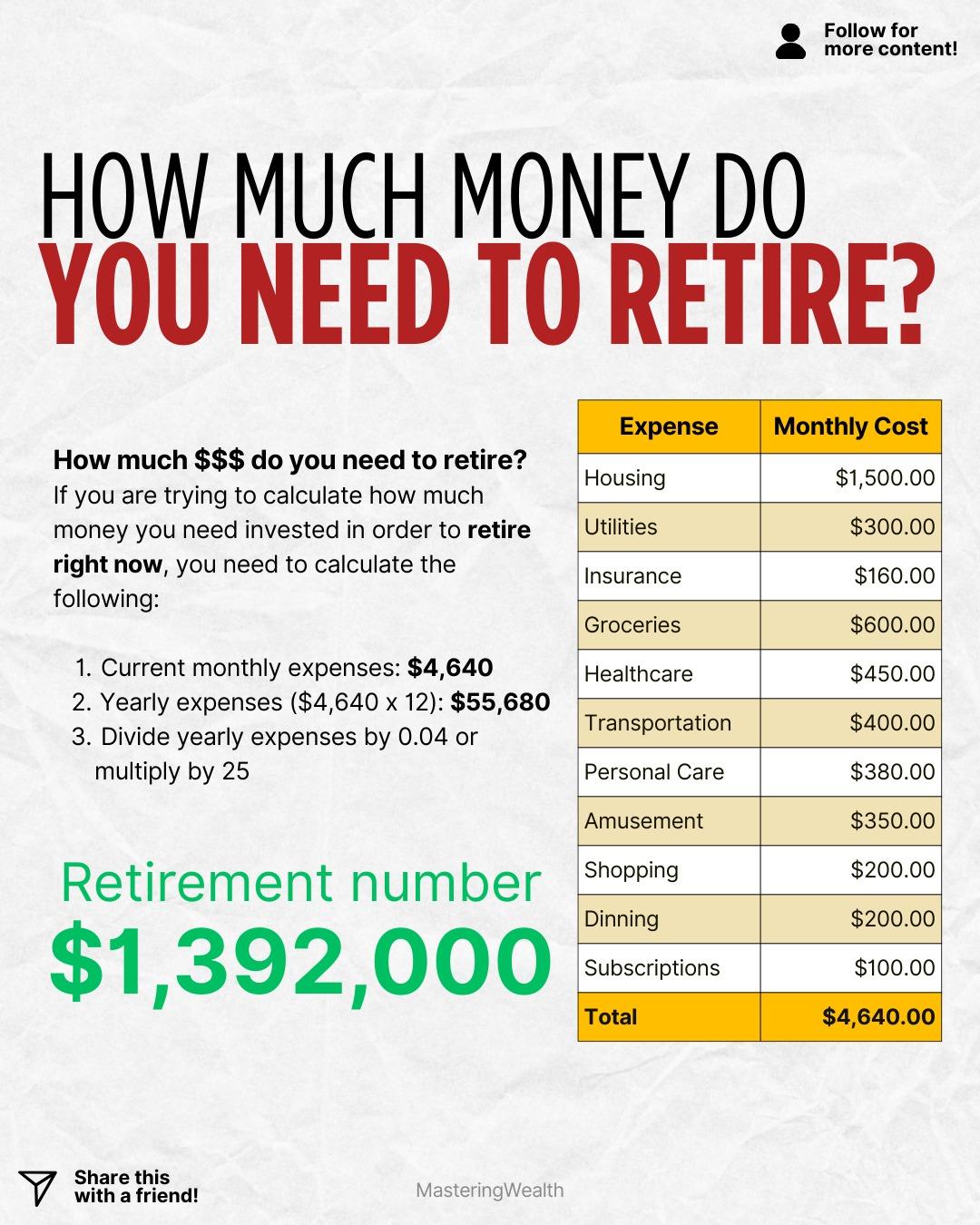

Figuring out how much money you need to retire can feel overwhelming, but this graphic breaks it down into a simple formula that anyone can understand. The key is knowing your monthly expenses and then calculating your yearly spending. From there you can use the four percent rule to estimate the total amount you need invested to retire comfortably.

In this example the monthly expenses are four thousand six hundred forty dollars which adds up to fifty five thousand six hundred eighty dollars per year. When you multiply that number by twenty five you get a retirement number of one million three hundred ninety two thousand dollars. This number represents how much money you would need invested so that a four percent withdrawal rate could support your lifestyle.

The four percent rule is based on historical market performance and is used as a guideline for safe withdrawals in retirement. It provides a way to estimate how much money your investments can generate each year without running out too quickly. While the exact amount will vary from person to person the formula gives you a starting point for retirement planning.

Knowing your retirement number helps you map out your journey toward financial independence. It makes your goal feel more realistic because you have a target instead of guessing. Once you know how much you need you can reverse engineer a plan and adjust your savings rate and investment strategy.

The expenses shown in the chart also remind you that your retirement plan must reflect your real lifestyle. Housing, groceries, transportation, healthcare, subscriptions, entertainment, and personal care all play a role in your overall number. The more accurately you track your expenses the more accurate your retirement calculation will be.

If you want to see my dividend portfolio which helps me build long term wealth and move closer to financial independence, comment “Stocks” and I will send you the link.

This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

In this example the monthly expenses are four thousand six hundred forty dollars which adds up to fifty five thousand six hundred eighty dollars per year. When you multiply that number by twenty five you get a retirement number of one million three hundred ninety two thousand dollars. This number represents how much money you would need invested so that a four percent withdrawal rate could support your lifestyle.

The four percent rule is based on historical market performance and is used as a guideline for safe withdrawals in retirement. It provides a way to estimate how much money your investments can generate each year without running out too quickly. While the exact amount will vary from person to person the formula gives you a starting point for retirement planning.

Knowing your retirement number helps you map out your journey toward financial independence. It makes your goal feel more realistic because you have a target instead of guessing. Once you know how much you need you can reverse engineer a plan and adjust your savings rate and investment strategy.

The expenses shown in the chart also remind you that your retirement plan must reflect your real lifestyle. Housing, groceries, transportation, healthcare, subscriptions, entertainment, and personal care all play a role in your overall number. The more accurately you track your expenses the more accurate your retirement calculation will be.

If you want to see my dividend portfolio which helps me build long term wealth and move closer to financial independence, comment “Stocks” and I will send you the link.

This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

Figuring out how much money you need to retire can feel overwhelming, but this graphic breaks it down into a simple formula that anyone can understand. The key is knowing your monthly expenses and then calculating your yearly spending. From there you can use the four percent rule to estimate the total amount you need invested to retire comfortably.

In this example the monthly expenses are four thousand six hundred forty dollars which adds up to fifty five thousand six hundred eighty dollars per year. When you multiply that number by twenty five you get a retirement number of one million three hundred ninety two thousand dollars. This number represents how much money you would need invested so that a four percent withdrawal rate could support your lifestyle.

The four percent rule is based on historical market performance and is used as a guideline for safe withdrawals in retirement. It provides a way to estimate how much money your investments can generate each year without running out too quickly. While the exact amount will vary from person to person the formula gives you a starting point for retirement planning.

Knowing your retirement number helps you map out your journey toward financial independence. It makes your goal feel more realistic because you have a target instead of guessing. Once you know how much you need you can reverse engineer a plan and adjust your savings rate and investment strategy.

The expenses shown in the chart also remind you that your retirement plan must reflect your real lifestyle. Housing, groceries, transportation, healthcare, subscriptions, entertainment, and personal care all play a role in your overall number. The more accurately you track your expenses the more accurate your retirement calculation will be.

If you want to see my dividend portfolio which helps me build long term wealth and move closer to financial independence, comment “Stocks” and I will send you the link.

⚠️ This content is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making financial decisions.

·88 Vue

·0 Aperçu