What’s happening right now is bigger — and more complex — than just markets, bonds, or politics.

The “party” I described isn’t just a metaphor. It’s a real reflection of how trust works in the economy… and how quickly it can snap.

Understanding moments like this sparks a full range of emotions — confusion, anger, fear, hope.

Everyone interprets the driver differently:

Some think he’s reckless.

Some think he’s still the safest bet.

Others think the whole car is already crashing.

That’s what happens when systems crack: Perception outruns reality.

The truth is:

This isn’t about tariffs.

This isn’t about temporary market moves.

This isn’t even about inflation or GDP prints.

This is about fiscal dominance

about whether the United States can reassert responsibility over the financial system, or whether the world loses faith permanently.

It’s incredibly painful to go through — but it’s still the right thing to do.

Because once trust is lost, you can’t buy it back.

Not with money printing.

Not with stimulus.

Not with headlines.

Strong leadership right now isn’t about popularity.

It’s about showing the world that America can be trusted — even after stumbling.

It’s about fixing the foundation, not wallpapering over the cracks.

Yes, the tactics being used — fear, volatility, market pressure — look messy.

But the alternative, doing nothing and losing control of yields, debt, and credibility, would be far worse.

Right now, yields are the signal.

They are showing whether the system bends… or whether it breaks.

The party is over.

The hangover is here.

Now we find out:

Can leadership restore trust — or will the crowd call their own ride and leave?

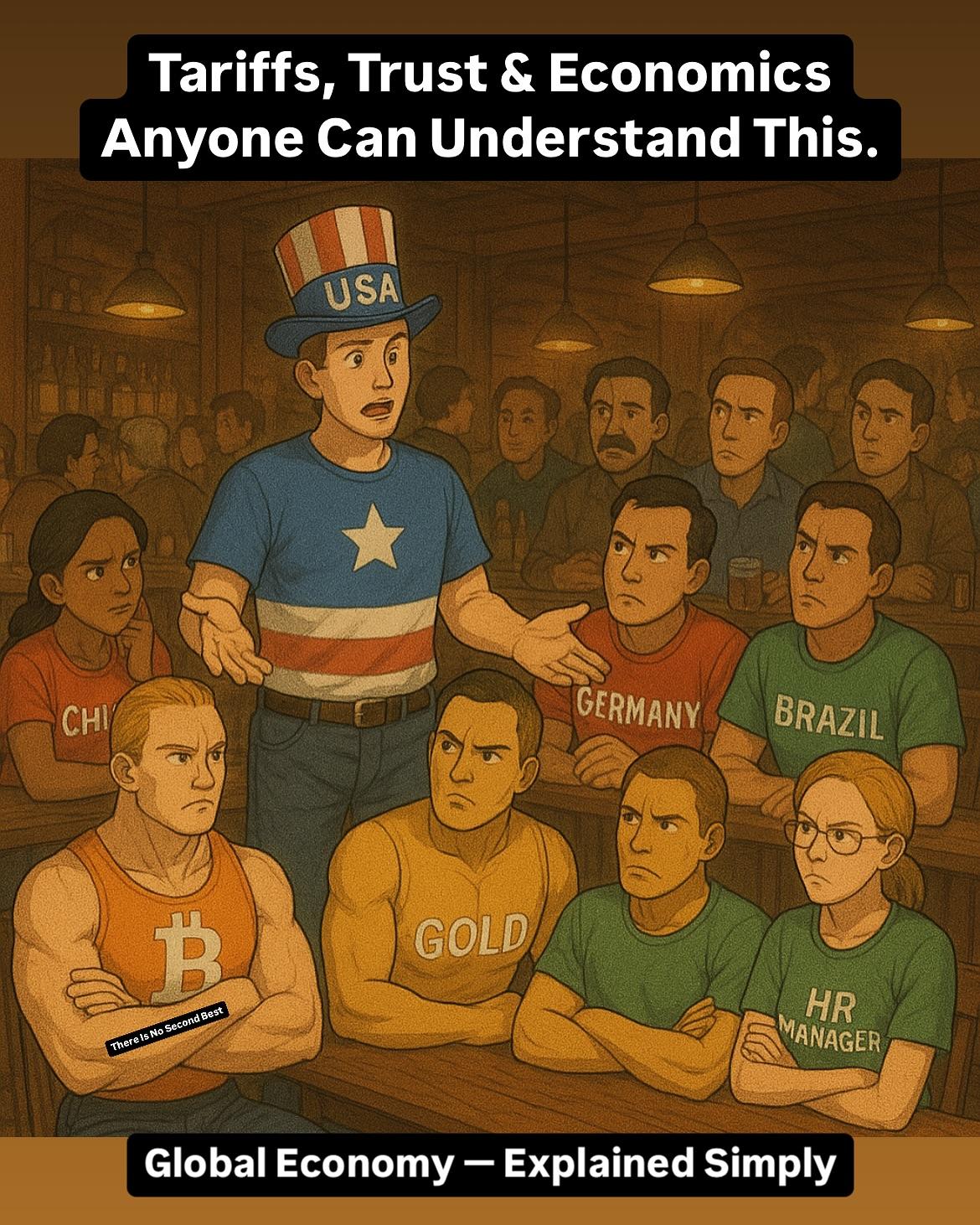

I designed the Party analogy intentionally — to make it easier to understand the complex dynamics and real conversations happening beneath the surface and how side conversations can have impacts.

The problems are serious.

The emotions are real.

But understanding what’s truly being tested right now is the only way to see clearly through the noise.

#economy #bonds #yields #stocks #stockmarket #trading #hedgefund #stocktrading #stockmarkets

The “party” I described isn’t just a metaphor. It’s a real reflection of how trust works in the economy… and how quickly it can snap.

Understanding moments like this sparks a full range of emotions — confusion, anger, fear, hope.

Everyone interprets the driver differently:

Some think he’s reckless.

Some think he’s still the safest bet.

Others think the whole car is already crashing.

That’s what happens when systems crack: Perception outruns reality.

The truth is:

This isn’t about tariffs.

This isn’t about temporary market moves.

This isn’t even about inflation or GDP prints.

This is about fiscal dominance

about whether the United States can reassert responsibility over the financial system, or whether the world loses faith permanently.

It’s incredibly painful to go through — but it’s still the right thing to do.

Because once trust is lost, you can’t buy it back.

Not with money printing.

Not with stimulus.

Not with headlines.

Strong leadership right now isn’t about popularity.

It’s about showing the world that America can be trusted — even after stumbling.

It’s about fixing the foundation, not wallpapering over the cracks.

Yes, the tactics being used — fear, volatility, market pressure — look messy.

But the alternative, doing nothing and losing control of yields, debt, and credibility, would be far worse.

Right now, yields are the signal.

They are showing whether the system bends… or whether it breaks.

The party is over.

The hangover is here.

Now we find out:

Can leadership restore trust — or will the crowd call their own ride and leave?

I designed the Party analogy intentionally — to make it easier to understand the complex dynamics and real conversations happening beneath the surface and how side conversations can have impacts.

The problems are serious.

The emotions are real.

But understanding what’s truly being tested right now is the only way to see clearly through the noise.

#economy #bonds #yields #stocks #stockmarket #trading #hedgefund #stocktrading #stockmarkets

What’s happening right now is bigger — and more complex — than just markets, bonds, or politics.

The “party” I described isn’t just a metaphor. It’s a real reflection of how trust works in the economy… and how quickly it can snap.

Understanding moments like this sparks a full range of emotions — confusion, anger, fear, hope.

Everyone interprets the driver differently:

Some think he’s reckless.

Some think he’s still the safest bet.

Others think the whole car is already crashing.

That’s what happens when systems crack: Perception outruns reality.

The truth is:

This isn’t about tariffs.

This isn’t about temporary market moves.

This isn’t even about inflation or GDP prints.

This is about fiscal dominance

about whether the United States can reassert responsibility over the financial system, or whether the world loses faith permanently.

It’s incredibly painful to go through — but it’s still the right thing to do.

Because once trust is lost, you can’t buy it back.

Not with money printing.

Not with stimulus.

Not with headlines.

Strong leadership right now isn’t about popularity.

It’s about showing the world that America can be trusted — even after stumbling.

It’s about fixing the foundation, not wallpapering over the cracks.

Yes, the tactics being used — fear, volatility, market pressure — look messy.

But the alternative, doing nothing and losing control of yields, debt, and credibility, would be far worse.

Right now, yields are the signal.

They are showing whether the system bends… or whether it breaks.

The party is over.

The hangover is here.

Now we find out:

Can leadership restore trust — or will the crowd call their own ride and leave?

I designed the Party analogy intentionally — to make it easier to understand the complex dynamics and real conversations happening beneath the surface and how side conversations can have impacts.

The problems are serious.

The emotions are real.

But understanding what’s truly being tested right now is the only way to see clearly through the noise.

#economy #bonds #yields #stocks #stockmarket #trading #hedgefund #stocktrading #stockmarkets

·1K Views

·0 Reviews