Core Principles of Long-Term Investing Wisdom

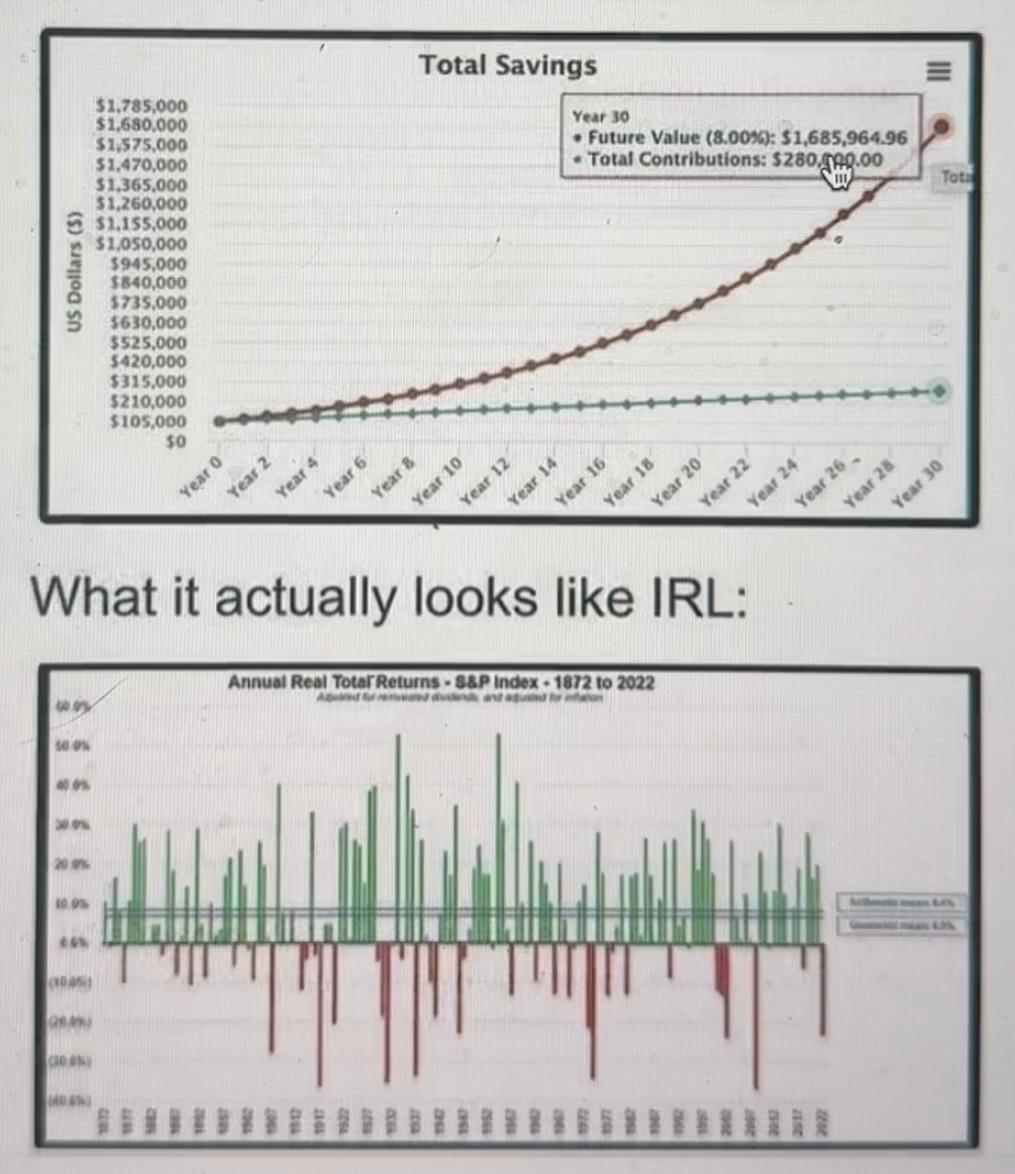

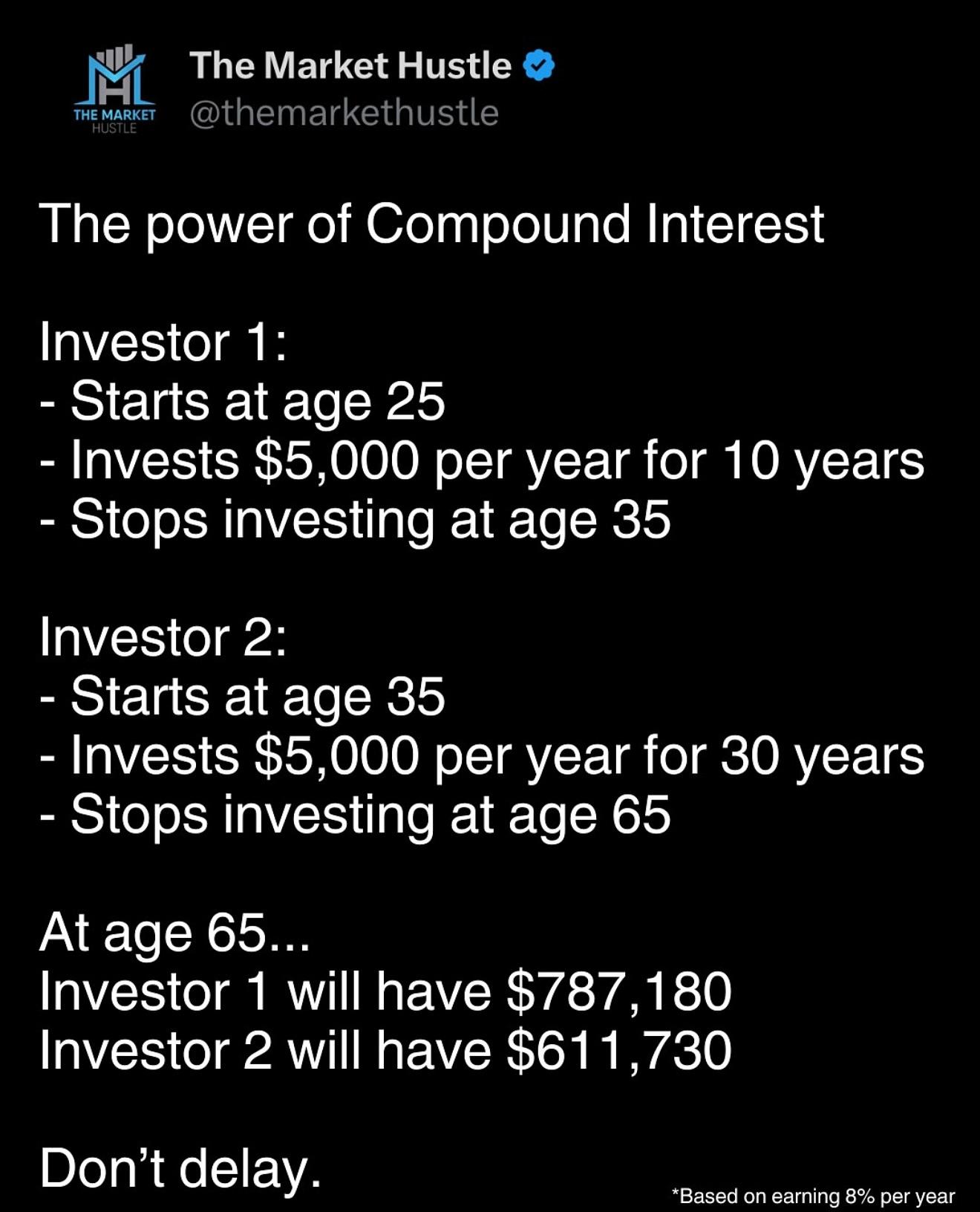

1. Think Long Term

Ignore short-term market noise. The real gains come over decades, not days or quarters.

2. Simplicity Beats Complexity

Index funds, understandable businesses, and “buy and hold” strategies outperform intricate tactics over time.

3. Don’t Overtrade

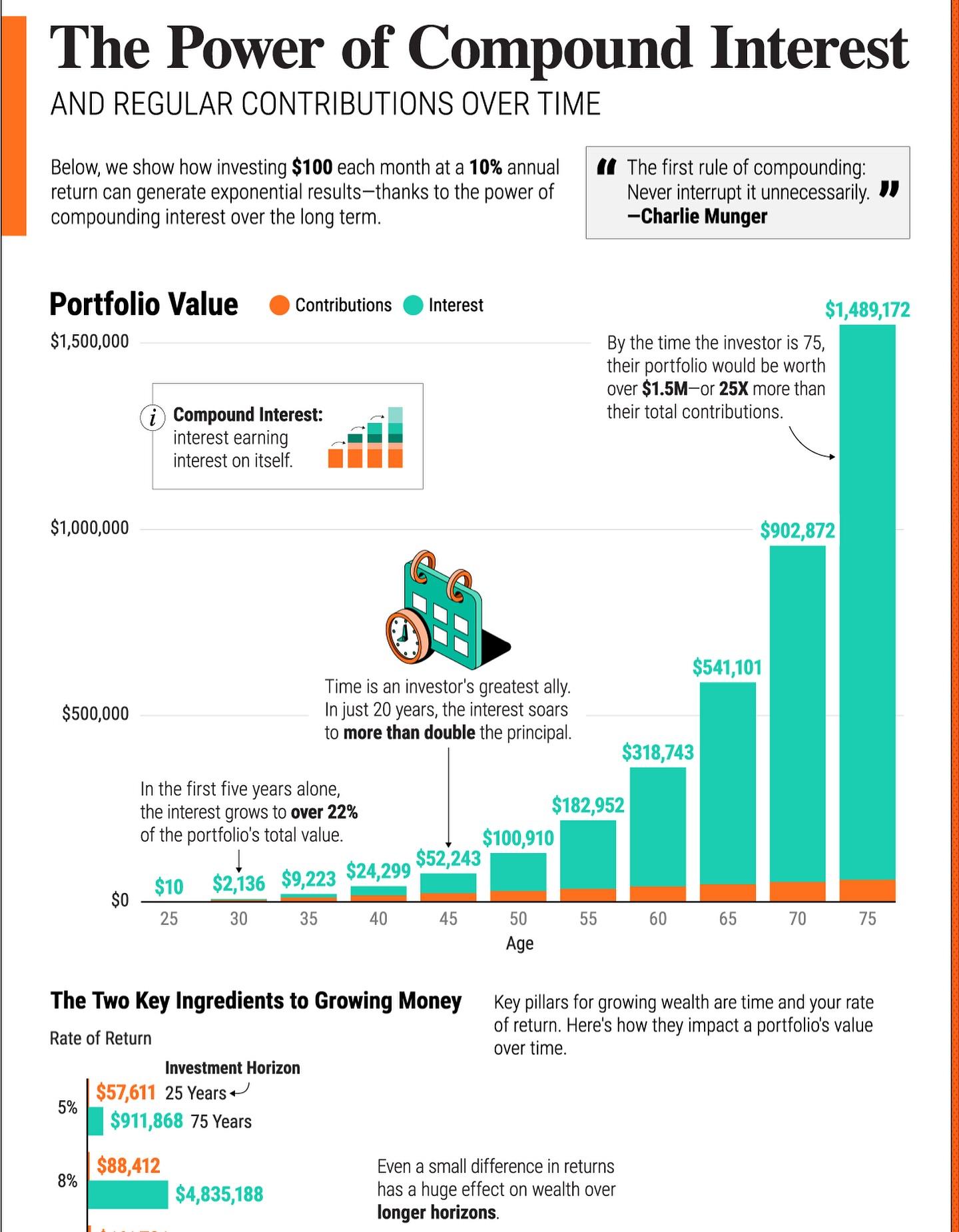

Excessive trading kills returns through taxes, fees, and emotional mistakes. Be still and let compounding work.

4. Invest in What You Understand

Stick with businesses or funds you can explain in a sentence. Complexity isn’t an edge—it’s a risk.

5. Behavior Matters More Than Brilliance

Discipline, patience, and emotional control matter more than intelligence. Time in the market beats timing the market.

6. Passive Investing Wins Over Time

Low-cost index funds outperform most active strategies net of fees and taxes.

7. Be Skeptical of Forecasts and Market Timing

No one reliably predicts markets. Stick to a process rather than reacting to headlines.

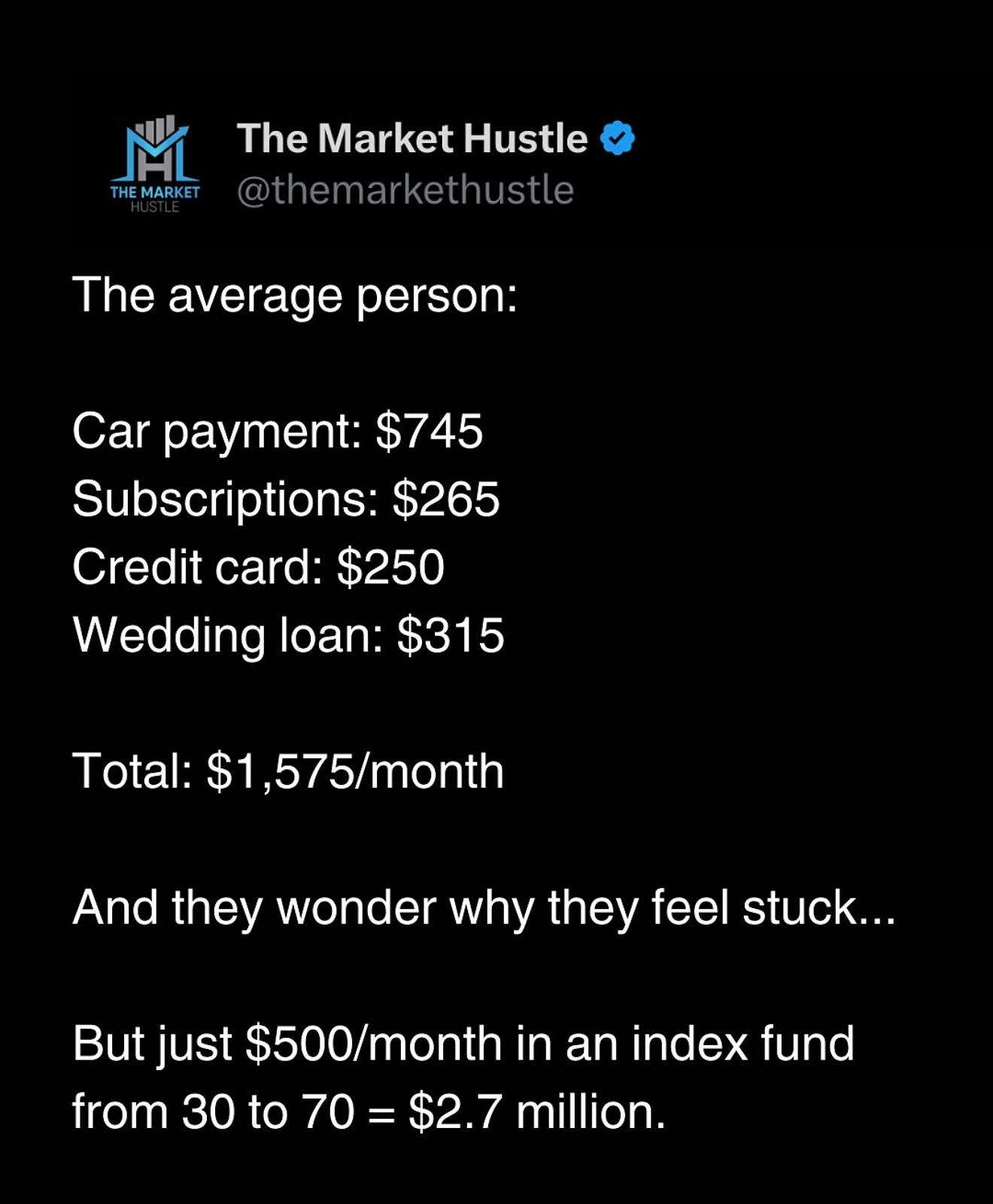

8. Costs and Fees Matter Immensely

High fees compound against you. Keep investment costs low to let your returns compound for you.

9. Know Thyself

Understand your goals, risk tolerance, and time horizon. A well-matched plan is better than a perfect one you’ll abandon.

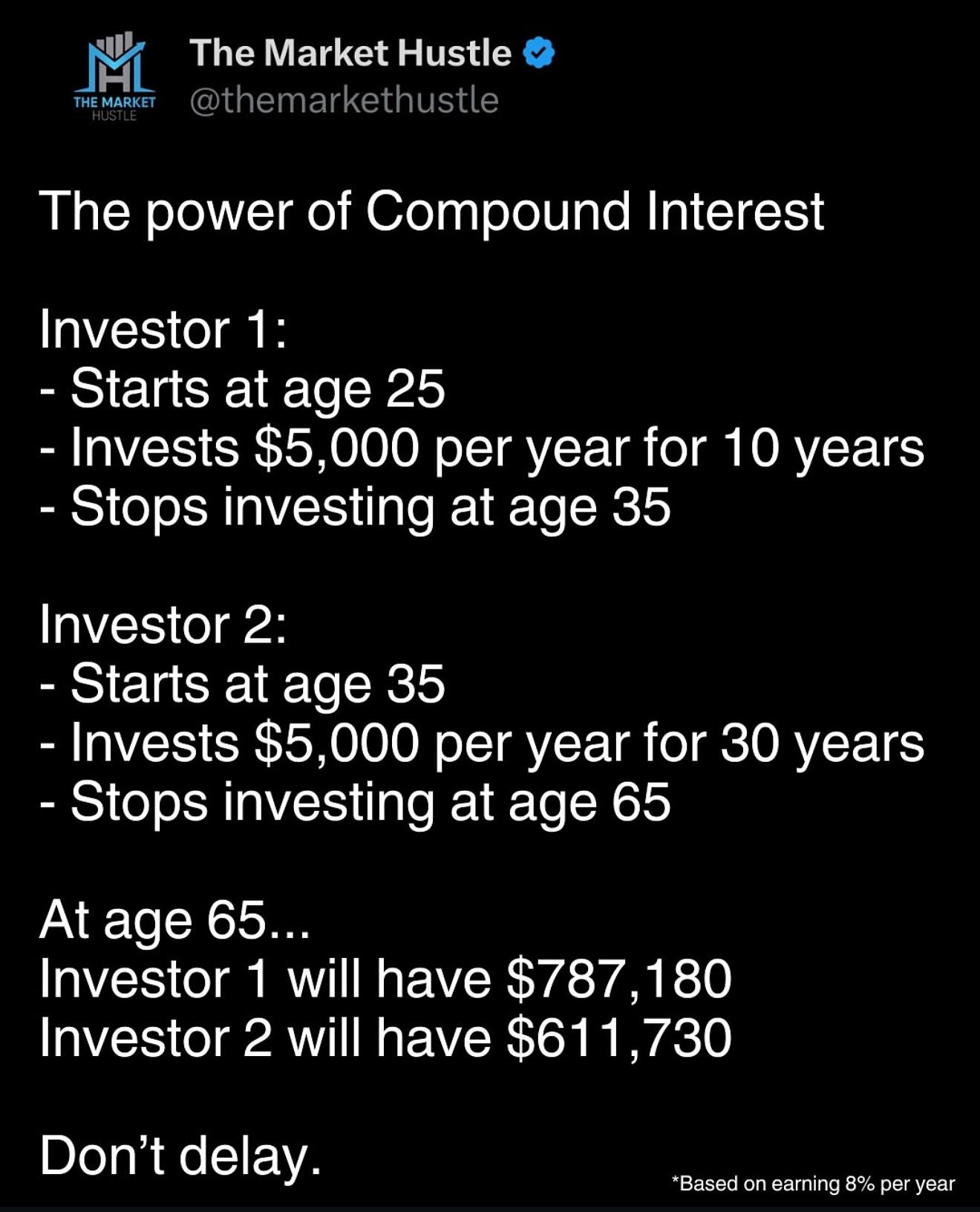

10. Let Compounding Work

The road is bumpy, but the destination is powerful wealth creation. Stay on course.

#LongTermInvesting #IndexFunds #InvestingWisdom #WarrenBuffett #CoffeeCanPortfolio #FinancialIndependence #CharlesEllis #PassiveInvesting #BehavioralFinance #InvestmentDiscipline #CompoundInterest #BuyAndHold #LowCostInvesting #KnowYourself #StayTheCourseCore Principles of Long-Term Investing Wisdom

1. Think Long Term

Ignore short-term market noise. The real gains come over decades, not days or quarters.

2. Simplicity Beats Complexity

Index funds, understandable businesses, and “buy and hold” strategies outperform intricate tactics over time.

3. Don’t Overtrade

Excessive trading kills returns through taxes, fees, and emotional mistakes. Be still and let compounding work.

4. Invest in What You Understand

Stick with businesses or funds you can explain in a sentence. Complexity isn’t an edge—it’s a risk.

5. Behavior Matters More Than Brilliance

Discipline, patience, and emotional control matter more than intelligence. Time in the market beats timing the market.

6. Passive Investing Wins Over Time

Low-cost index funds outperform most active strategies net of fees and taxes.

7. Be Skeptical of Forecasts and Market Timing

No one reliably predicts markets. Stick to a process rather than reacting to headlines.

8. Costs and Fees Matter Immensely

High fees compound against you. Keep investment costs low to let your returns compound for you.

9. Know Thyself

Understand your goals, risk tolerance, and time horizon. A well-matched plan is better than a perfect one you’ll abandon.

10. Let Compounding Work

The road is bumpy, but the destination is powerful wealth creation. Stay on course.

#LongTermInvesting #IndexFunds #InvestingWisdom #WarrenBuffett #CoffeeCanPortfolio #FinancialIndependence #CharlesEllis #PassiveInvesting #BehavioralFinance #InvestmentDiscipline #CompoundInterest #BuyAndHold #LowCostInvesting #KnowYourself #StayTheCourse