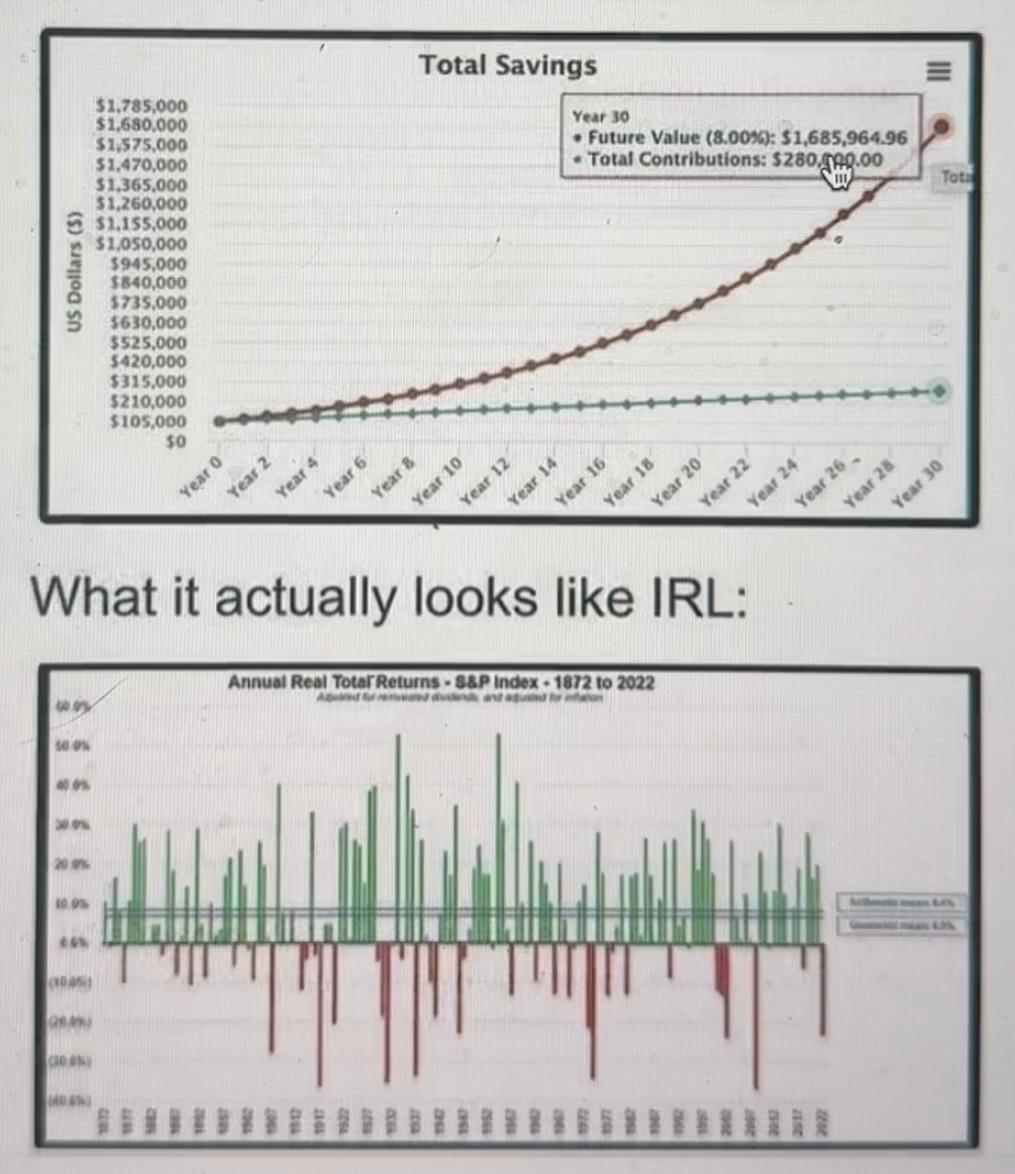

Everyone loves the smooth 8% compounding chart…

But this is what real investing looks like…messy, volatile, emotional.

The trick? Zoom out.

Check your portfolio less often. Make smart choices, automate contributions, and let time do its work.

Your house fluctuates in value all the time and no one freaks out.

Treat your investments the same way.

Hashtags:

#LongTermInvesting #InvestingReality #StockMarketTruth #CompoundInterest #FinancialDiscipline #WealthBuilding #SP500 #InvestmentJourney #IndexInvesting #MoneyMindset #InvestorPsychology #BuyAndHold #StayTheCourse #FinancialLiteracy #PassiveInvesting #InvestingTips #MarketVolatility #TimeInTheMarket #DollarCostAveraging #FinancialFreedom

But this is what real investing looks like…messy, volatile, emotional.

The trick? Zoom out.

Check your portfolio less often. Make smart choices, automate contributions, and let time do its work.

Your house fluctuates in value all the time and no one freaks out.

Treat your investments the same way.

Hashtags:

#LongTermInvesting #InvestingReality #StockMarketTruth #CompoundInterest #FinancialDiscipline #WealthBuilding #SP500 #InvestmentJourney #IndexInvesting #MoneyMindset #InvestorPsychology #BuyAndHold #StayTheCourse #FinancialLiteracy #PassiveInvesting #InvestingTips #MarketVolatility #TimeInTheMarket #DollarCostAveraging #FinancialFreedom

Everyone loves the smooth 8% compounding chart…

But this is what real investing looks like…messy, volatile, emotional.

The trick? Zoom out.

Check your portfolio less often. Make smart choices, automate contributions, and let time do its work.

Your house fluctuates in value all the time and no one freaks out.

Treat your investments the same way.

Hashtags:

#LongTermInvesting #InvestingReality #StockMarketTruth #CompoundInterest #FinancialDiscipline #WealthBuilding #SP500 #InvestmentJourney #IndexInvesting #MoneyMindset #InvestorPsychology #BuyAndHold #StayTheCourse #FinancialLiteracy #PassiveInvesting #InvestingTips #MarketVolatility #TimeInTheMarket #DollarCostAveraging #FinancialFreedom

·1K Views

·0 Reviews