Ethereum’s current performance: A closer look at its ecosystem and market position.

By Crypto Team -November 23, 2024

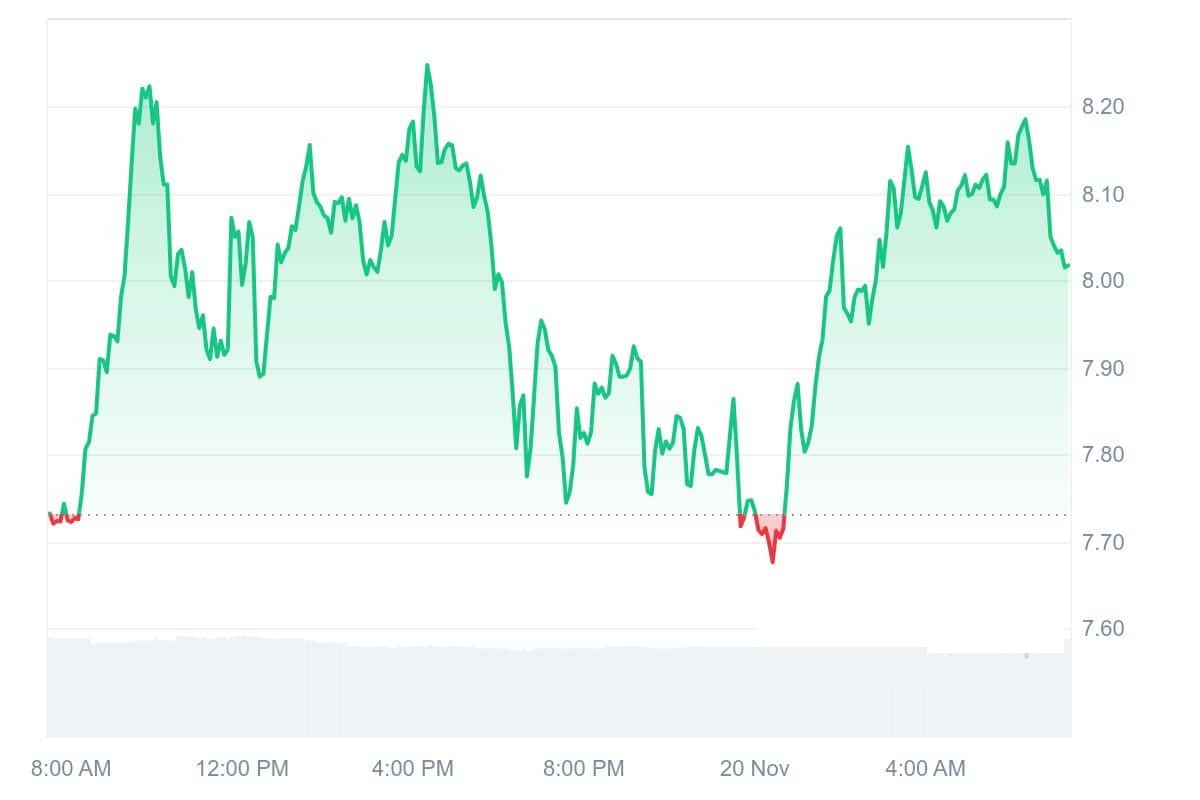

As of November 23, 2024, Ethereum is trading at around $3,344.90, down 0.43% from the previous day. Despite this modest decrease, Ethereum continues to be a leading platform for decentralized applications (dApps), attracting both developers and companies because to its rich ecosystem and creative capabilities.

Understanding Ethereum’s value proposition.

Ethereum, which debuted in 2015, pioneered the notion of smart contracts—self-executing contracts with the contents of the agreement directly put into code. This breakthrough has radically altered how blockchain transactions are carried out, enabling trustless interactions without intermediaries. The Ethereum blockchain enables a wide range of applications, including banking (DeFi), gaming, and supply chain management, making it one of the most adaptable platforms in the cryptocurrency field.

Key features of Ethereum:

Smart contracts: These automate operations and remove the need for intermediaries, hence increasing efficiency and security.

Decentralized Applications (dApps): Developers can create applications that use the Ethereum blockchain’s decentralized characteristics.

The Ethereum Virtual Machine (EVM) enables developers to deploy smart contracts in a secure environment while maintaining uniform behavior across all nodes.

Current Market Dynamics

Several market factors have contributed to Ethereum’s minor price fall. The cryptocurrency market is notoriously volatile, impacted by macroeconomic trends, regulatory developments, and investor emotion. Nonetheless, Ethereum’s foundations remain robust. The platform is constantly evolving, with enhancements targeted at increasing scalability and lowering transaction costs.

One notable update is the move to Ethereum 2.0, which intends to replace the proof-of-work (PoW) consensus method with proof-of-stake (PoS). This shift is projected to improve network efficiency and security while lowering energy consumption—an important consideration as worldwide awareness of sustainability grows.

Developer Engagement and Ecosystem Growth

Despite recent price volatility, Ethereum remains popular among developers because of its comprehensive development tools and vibrant community. Frameworks such as Truffle and Hardhat provide critical resources for developing dApps, streamlining the development process. These tools allow developers to efficiently build, test, and deploy smart contracts, which promotes ecosystem innovation.

Furthermore, Ethereum’s active community contributes greatly to its expansion. Hackathons, workshops, and online forums encourage developer engagement, resulting in the advancement of new ideas and projects that take advantage of Ethereum’s features.

Future Outlook

Looking ahead, Ethereum’s position in the cryptocurrency industry is positive. Analysts predict that as more organizations discover the benefits of blockchain technology in their operations, particularly in areas such as supply chain transparency and financial services, demand for Ethereum-based solutions will increase.

Furthermore, when Layer 2 solutions such as Optimism and Arbitrum gain traction by addressing scalability difficulties on the Ethereum network, transaction speeds are expected to rise dramatically while remaining cost-effective. This could improve user experience and increase acceptance among developers and end users.

In conclusion, while Ethereum’s price is currently falling slightly, its fundamental technology and ecosystem remain strong. The platform’s drive to innovation, combined with a robust developer community and continuing updates such as Ethereum 2.0, positions it well for future growth in an increasingly digital economy. As interest in decentralized applications grows, Ethereum is expected to maintain its position as a blockchain industry leader.

Ethereum’s current performance: A closer look at its ecosystem and market position.

By Crypto Team -November 23, 2024

As of November 23, 2024, Ethereum is trading at around $3,344.90, down 0.43% from the previous day. Despite this modest decrease, Ethereum continues to be a leading platform for decentralized applications (dApps), attracting both developers and companies because to its rich ecosystem and creative capabilities.

Understanding Ethereum’s value proposition.

Ethereum, which debuted in 2015, pioneered the notion of smart contracts—self-executing contracts with the contents of the agreement directly put into code. This breakthrough has radically altered how blockchain transactions are carried out, enabling trustless interactions without intermediaries. The Ethereum blockchain enables a wide range of applications, including banking (DeFi), gaming, and supply chain management, making it one of the most adaptable platforms in the cryptocurrency field.

Key features of Ethereum:

Smart contracts: These automate operations and remove the need for intermediaries, hence increasing efficiency and security.

Decentralized Applications (dApps): Developers can create applications that use the Ethereum blockchain’s decentralized characteristics.

The Ethereum Virtual Machine (EVM) enables developers to deploy smart contracts in a secure environment while maintaining uniform behavior across all nodes.

Current Market Dynamics

Several market factors have contributed to Ethereum’s minor price fall. The cryptocurrency market is notoriously volatile, impacted by macroeconomic trends, regulatory developments, and investor emotion. Nonetheless, Ethereum’s foundations remain robust. The platform is constantly evolving, with enhancements targeted at increasing scalability and lowering transaction costs.

One notable update is the move to Ethereum 2.0, which intends to replace the proof-of-work (PoW) consensus method with proof-of-stake (PoS). This shift is projected to improve network efficiency and security while lowering energy consumption—an important consideration as worldwide awareness of sustainability grows.

Developer Engagement and Ecosystem Growth

Despite recent price volatility, Ethereum remains popular among developers because of its comprehensive development tools and vibrant community. Frameworks such as Truffle and Hardhat provide critical resources for developing dApps, streamlining the development process. These tools allow developers to efficiently build, test, and deploy smart contracts, which promotes ecosystem innovation.

Furthermore, Ethereum’s active community contributes greatly to its expansion. Hackathons, workshops, and online forums encourage developer engagement, resulting in the advancement of new ideas and projects that take advantage of Ethereum’s features.

Future Outlook

Looking ahead, Ethereum’s position in the cryptocurrency industry is positive. Analysts predict that as more organizations discover the benefits of blockchain technology in their operations, particularly in areas such as supply chain transparency and financial services, demand for Ethereum-based solutions will increase.

Furthermore, when Layer 2 solutions such as Optimism and Arbitrum gain traction by addressing scalability difficulties on the Ethereum network, transaction speeds are expected to rise dramatically while remaining cost-effective. This could improve user experience and increase acceptance among developers and end users.

In conclusion, while Ethereum’s price is currently falling slightly, its fundamental technology and ecosystem remain strong. The platform’s drive to innovation, combined with a robust developer community and continuing updates such as Ethereum 2.0, positions it well for future growth in an increasingly digital economy. As interest in decentralized applications grows, Ethereum is expected to maintain its position as a blockchain industry leader.