Central banks have been steadily increasing their gold holdings, and the pace has recently accelerated to levels not seen in decades.

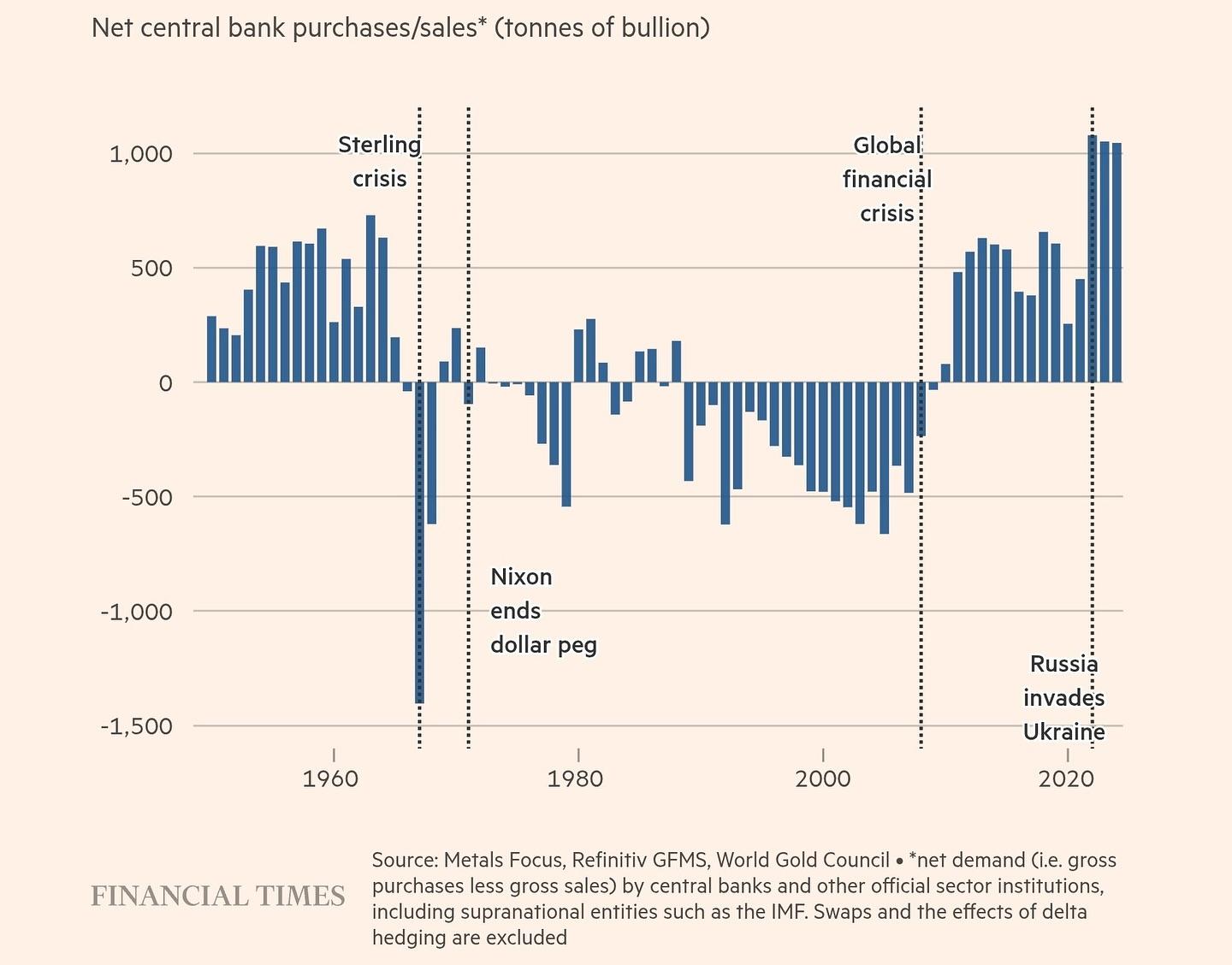

This chart from the Financial Times highlights global net purchases of gold by central banks going back to the 1950s. After a long period of net selling in the late 20th century, central bank demand began to pick up following the Global Financial Crisis. Since 2022, purchases have climbed even further.

Several factors may be driving this shift, including efforts to diversify reserve portfolios, manage risk, and hedge against currency volatility. Global uncertainty, changes in trade patterns, and evolving monetary frameworks could all be contributing to the trend.

Rather than short-term trading, this appears to be part of a broader strategy to build resilience in reserves. Gold remains one of the few assets held widely across countries and financial systems due to its historical role and liquidity.

#GoldReserves #GlobalEconomy #CentralBanks #Macroeconomics #FinancialStability #PortfolioDiversification #MarketTrends #ReserveAssets #WorldEconomy #LongTermInvesting #SafeAssets #EconomicStrategy

This chart from the Financial Times highlights global net purchases of gold by central banks going back to the 1950s. After a long period of net selling in the late 20th century, central bank demand began to pick up following the Global Financial Crisis. Since 2022, purchases have climbed even further.

Several factors may be driving this shift, including efforts to diversify reserve portfolios, manage risk, and hedge against currency volatility. Global uncertainty, changes in trade patterns, and evolving monetary frameworks could all be contributing to the trend.

Rather than short-term trading, this appears to be part of a broader strategy to build resilience in reserves. Gold remains one of the few assets held widely across countries and financial systems due to its historical role and liquidity.

#GoldReserves #GlobalEconomy #CentralBanks #Macroeconomics #FinancialStability #PortfolioDiversification #MarketTrends #ReserveAssets #WorldEconomy #LongTermInvesting #SafeAssets #EconomicStrategy

Central banks have been steadily increasing their gold holdings, and the pace has recently accelerated to levels not seen in decades.

This chart from the Financial Times highlights global net purchases of gold by central banks going back to the 1950s. After a long period of net selling in the late 20th century, central bank demand began to pick up following the Global Financial Crisis. Since 2022, purchases have climbed even further.

Several factors may be driving this shift, including efforts to diversify reserve portfolios, manage risk, and hedge against currency volatility. Global uncertainty, changes in trade patterns, and evolving monetary frameworks could all be contributing to the trend.

Rather than short-term trading, this appears to be part of a broader strategy to build resilience in reserves. Gold remains one of the few assets held widely across countries and financial systems due to its historical role and liquidity.

#GoldReserves #GlobalEconomy #CentralBanks #Macroeconomics #FinancialStability #PortfolioDiversification #MarketTrends #ReserveAssets #WorldEconomy #LongTermInvesting #SafeAssets #EconomicStrategy

·551 Vue

·0 Aperçu