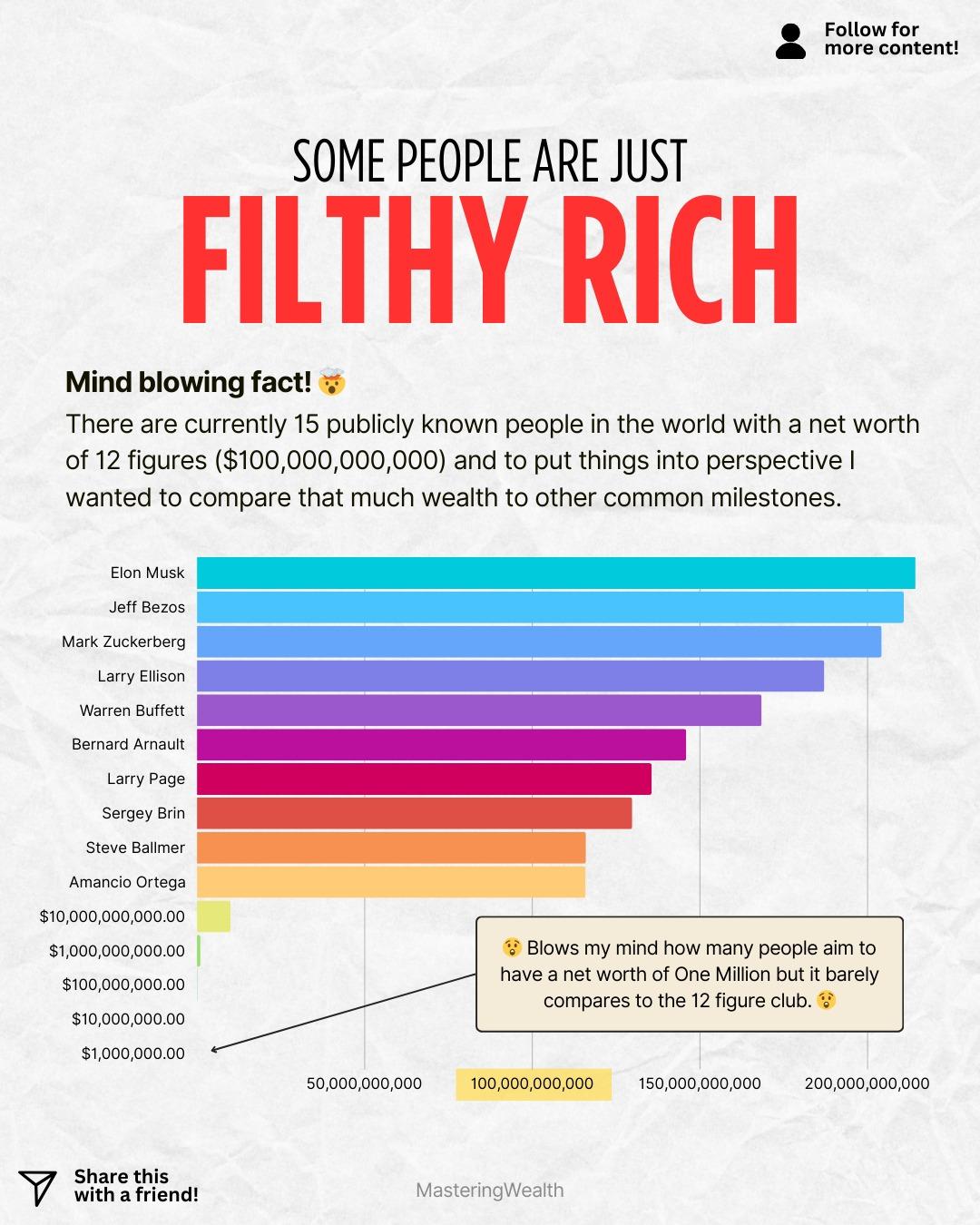

The level of wealth shown in this chart is almost impossible to wrap your mind around. The people highlighted here are part of the extremely rare twelve figure club which means their net worth reaches one hundred billion dollars or more. Seeing these numbers next to common financial milestones like one million makes you realize how massive the gap is between everyday wealth and ultra wealth.

Right now there are about fifteen publicly known individuals who have reached this level. Names like Elon Musk, Jeff Bezos, Mark Zuckerberg, Warren Buffett, Larry Page, Sergey Brin and Bernard Arnault dominate the list because they built companies that changed entire industries. Their wealth is tied to innovation, ownership, and long term growth rather than salary.

The graphic helps show the scale visually. One million dollars looks tiny when placed next to one hundred billion dollars and that is the entire point. Many people chase their first million while these individuals have created wealth that is one hundred thousand times greater.

The world of extreme wealth teaches us something important. Wealth grows exponentially when you own assets that scale and reach global markets. Technology, platforms, and long term business ownership continue to be the vehicles that create new billionaires.

If you want to see the dividend portfolio I use to build steady long term wealth, comment “Stocks” and I will send you the link.

Which person on this list inspires you the most and why do you think they were able to reach this level of financial success?

For more content that breaks down wealth building, investing, net worth growth, and financial education in a simple visual way, follow @MasteringWealth and level up your money knowledge daily.

This content is for educational purposes only and is not financial advice. Always make informed decisions and consult with a licensed professional where needed.

The level of wealth shown in this chart is almost impossible to wrap your mind around. The people highlighted here are part of the extremely rare twelve figure club which means their net worth reaches one hundred billion dollars or more. Seeing these numbers next to common financial milestones like one million makes you realize how massive the gap is between everyday wealth and ultra wealth.

Right now there are about fifteen publicly known individuals who have reached this level. Names like Elon Musk, Jeff Bezos, Mark Zuckerberg, Warren Buffett, Larry Page, Sergey Brin and Bernard Arnault dominate the list because they built companies that changed entire industries. Their wealth is tied to innovation, ownership, and long term growth rather than salary.

The graphic helps show the scale visually. One million dollars looks tiny when placed next to one hundred billion dollars and that is the entire point. Many people chase their first million while these individuals have created wealth that is one hundred thousand times greater.

The world of extreme wealth teaches us something important. Wealth grows exponentially when you own assets that scale and reach global markets. Technology, platforms, and long term business ownership continue to be the vehicles that create new billionaires.

If you want to see the dividend portfolio I use to build steady long term wealth, comment “Stocks” and I will send you the link.

Which person on this list inspires you the most and why do you think they were able to reach this level of financial success?

For more content that breaks down wealth building, investing, net worth growth, and financial education in a simple visual way, follow @MasteringWealth and level up your money knowledge daily.

⚠️ This content is for educational purposes only and is not financial advice. Always make informed decisions and consult with a licensed professional where needed.