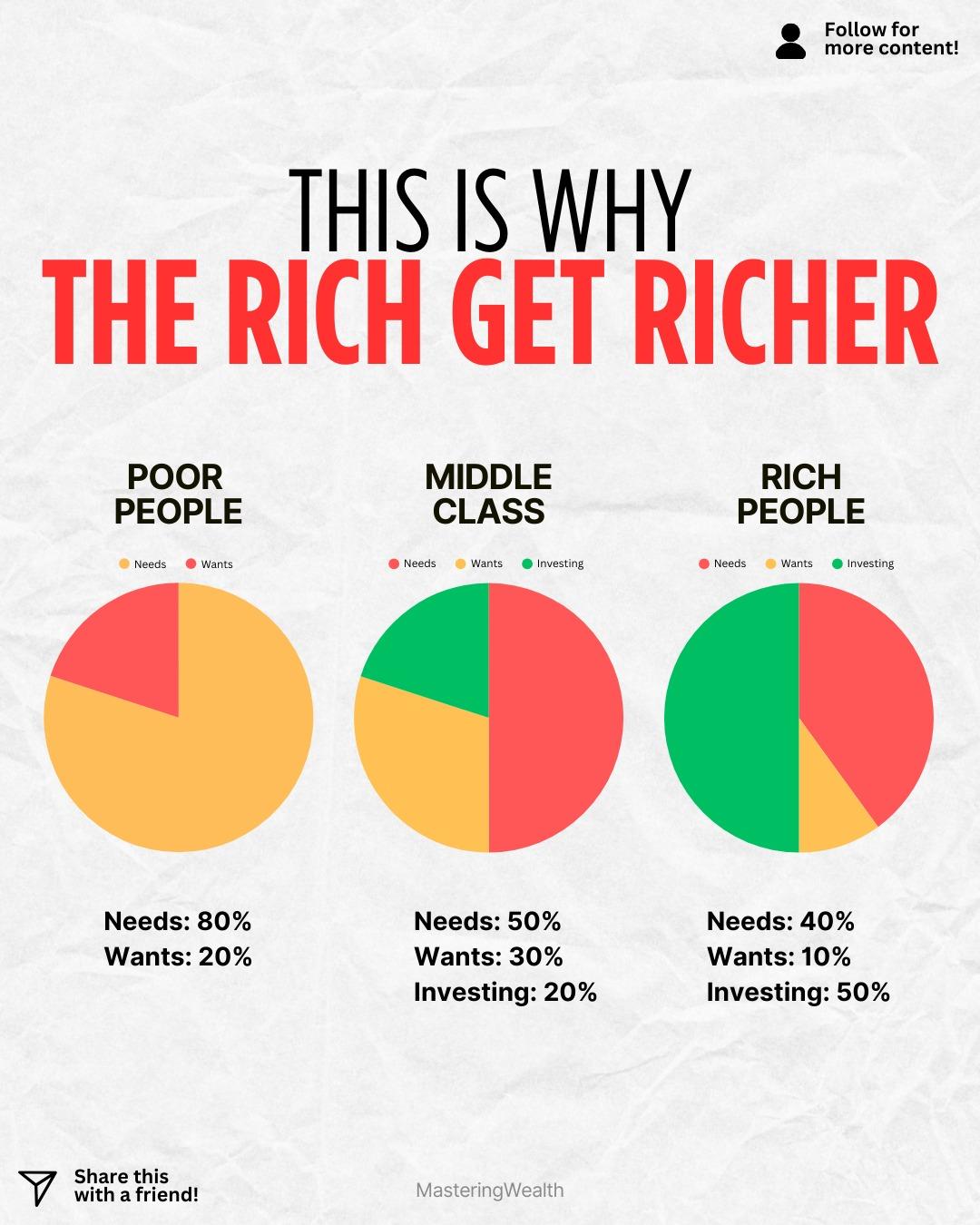

Most people never realize that the biggest difference between poor people middle class people and rich people is not just income. The difference is how each group allocates their money and how much of their cash flow goes toward building future wealth. The chart shows three spending patterns that create completely different financial outcomes over time.

Poor people spend the majority of their money on needs and the rest usually goes toward wants which leaves nothing left to invest. With no money invested there is no growth and no long term wealth building taking place. This creates a cycle where every dollar is already spent before it even arrives.

Middle class people split their budget between needs wants and a small amount for investing. This is better than not investing at all but usually not enough to create true financial freedom. Without increasing the investing percentage it becomes difficult to break out of the paycheck to paycheck rhythm.

Rich people prioritize investing first which is why they continue to grow wealth over time. Half of their money goes toward investments which then generate more money through compound growth. That reinvested growth is what keeps expanding their net worth year after year.

When you study the habits of wealthy people you realize it is not just about earning more money but about keeping more of it. The more you invest the more your money begins working for you instead of you constantly working for money. Even small changes in your percentages can change your long term financial trajectory.

If you want the link to see my dividend portfolio and learn how I personally invest for long term income comment Stocks and I will send it to you.

Which of the three spending patterns do you feel you are closest to right now and what percentage do you want to work toward next?

For more content that breaks down money in a simple and visual way make sure to follow @MasteringWealth for daily financial education.

This content is for educational purposes only and should not be taken as financial advice. Always do your own research or speak with a licensed professional before making financial decisions.

Poor people spend the majority of their money on needs and the rest usually goes toward wants which leaves nothing left to invest. With no money invested there is no growth and no long term wealth building taking place. This creates a cycle where every dollar is already spent before it even arrives.

Middle class people split their budget between needs wants and a small amount for investing. This is better than not investing at all but usually not enough to create true financial freedom. Without increasing the investing percentage it becomes difficult to break out of the paycheck to paycheck rhythm.

Rich people prioritize investing first which is why they continue to grow wealth over time. Half of their money goes toward investments which then generate more money through compound growth. That reinvested growth is what keeps expanding their net worth year after year.

When you study the habits of wealthy people you realize it is not just about earning more money but about keeping more of it. The more you invest the more your money begins working for you instead of you constantly working for money. Even small changes in your percentages can change your long term financial trajectory.

If you want the link to see my dividend portfolio and learn how I personally invest for long term income comment Stocks and I will send it to you.

Which of the three spending patterns do you feel you are closest to right now and what percentage do you want to work toward next?

For more content that breaks down money in a simple and visual way make sure to follow @MasteringWealth for daily financial education.

This content is for educational purposes only and should not be taken as financial advice. Always do your own research or speak with a licensed professional before making financial decisions.

Most people never realize that the biggest difference between poor people middle class people and rich people is not just income. The difference is how each group allocates their money and how much of their cash flow goes toward building future wealth. The chart shows three spending patterns that create completely different financial outcomes over time.

Poor people spend the majority of their money on needs and the rest usually goes toward wants which leaves nothing left to invest. With no money invested there is no growth and no long term wealth building taking place. This creates a cycle where every dollar is already spent before it even arrives.

Middle class people split their budget between needs wants and a small amount for investing. This is better than not investing at all but usually not enough to create true financial freedom. Without increasing the investing percentage it becomes difficult to break out of the paycheck to paycheck rhythm.

Rich people prioritize investing first which is why they continue to grow wealth over time. Half of their money goes toward investments which then generate more money through compound growth. That reinvested growth is what keeps expanding their net worth year after year.

When you study the habits of wealthy people you realize it is not just about earning more money but about keeping more of it. The more you invest the more your money begins working for you instead of you constantly working for money. Even small changes in your percentages can change your long term financial trajectory.

If you want the link to see my dividend portfolio and learn how I personally invest for long term income comment Stocks and I will send it to you.

Which of the three spending patterns do you feel you are closest to right now and what percentage do you want to work toward next?

For more content that breaks down money in a simple and visual way make sure to follow @MasteringWealth for daily financial education.

⚠️ This content is for educational purposes only and should not be taken as financial advice. Always do your own research or speak with a licensed professional before making financial decisions.

·171 Views

·0 Reviews