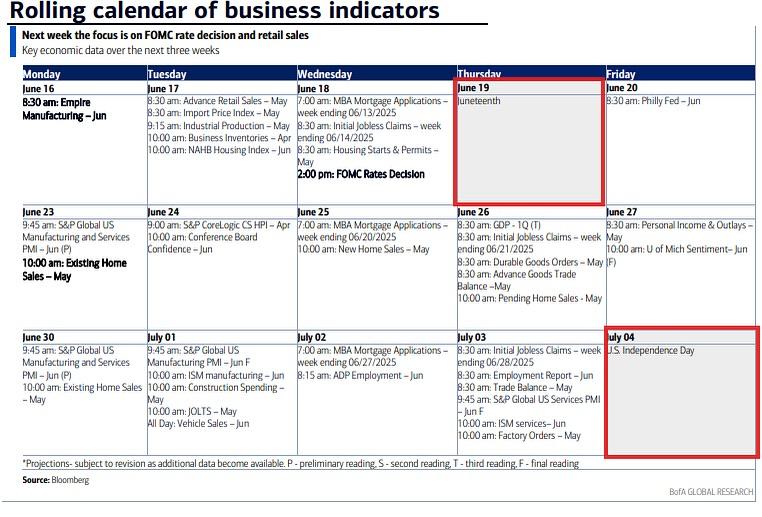

Next week’s trading week is set to be eventful and unusually compressed. Tuesday and Wednesday are stacked with key economic releases and central bank action, while Thursday marks Juneteenth (market holiday) and Friday could see thin participation due to many market participants taking a long weekend ahead of a triple witching expiration.

Tuesday kicks off with a barrage of data: advance retail sales, industrial production, import prices, business inventories, and the NAHB housing index. Then on Wednesday, attention turns sharply to the Fed with the FOMC rate decision at 2:00 PM ET, followed by Powell’s press conference. It’s one of the most closely watched events of the month and could set the tone for the second half of June.

With Juneteenth on Thursday and a summer Friday ahead, it’s highly likely traders and institutions will front-load positioning early in the week. Notably, Friday also marks a triple witching expiration (index futures, index options, and stock options expiring simultaneously), which typically adds volatility and volume—though it may be muted this time if liquidity dries up due to a quasi-long weekend.

Looking ahead, July 4th (on a Friday this year) is just around the corner, meaning two holiday-shortened weeks are on the radar. In this context, next week’s window from Tuesday morning to Wednesday afternoon could be the most concentrated macro/market risk zone of the month.

#FOMC #Powell #RetailSales #MacroTrading #TripleWitching #RateHike #MarketHoliday #FedWatch #EquityMarkets #HolidayTrading #OptionsExpiration #Volatility #SummerTrading #USEconomy

Tuesday kicks off with a barrage of data: advance retail sales, industrial production, import prices, business inventories, and the NAHB housing index. Then on Wednesday, attention turns sharply to the Fed with the FOMC rate decision at 2:00 PM ET, followed by Powell’s press conference. It’s one of the most closely watched events of the month and could set the tone for the second half of June.

With Juneteenth on Thursday and a summer Friday ahead, it’s highly likely traders and institutions will front-load positioning early in the week. Notably, Friday also marks a triple witching expiration (index futures, index options, and stock options expiring simultaneously), which typically adds volatility and volume—though it may be muted this time if liquidity dries up due to a quasi-long weekend.

Looking ahead, July 4th (on a Friday this year) is just around the corner, meaning two holiday-shortened weeks are on the radar. In this context, next week’s window from Tuesday morning to Wednesday afternoon could be the most concentrated macro/market risk zone of the month.

#FOMC #Powell #RetailSales #MacroTrading #TripleWitching #RateHike #MarketHoliday #FedWatch #EquityMarkets #HolidayTrading #OptionsExpiration #Volatility #SummerTrading #USEconomy

Next week’s trading week is set to be eventful and unusually compressed. Tuesday and Wednesday are stacked with key economic releases and central bank action, while Thursday marks Juneteenth (market holiday) and Friday could see thin participation due to many market participants taking a long weekend ahead of a triple witching expiration.

Tuesday kicks off with a barrage of data: advance retail sales, industrial production, import prices, business inventories, and the NAHB housing index. Then on Wednesday, attention turns sharply to the Fed with the FOMC rate decision at 2:00 PM ET, followed by Powell’s press conference. It’s one of the most closely watched events of the month and could set the tone for the second half of June.

With Juneteenth on Thursday and a summer Friday ahead, it’s highly likely traders and institutions will front-load positioning early in the week. Notably, Friday also marks a triple witching expiration (index futures, index options, and stock options expiring simultaneously), which typically adds volatility and volume—though it may be muted this time if liquidity dries up due to a quasi-long weekend.

Looking ahead, July 4th (on a Friday this year) is just around the corner, meaning two holiday-shortened weeks are on the radar. In this context, next week’s window from Tuesday morning to Wednesday afternoon could be the most concentrated macro/market risk zone of the month.

#FOMC #Powell #RetailSales #MacroTrading #TripleWitching #RateHike #MarketHoliday #FedWatch #EquityMarkets #HolidayTrading #OptionsExpiration #Volatility #SummerTrading #USEconomy

·467 Visualizações

·0 Anterior