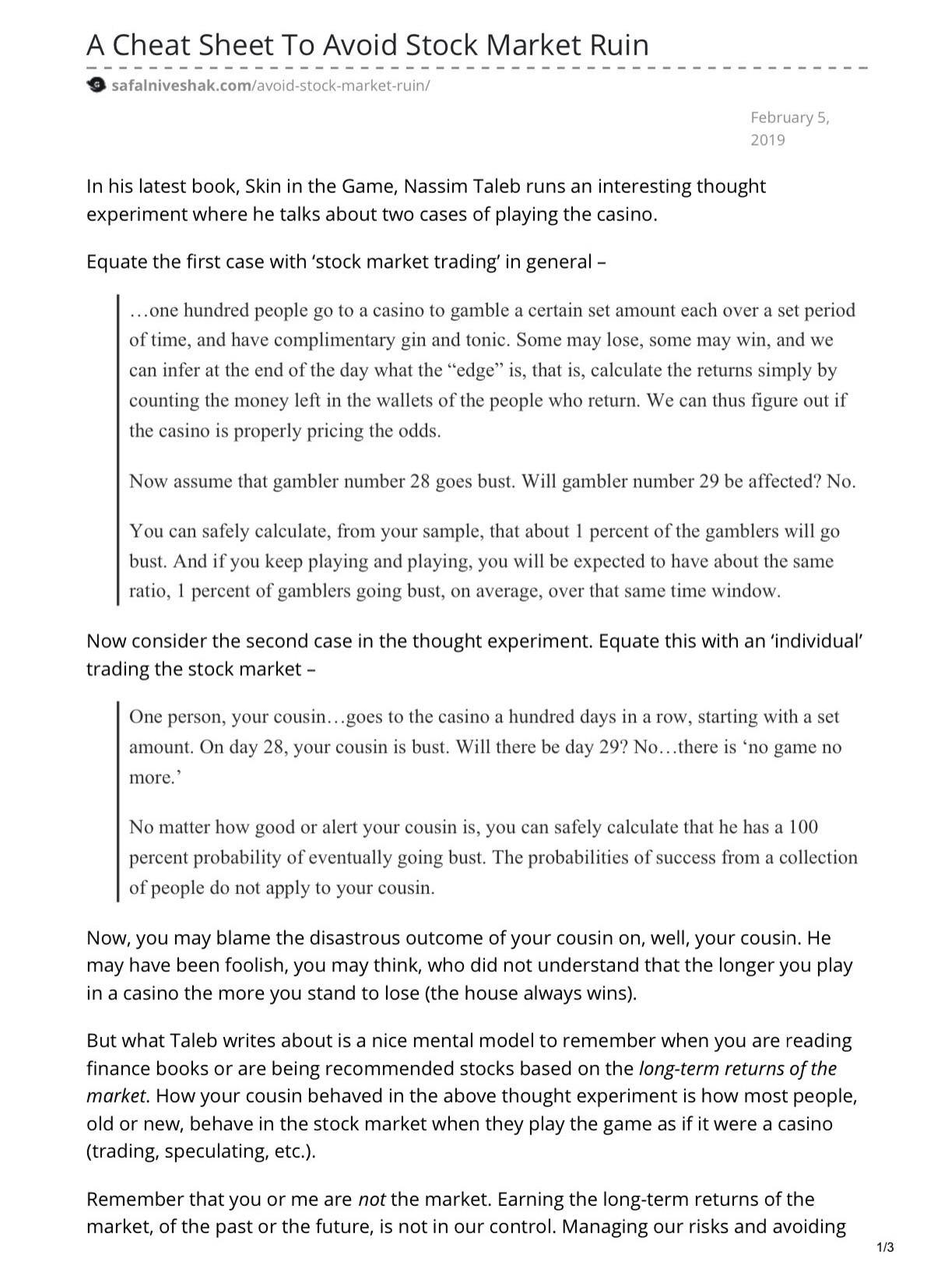

A Cheat Sheet to Avoid Stock Market Ruin. Most investors treat the market like a casino, forgetting that unlike the house, we can actually go bust. The key lesson is survival. You are not the market, so stop chasing “market returns” and instead focus on your own risk tolerance and capital preservation. Don’t speculate because stocks represent real businesses, not lottery tickets. Respect them and play the long game. If you feel the urge to speculate, do it only with “sin money,” never with the capital that secures your survival. Speculate only with what you can afford to lose completely. Above all, remember that the only way to truly win in investing is to survive. As Peter Bernstein wrote, “Survival is the only road to riches.” Longevity in the market matters more than brilliance. Avoid systemic ruin, manage risks, stay humble, and let compounding do the work over time.

#InvestingWisdom #StockMarketTips #NassimTaleb #SkinInTheGame #RiskManagement #LongTermInvesting #Survival #WealthBuilding #SmartInvesting #FinancialFreedom #InvestmentStrategy #ValueInvesting #BehavioralFinance #CompoundingReturns #StockMarketEducation

#InvestingWisdom #StockMarketTips #NassimTaleb #SkinInTheGame #RiskManagement #LongTermInvesting #Survival #WealthBuilding #SmartInvesting #FinancialFreedom #InvestmentStrategy #ValueInvesting #BehavioralFinance #CompoundingReturns #StockMarketEducation

A Cheat Sheet to Avoid Stock Market Ruin. Most investors treat the market like a casino, forgetting that unlike the house, we can actually go bust. The key lesson is survival. You are not the market, so stop chasing “market returns” and instead focus on your own risk tolerance and capital preservation. Don’t speculate because stocks represent real businesses, not lottery tickets. Respect them and play the long game. If you feel the urge to speculate, do it only with “sin money,” never with the capital that secures your survival. Speculate only with what you can afford to lose completely. Above all, remember that the only way to truly win in investing is to survive. As Peter Bernstein wrote, “Survival is the only road to riches.” Longevity in the market matters more than brilliance. Avoid systemic ruin, manage risks, stay humble, and let compounding do the work over time.

#InvestingWisdom #StockMarketTips #NassimTaleb #SkinInTheGame #RiskManagement #LongTermInvesting #Survival #WealthBuilding #SmartInvesting #FinancialFreedom #InvestmentStrategy #ValueInvesting #BehavioralFinance #CompoundingReturns #StockMarketEducation

·870 مشاهدة

·0 معاينة