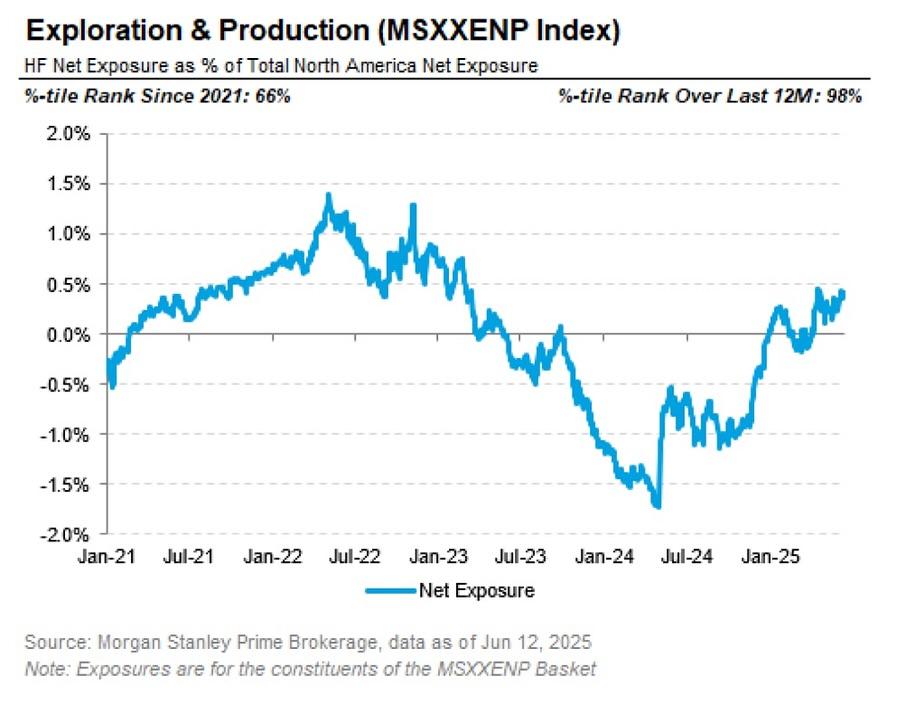

Hedge funds have been steadily adding exposure to exploration & production (E&P) stocks, and there could still be room for further gains. As of mid-June, net exposure in the MSXXENP Index is at its highest level in a year (98th percentile over the last 12 months), but it’s still only at the 66th percentile compared to levels since 2021. This reflects a transition from net short to slightly net long not a euphoric chase yet.

The 10-day return on the E&P basket is roughly +7%, which closely aligns with the +11% move in WTI crude futures over the same period. That’s broadly in line with beta expectations (R² = 47% over the last two years), suggesting the rally hasn’t overshot. Technically, there’s no major divergence yet.

Also worth noting: energy remains the largest net short exposure in 12-month momentum strategies, around -9%, with the short leg of these trades carrying a -13% weight in energy. In the most recent rebalance, energy saw the biggest increase in short-weighting setting the stage for potential covering if strength persists.

If oil prices remain supported and the short unwind continues, E&P equities have further room to rally from both a positioning and momentum perspective.

#EnergyStocks #CrudeOil #OilStocks #WTI #MacroTrading #EarningsSeason #Commodities #Quant #MomentumTrading #InstitutionalInvesting #HedgeFunds #OilExploration #InflationTrades #MSXXENP #CL1 #Markets #oil #hedgefunds

The 10-day return on the E&P basket is roughly +7%, which closely aligns with the +11% move in WTI crude futures over the same period. That’s broadly in line with beta expectations (R² = 47% over the last two years), suggesting the rally hasn’t overshot. Technically, there’s no major divergence yet.

Also worth noting: energy remains the largest net short exposure in 12-month momentum strategies, around -9%, with the short leg of these trades carrying a -13% weight in energy. In the most recent rebalance, energy saw the biggest increase in short-weighting setting the stage for potential covering if strength persists.

If oil prices remain supported and the short unwind continues, E&P equities have further room to rally from both a positioning and momentum perspective.

#EnergyStocks #CrudeOil #OilStocks #WTI #MacroTrading #EarningsSeason #Commodities #Quant #MomentumTrading #InstitutionalInvesting #HedgeFunds #OilExploration #InflationTrades #MSXXENP #CL1 #Markets #oil #hedgefunds

Hedge funds have been steadily adding exposure to exploration & production (E&P) stocks, and there could still be room for further gains. As of mid-June, net exposure in the MSXXENP Index is at its highest level in a year (98th percentile over the last 12 months), but it’s still only at the 66th percentile compared to levels since 2021. This reflects a transition from net short to slightly net long not a euphoric chase yet.

The 10-day return on the E&P basket is roughly +7%, which closely aligns with the +11% move in WTI crude futures over the same period. That’s broadly in line with beta expectations (R² = 47% over the last two years), suggesting the rally hasn’t overshot. Technically, there’s no major divergence yet.

Also worth noting: energy remains the largest net short exposure in 12-month momentum strategies, around -9%, with the short leg of these trades carrying a -13% weight in energy. In the most recent rebalance, energy saw the biggest increase in short-weighting setting the stage for potential covering if strength persists.

If oil prices remain supported and the short unwind continues, E&P equities have further room to rally from both a positioning and momentum perspective.

#EnergyStocks #CrudeOil #OilStocks #WTI #MacroTrading #EarningsSeason #Commodities #Quant #MomentumTrading #InstitutionalInvesting #HedgeFunds #OilExploration #InflationTrades #MSXXENP #CL1 #Markets #oil #hedgefunds

·528 Views

·0 previzualizare