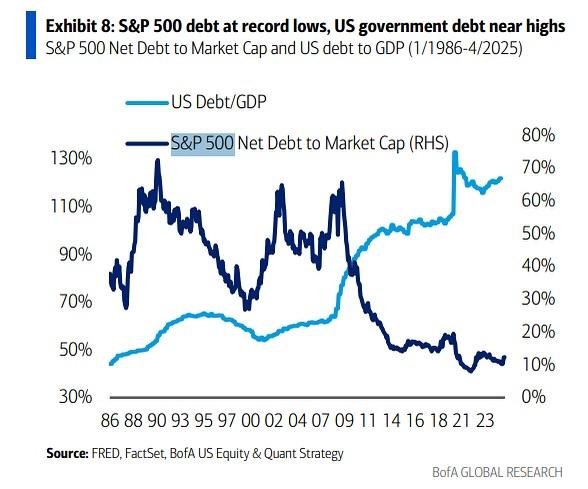

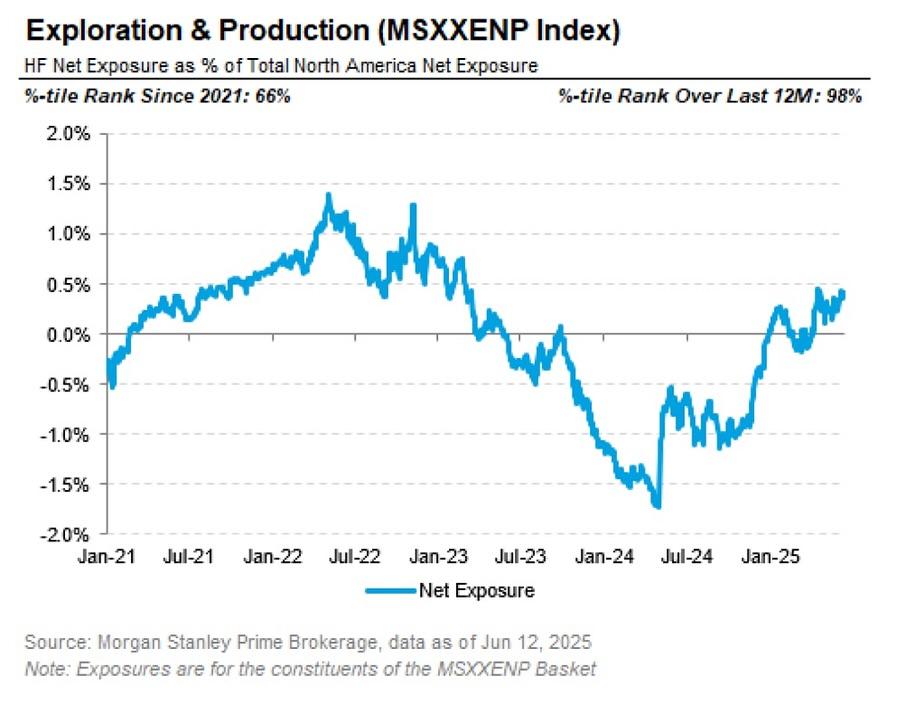

It’s incredibly fascinating to watch what’s happening right now in the UK gilt market. I often focus on the US understandably, since it dominates global financial markets but the signals coming from the UK bond market deserve serious attention.

When people talk about gilts being “undervalued,” what they’re really reacting to is something deeper… the market’s perception of fiscal credibility.

Here’s what often gets overlooked…

Bond markets are one of the few real time mechanisms that hold governments accountable. While we usually associate accountability with elections and politics, markets speak a different language… cost.

When governments borrow too aggressively or look fiscally reckless, lenders (investors) start to lose confidence. That loss of trust shows up fast… in higher yields, weaker demand, and rising refinancing costs. It’s not about partisanship it’s about risk and trust.

If a government behaves as if it can spend freely or rely on money printing without consequences, the bond market pushes back. And that’s exactly what we’re seeing now.

It’s not just a technical issue or a pricing anomaly it’s the market demanding responsibility.

The UK’s current situation is a powerful reminder… the cost of capital matters. Markets aren’t political they’re rational. And when that rationality flags something, it’s worth paying attention.

I’ll translate… please somebody buy our debt…

Anyway…

Probably nothing

#bonds #uk #gilts #hedgefunds #markets #stocks #stockmarket #bondmarket #macroeconomicsIt’s incredibly fascinating to watch what’s happening right now in the UK gilt market. I often focus on the US understandably, since it dominates global financial markets but the signals coming from the UK bond market deserve serious attention.

When people talk about gilts being “undervalued,” what they’re really reacting to is something deeper… the market’s perception of fiscal credibility.

Here’s what often gets overlooked…

Bond markets are one of the few real time mechanisms that hold governments accountable. While we usually associate accountability with elections and politics, markets speak a different language… cost.

When governments borrow too aggressively or look fiscally reckless, lenders (investors) start to lose confidence. That loss of trust shows up fast… in higher yields, weaker demand, and rising refinancing costs. It’s not about partisanship it’s about risk and trust.

If a government behaves as if it can spend freely or rely on money printing without consequences, the bond market pushes back. And that’s exactly what we’re seeing now.

It’s not just a technical issue or a pricing anomaly it’s the market demanding responsibility.

The UK’s current situation is a powerful reminder… the cost of capital matters. Markets aren’t political they’re rational. And when that rationality flags something, it’s worth paying attention.

I’ll translate… please somebody buy our debt…

Anyway…

Probably nothing

#bonds #uk #gilts #hedgefunds #markets #stocks #stockmarket #bondmarket #macroeconomics