Most investors lose money because they don’t understand these truths.

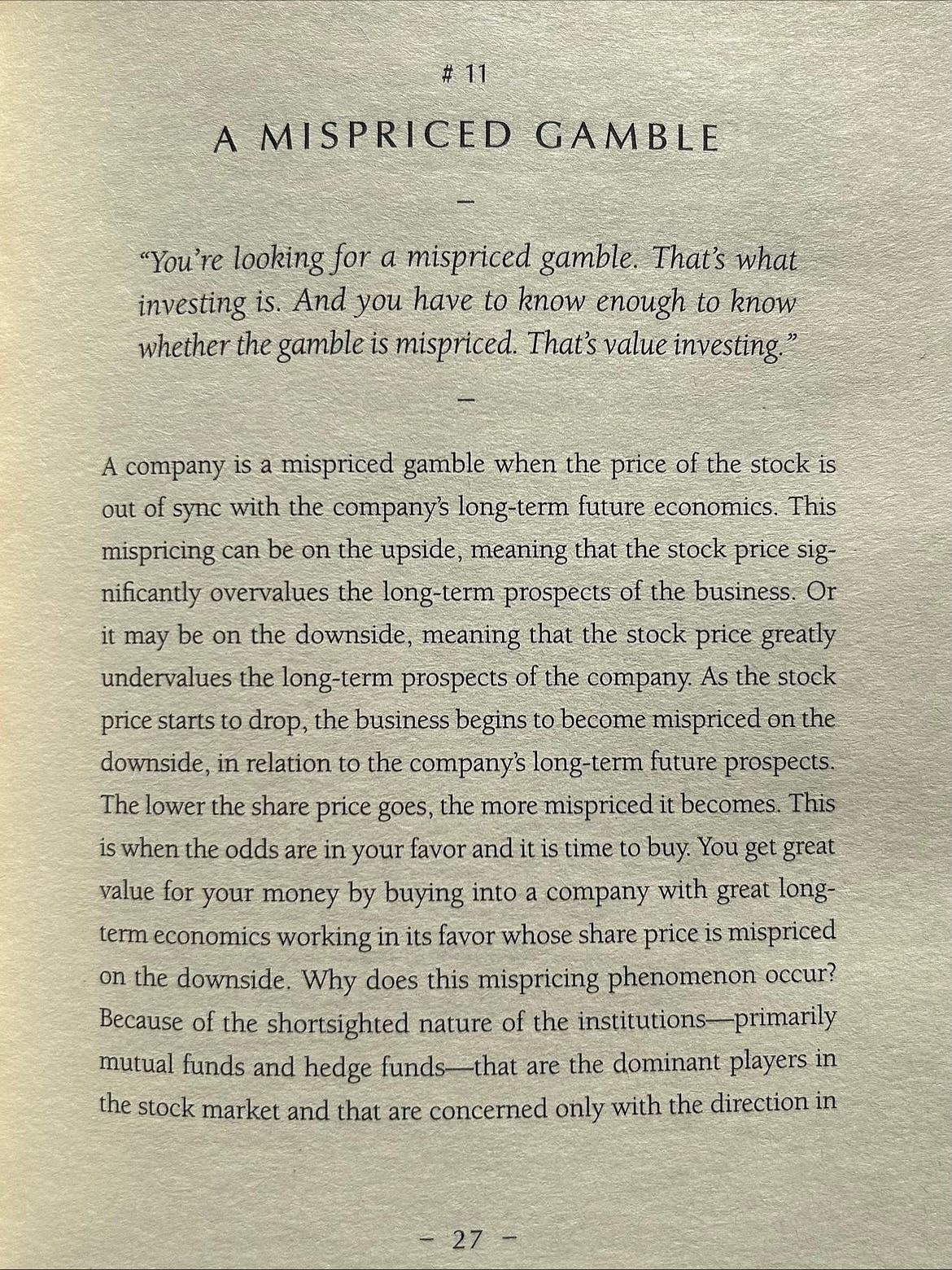

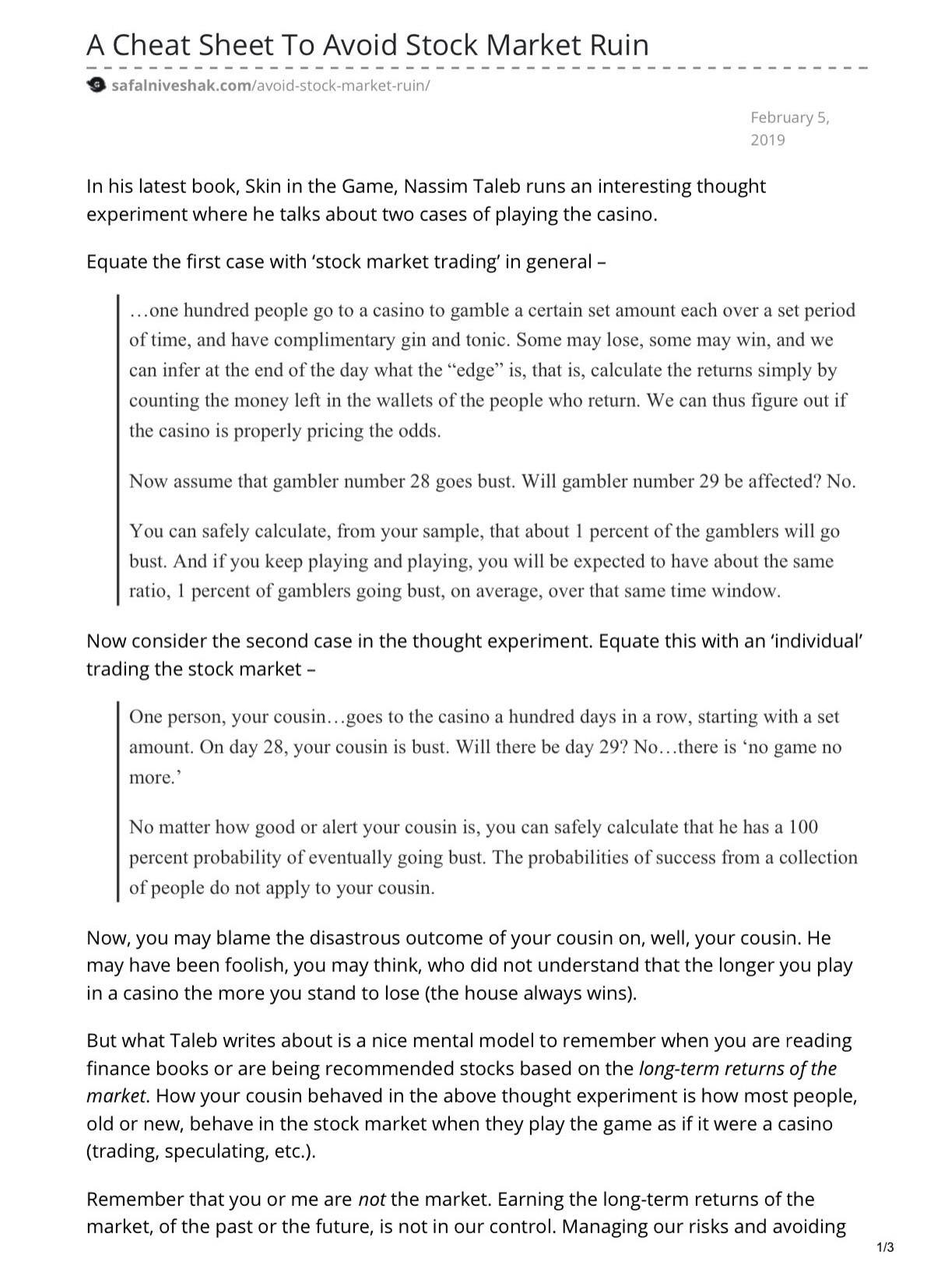

Investing isn’t about predicting the future it’s about pricing risk correctly.

A mispriced gamble can make you rich.

An overpriced one can ruin you.

Diversification protects mediocrity.

You can’t outperform the market by copying it.

EBITDA? As Charlie said, it often means “bullsh*t earnings.”

Real investors look at cash flow, not accounting tricks.

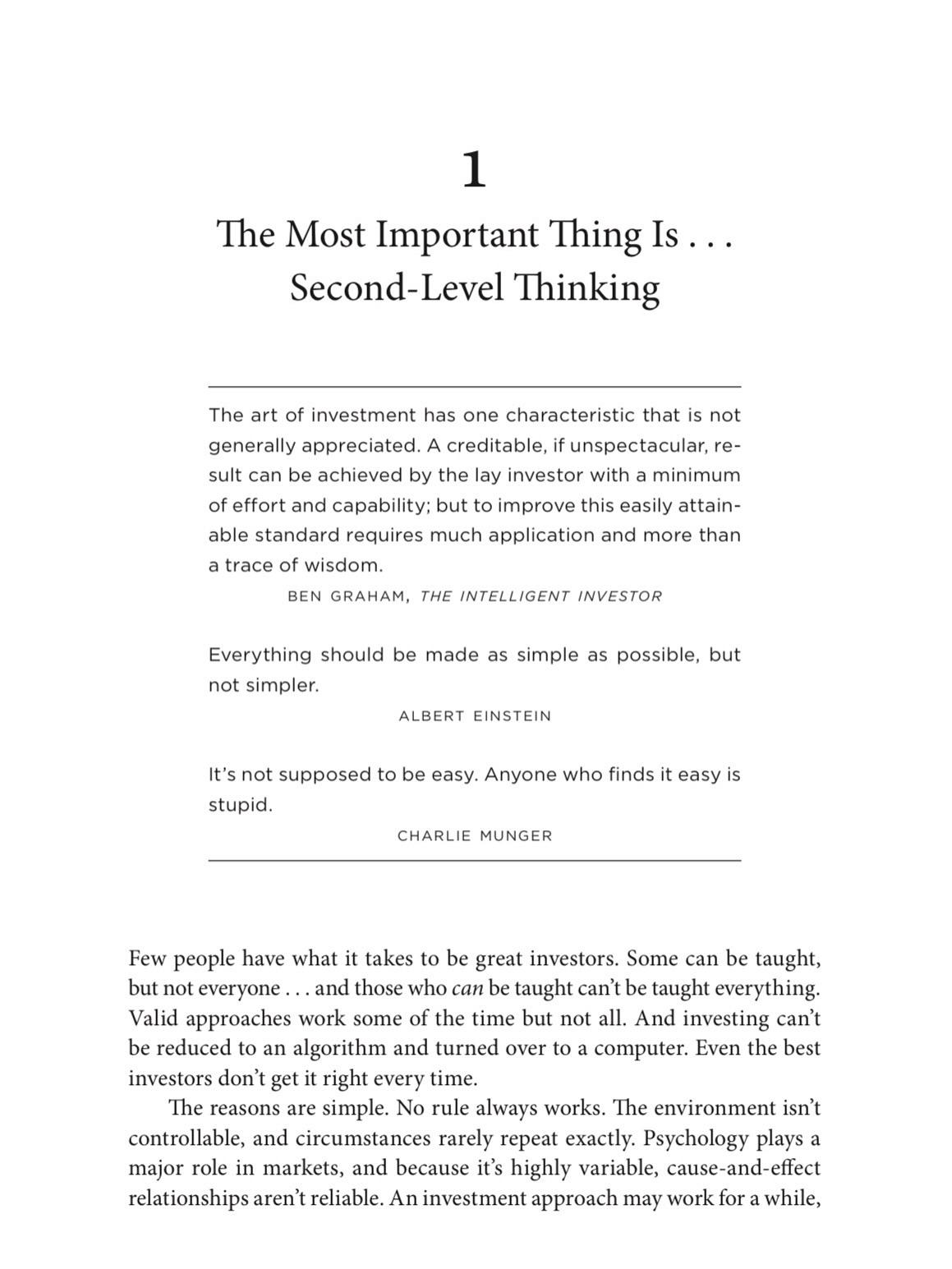

Intelligence helps.

But avoiding stupidity helps more.

And above all waiting is the hardest, most profitable skill in finance.

If you can sit still when everyone else is panicking or chasing hype,

you’ve already won.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestingWisdom #FinancialEducation #StockMarket #FinanceMindset #InvestmentStrategy #PatiencePays #MarketPsychology

Investing isn’t about predicting the future it’s about pricing risk correctly.

A mispriced gamble can make you rich.

An overpriced one can ruin you.

Diversification protects mediocrity.

You can’t outperform the market by copying it.

EBITDA? As Charlie said, it often means “bullsh*t earnings.”

Real investors look at cash flow, not accounting tricks.

Intelligence helps.

But avoiding stupidity helps more.

And above all waiting is the hardest, most profitable skill in finance.

If you can sit still when everyone else is panicking or chasing hype,

you’ve already won.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestingWisdom #FinancialEducation #StockMarket #FinanceMindset #InvestmentStrategy #PatiencePays #MarketPsychology

Most investors lose money because they don’t understand these truths.

💭 Investing isn’t about predicting the future it’s about pricing risk correctly.

A mispriced gamble can make you rich.

An overpriced one can ruin you.

📉 Diversification protects mediocrity.

You can’t outperform the market by copying it.

📊 EBITDA? As Charlie said, it often means “bullsh*t earnings.”

Real investors look at cash flow, not accounting tricks.

💡 Intelligence helps.

But avoiding stupidity helps more.

⏳ And above all waiting is the hardest, most profitable skill in finance.

If you can sit still when everyone else is panicking or chasing hype,

you’ve already won.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestingWisdom #FinancialEducation #StockMarket #FinanceMindset #InvestmentStrategy #PatiencePays #MarketPsychology

·190 Views

·0 Vista previa