So you’ve saved your first $1,000 and you’re wondering what to do next. Should you invest it, save it, or use it to learn more about money? The truth is, your first thousand dollars is less about growing it fast and more about building the foundation for your long-term wealth.

Start by investing in yourself. Use around $200 to buy books that teach you how money works, how to think like an investor, and how to make smarter financial decisions. Great options include Rich Dad Poor Dad, The Intelligent Investor, The Millionaire Next Door, and The Compound Effect. These aren’t just books; they’re tools to help you shift from consumer thinking to investor thinking.

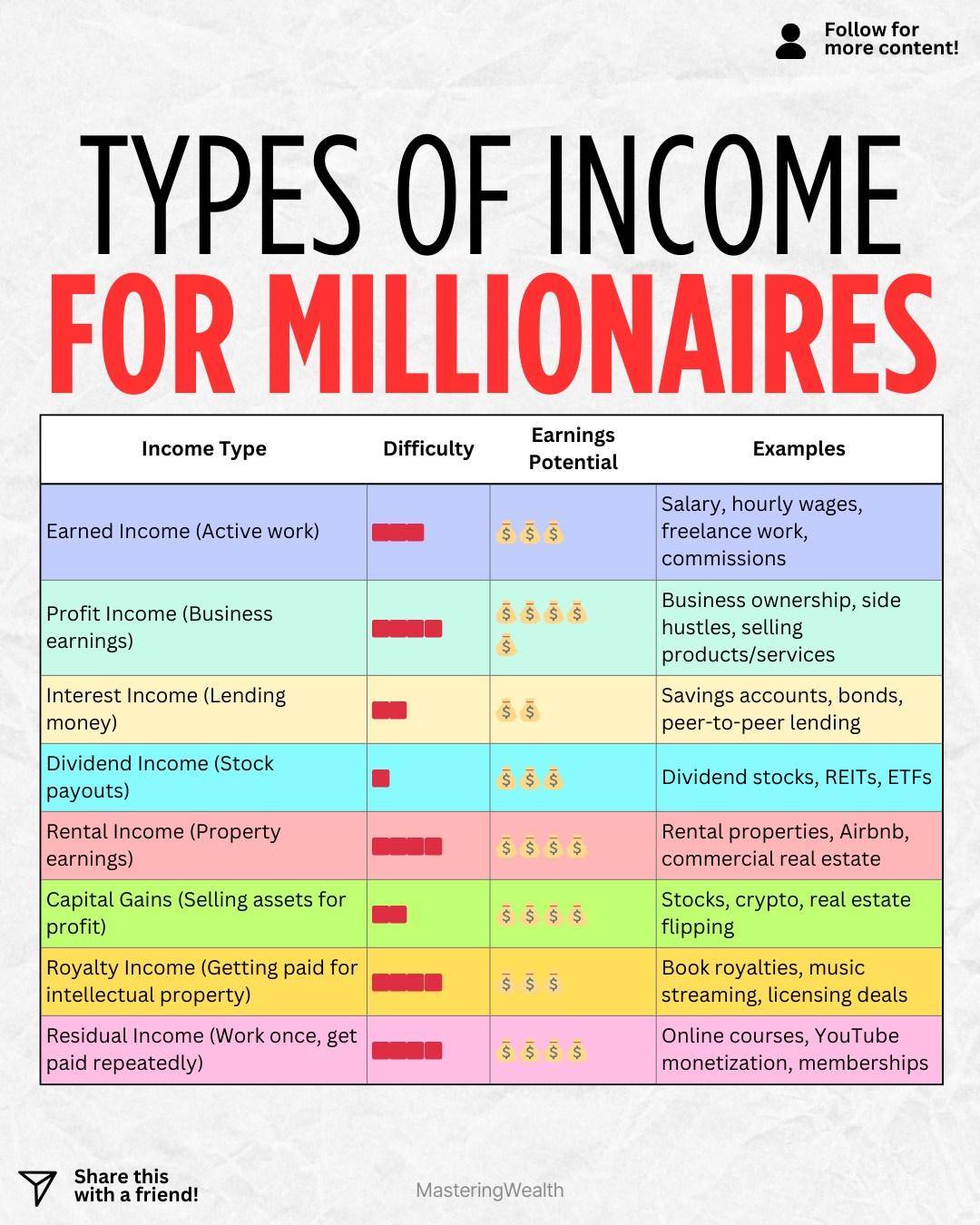

With the remaining $800, it’s time to enter the investing world. A great place to start is with index funds or ETFs because they let you own small pieces of hundreds of companies with one purchase. This spreads your risk and helps you grow your money steadily through the power of compound interest.

Some great starting options include the Total Stock Market Index Fund (FZROX, VTSAX, VTI), the S&P 500 Index Fund (FXAIX, VFIAX, VOO), or the Nasdaq 100 Index Fund (QQQ, USNQX). These funds have historically produced solid long-term returns and require no advanced investing experience.

The key is to start early and stay consistent. You don’t need to be an expert to invest wisely; you just need patience and a plan. Even a small amount like $1,000 can grow into something significant when combined with time, education, and consistent investing.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for long-term growth and passive income.

If you were given $1,000 today, would you invest it, save it, or spend it?

Follow @MasteringWealth for more simple, practical investing tips that help you build wealth step by step, even if you’re just starting out.

Disclaimer: This content is for educational purposes only and not financial advice. Always do your own research or consult a financial professional before making investment decisions.

💰 So you’ve saved your first $1,000 and you’re wondering what to do next. Should you invest it, save it, or use it to learn more about money? The truth is, your first thousand dollars is less about growing it fast and more about building the foundation for your long-term wealth.

📚 Start by investing in yourself. Use around $200 to buy books that teach you how money works, how to think like an investor, and how to make smarter financial decisions. Great options include Rich Dad Poor Dad, The Intelligent Investor, The Millionaire Next Door, and The Compound Effect. These aren’t just books; they’re tools to help you shift from consumer thinking to investor thinking.

📈 With the remaining $800, it’s time to enter the investing world. A great place to start is with index funds or ETFs because they let you own small pieces of hundreds of companies with one purchase. This spreads your risk and helps you grow your money steadily through the power of compound interest.

Some great starting options include the Total Stock Market Index Fund (FZROX, VTSAX, VTI), the S&P 500 Index Fund (FXAIX, VFIAX, VOO), or the Nasdaq 100 Index Fund (QQQ, USNQX). These funds have historically produced solid long-term returns and require no advanced investing experience.

🚀 The key is to start early and stay consistent. You don’t need to be an expert to invest wisely; you just need patience and a plan. Even a small amount like $1,000 can grow into something significant when combined with time, education, and consistent investing.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how I invest for long-term growth and passive income.

🤔 If you were given $1,000 today, would you invest it, save it, or spend it?

👉 Follow @MasteringWealth for more simple, practical investing tips that help you build wealth step by step, even if you’re just starting out.

⚠️ Disclaimer: This content is for educational purposes only and not financial advice. Always do your own research or consult a financial professional before making investment decisions.

·165 Visualizações

·0 Anterior