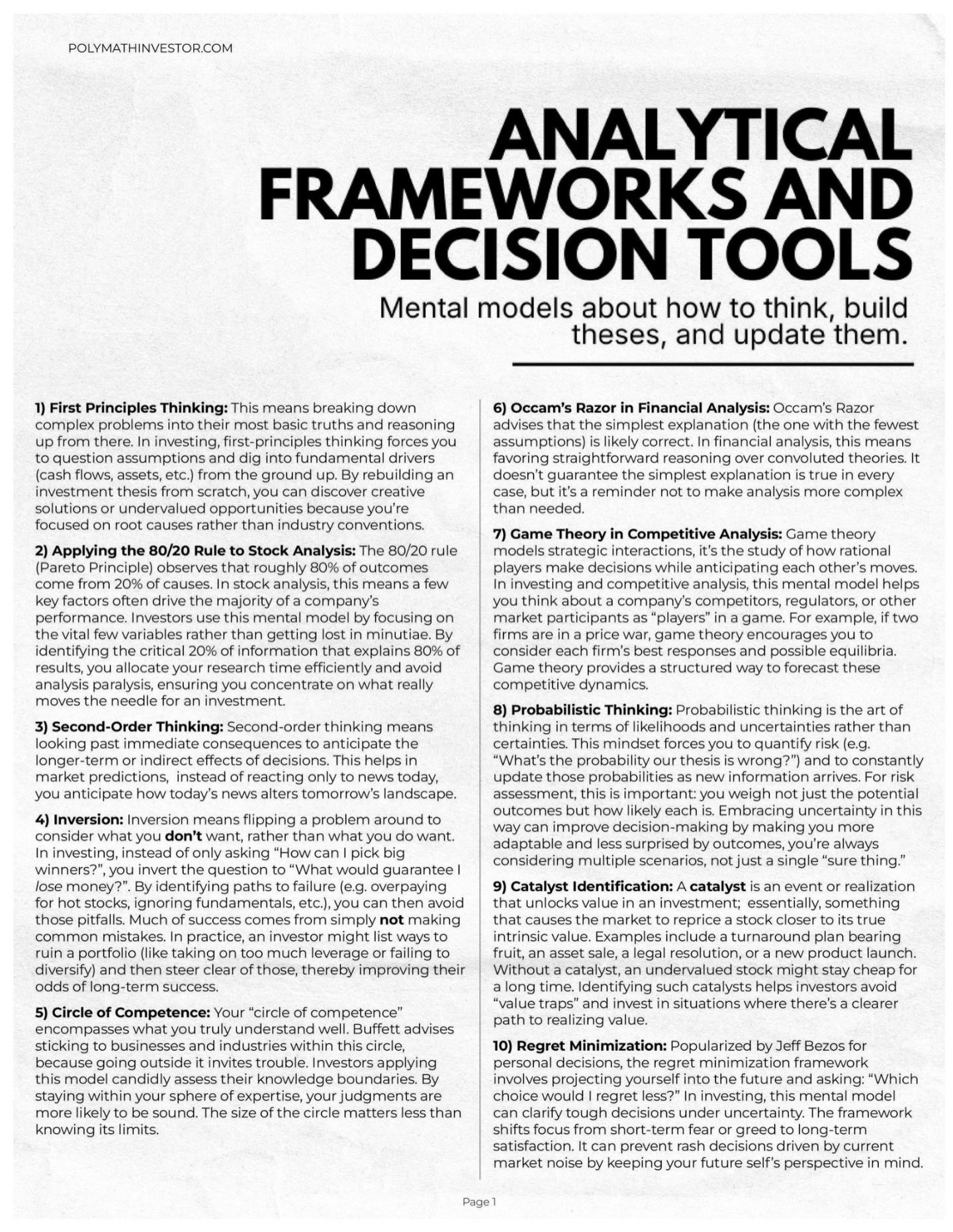

44 mental models every serious investor should know.

What makes these useful isn’t how many you can memorize it’s how many you can actually apply when making decisions under uncertainty.

A few worth keeping close:

The McNamara Fallacy

What gets measured gets managed but sometimes the most important variables can’t be easily quantified. Markets aren’t just numbers. Sentiment, incentives, governance quality, and strategy don’t fit neatly into a spreadsheet… but they drive outcomes. The danger is letting easy to measure metrics blind you to meaningful but hard to measure risks.

The Semmelweis Reflex

Markets hate new information especially information that challenges existing beliefs. Every cycle, investors dismiss certain trends as “temporary”… until they aren’t. Think EVs, cloud software, crypto, AI. Reflexive rejection is comfortable until it becomes expensive.

The Baader Meinhof Phenomenon

Once an idea enters your awareness, suddenly you see it everywhere. In markets, this can create false confidence and FOMO. Just because a theme dominates headlines doesn’t mean it’s investable or priced attractively.

These frameworks don’t tell you what to buy they help you avoid being misled by your own psychology while you do it.

Great investing is less about predicting the future and more about avoiding the mental traps that keep most people from seeing it clearly.

#investing #finance44 mental models every serious investor should know.

What makes these useful isn’t how many you can memorize it’s how many you can actually apply when making decisions under uncertainty.

A few worth keeping close:

The McNamara Fallacy

What gets measured gets managed but sometimes the most important variables can’t be easily quantified. Markets aren’t just numbers. Sentiment, incentives, governance quality, and strategy don’t fit neatly into a spreadsheet… but they drive outcomes. The danger is letting easy to measure metrics blind you to meaningful but hard to measure risks.

The Semmelweis Reflex

Markets hate new information especially information that challenges existing beliefs. Every cycle, investors dismiss certain trends as “temporary”… until they aren’t. Think EVs, cloud software, crypto, AI. Reflexive rejection is comfortable until it becomes expensive.

The Baader Meinhof Phenomenon

Once an idea enters your awareness, suddenly you see it everywhere. In markets, this can create false confidence and FOMO. Just because a theme dominates headlines doesn’t mean it’s investable or priced attractively.

These frameworks don’t tell you what to buy they help you avoid being misled by your own psychology while you do it.

Great investing is less about predicting the future and more about avoiding the mental traps that keep most people from seeing it clearly.

#investing #finance