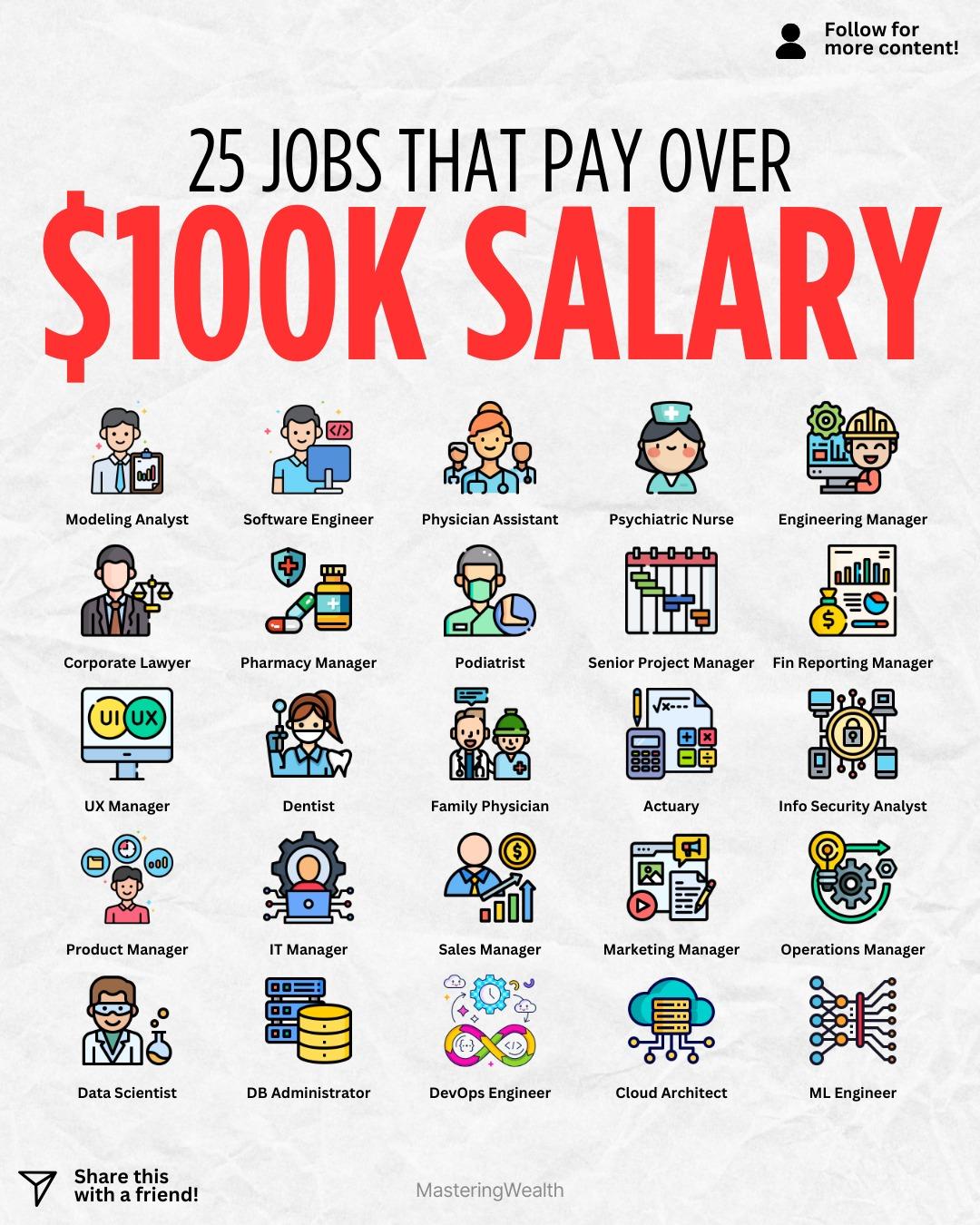

Many people assume that earning a six figure salary is out of reach, but the truth is that there are many high income careers across tech, healthcare, engineering and business that regularly pay above one hundred thousand dollars a year . Jobs like software engineer, physician assistant, data scientist, product manager, cloud architect and corporate lawyer continue to be in demand and offer strong income growth over time . The list in this post highlights twenty five careers that consistently offer six figure earning potential for people who pursue the right skills and experience.

High income jobs like modeling analyst, IT manager, UX manager, engineering manager and DevOps engineer continue to grow in popularity because companies need specialized talent to solve complex problems. Healthcare roles such as dentist, podiatrist, family physician and psychiatric nurse also provide strong earning power due to long term demand for medical professionals . Tech roles including machine learning engineer, information security analyst and cloud architect are some of the fastest growing career paths because businesses rely on digital systems more than ever.

If you are exploring different career options, it helps to understand why these roles pay so well. Many of these careers require advanced knowledge or technical expertise, while others require leadership experience or responsibility for managing large teams. The reward for developing rare skills is often a higher salary and long term job stability .

If you want to see the dividend portfolio that helps me build wealth outside of my career, comment the word Stocks and I will send you the link .

Which high income career on this list do you find the most interesting and why

If you enjoy learning about money, career growth and financial education, follow me at MasteringWealth for more daily content that helps you build a stronger financial future .

This content is for education only and is not financial advice.

High income jobs like modeling analyst, IT manager, UX manager, engineering manager and DevOps engineer continue to grow in popularity because companies need specialized talent to solve complex problems. Healthcare roles such as dentist, podiatrist, family physician and psychiatric nurse also provide strong earning power due to long term demand for medical professionals . Tech roles including machine learning engineer, information security analyst and cloud architect are some of the fastest growing career paths because businesses rely on digital systems more than ever.

If you are exploring different career options, it helps to understand why these roles pay so well. Many of these careers require advanced knowledge or technical expertise, while others require leadership experience or responsibility for managing large teams. The reward for developing rare skills is often a higher salary and long term job stability .

If you want to see the dividend portfolio that helps me build wealth outside of my career, comment the word Stocks and I will send you the link .

Which high income career on this list do you find the most interesting and why

If you enjoy learning about money, career growth and financial education, follow me at MasteringWealth for more daily content that helps you build a stronger financial future .

This content is for education only and is not financial advice.

Many people assume that earning a six figure salary is out of reach, but the truth is that there are many high income careers across tech, healthcare, engineering and business that regularly pay above one hundred thousand dollars a year 💼💰. Jobs like software engineer, physician assistant, data scientist, product manager, cloud architect and corporate lawyer continue to be in demand and offer strong income growth over time 📈. The list in this post highlights twenty five careers that consistently offer six figure earning potential for people who pursue the right skills and experience.

High income jobs like modeling analyst, IT manager, UX manager, engineering manager and DevOps engineer continue to grow in popularity because companies need specialized talent to solve complex problems. Healthcare roles such as dentist, podiatrist, family physician and psychiatric nurse also provide strong earning power due to long term demand for medical professionals 👨⚕️👩⚕️. Tech roles including machine learning engineer, information security analyst and cloud architect are some of the fastest growing career paths because businesses rely on digital systems more than ever.

If you are exploring different career options, it helps to understand why these roles pay so well. Many of these careers require advanced knowledge or technical expertise, while others require leadership experience or responsibility for managing large teams. The reward for developing rare skills is often a higher salary and long term job stability 🔑.

If you want to see the dividend portfolio that helps me build wealth outside of my career, comment the word Stocks and I will send you the link 📬.

Which high income career on this list do you find the most interesting and why 🤔

If you enjoy learning about money, career growth and financial education, follow me at MasteringWealth for more daily content that helps you build a stronger financial future 🌟.

This content is for education only and is not financial advice.

·361 Views

·0 previzualizare