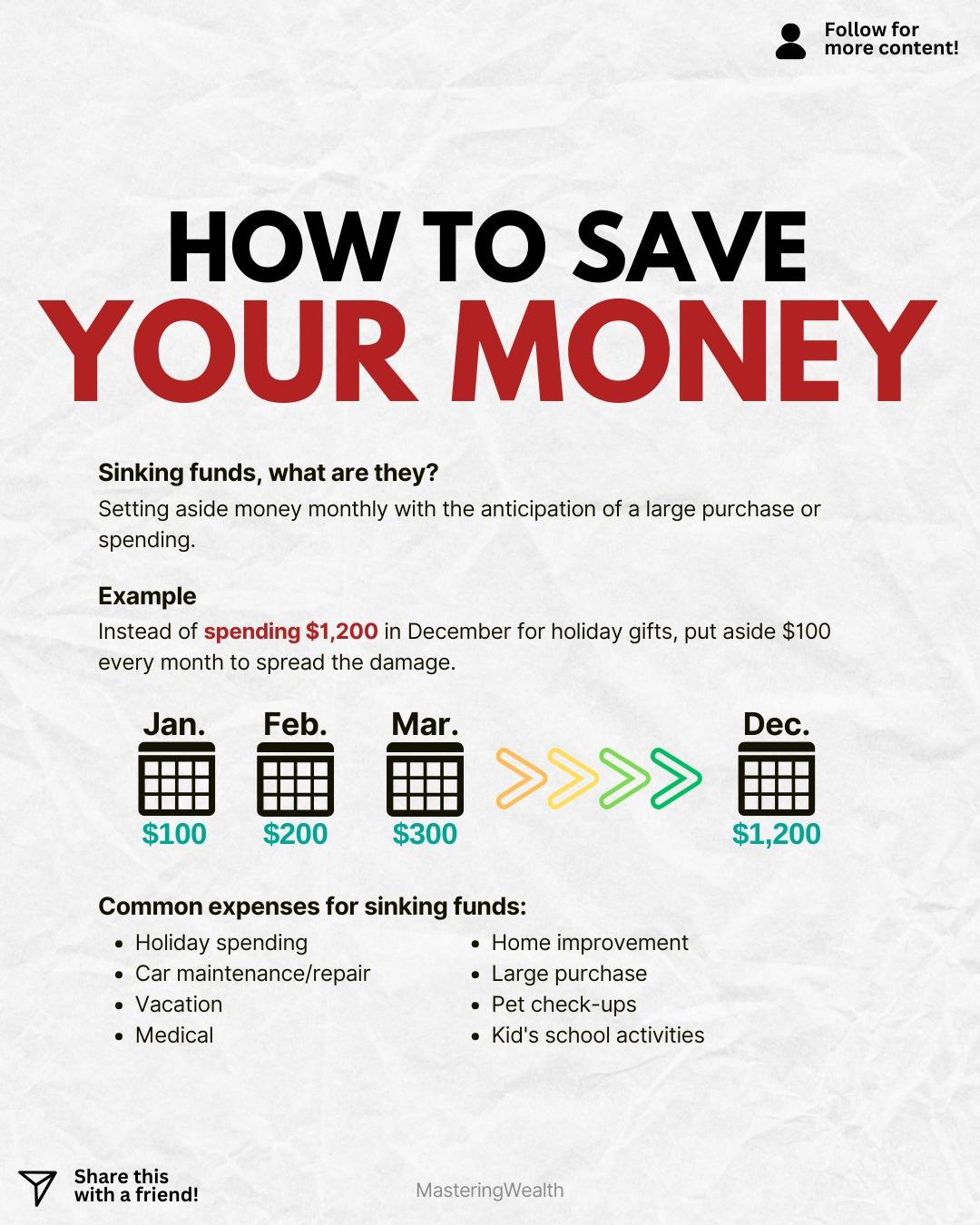

Saving money becomes much easier when you plan for expenses before they happen. The graphic in this post explains sinking funds which are one of the most effective budgeting tools for long term financial stability. Instead of being surprised by large costs, you prepare for them little by little throughout the year.

A sinking fund is money you set aside each month for a specific future expense. It is different from your emergency fund because it is designed for expenses you already know are coming. Holidays, vacations, car repairs, and medical costs are all perfect examples.

The chart shows how simple it can be. Instead of spending one thousand two hundred dollars in December for gifts, you put aside one hundred dollars every month. By the end of the year you have the full amount ready without stressing your budget.

This method works because it spreads out the financial pressure. You avoid going into debt or dipping into savings for predictable expenses. Your budget becomes smoother and your money becomes easier to control.

Common sinking fund categories include holiday spending, home improvement, large purchases, pet check ups, school activities, vacations, and car maintenance. You can have as many or as few categories as you want. The goal is to give every dollar a purpose and reduce last minute financial surprises.

Using sinking funds consistently helps you stay ahead of your expenses. It also helps you create better saving habits because you learn to plan instead of react. This is one of the simplest steps toward financial stability and long term peace of mind.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how investing fits into a balanced financial plan.

Which sinking fund category do you think would help you the most if you added it to your budget right now?

For more visuals and tips on budgeting, saving, investing, and building wealth step by step, follow @MasteringWealth for daily financial education.

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making financial decisions.

A sinking fund is money you set aside each month for a specific future expense. It is different from your emergency fund because it is designed for expenses you already know are coming. Holidays, vacations, car repairs, and medical costs are all perfect examples.

The chart shows how simple it can be. Instead of spending one thousand two hundred dollars in December for gifts, you put aside one hundred dollars every month. By the end of the year you have the full amount ready without stressing your budget.

This method works because it spreads out the financial pressure. You avoid going into debt or dipping into savings for predictable expenses. Your budget becomes smoother and your money becomes easier to control.

Common sinking fund categories include holiday spending, home improvement, large purchases, pet check ups, school activities, vacations, and car maintenance. You can have as many or as few categories as you want. The goal is to give every dollar a purpose and reduce last minute financial surprises.

Using sinking funds consistently helps you stay ahead of your expenses. It also helps you create better saving habits because you learn to plan instead of react. This is one of the simplest steps toward financial stability and long term peace of mind.

Comment “Stocks” if you want a link to see my dividend portfolio and learn how investing fits into a balanced financial plan.

Which sinking fund category do you think would help you the most if you added it to your budget right now?

For more visuals and tips on budgeting, saving, investing, and building wealth step by step, follow @MasteringWealth for daily financial education.

This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making financial decisions.

Saving money becomes much easier when you plan for expenses before they happen. The graphic in this post explains sinking funds which are one of the most effective budgeting tools for long term financial stability. Instead of being surprised by large costs, you prepare for them little by little throughout the year.

A sinking fund is money you set aside each month for a specific future expense. It is different from your emergency fund because it is designed for expenses you already know are coming. Holidays, vacations, car repairs, and medical costs are all perfect examples.

The chart shows how simple it can be. Instead of spending one thousand two hundred dollars in December for gifts, you put aside one hundred dollars every month. By the end of the year you have the full amount ready without stressing your budget.

This method works because it spreads out the financial pressure. You avoid going into debt or dipping into savings for predictable expenses. Your budget becomes smoother and your money becomes easier to control.

Common sinking fund categories include holiday spending, home improvement, large purchases, pet check ups, school activities, vacations, and car maintenance. You can have as many or as few categories as you want. The goal is to give every dollar a purpose and reduce last minute financial surprises.

Using sinking funds consistently helps you stay ahead of your expenses. It also helps you create better saving habits because you learn to plan instead of react. This is one of the simplest steps toward financial stability and long term peace of mind.

💬 Comment “Stocks” if you want a link to see my dividend portfolio and learn how investing fits into a balanced financial plan.

Which sinking fund category do you think would help you the most if you added it to your budget right now?

For more visuals and tips on budgeting, saving, investing, and building wealth step by step, follow @MasteringWealth for daily financial education.

⚠️ This content is for educational purposes only and is not financial advice. Always research carefully or consult a licensed professional before making financial decisions.

·224 Views

·0 voorbeeld