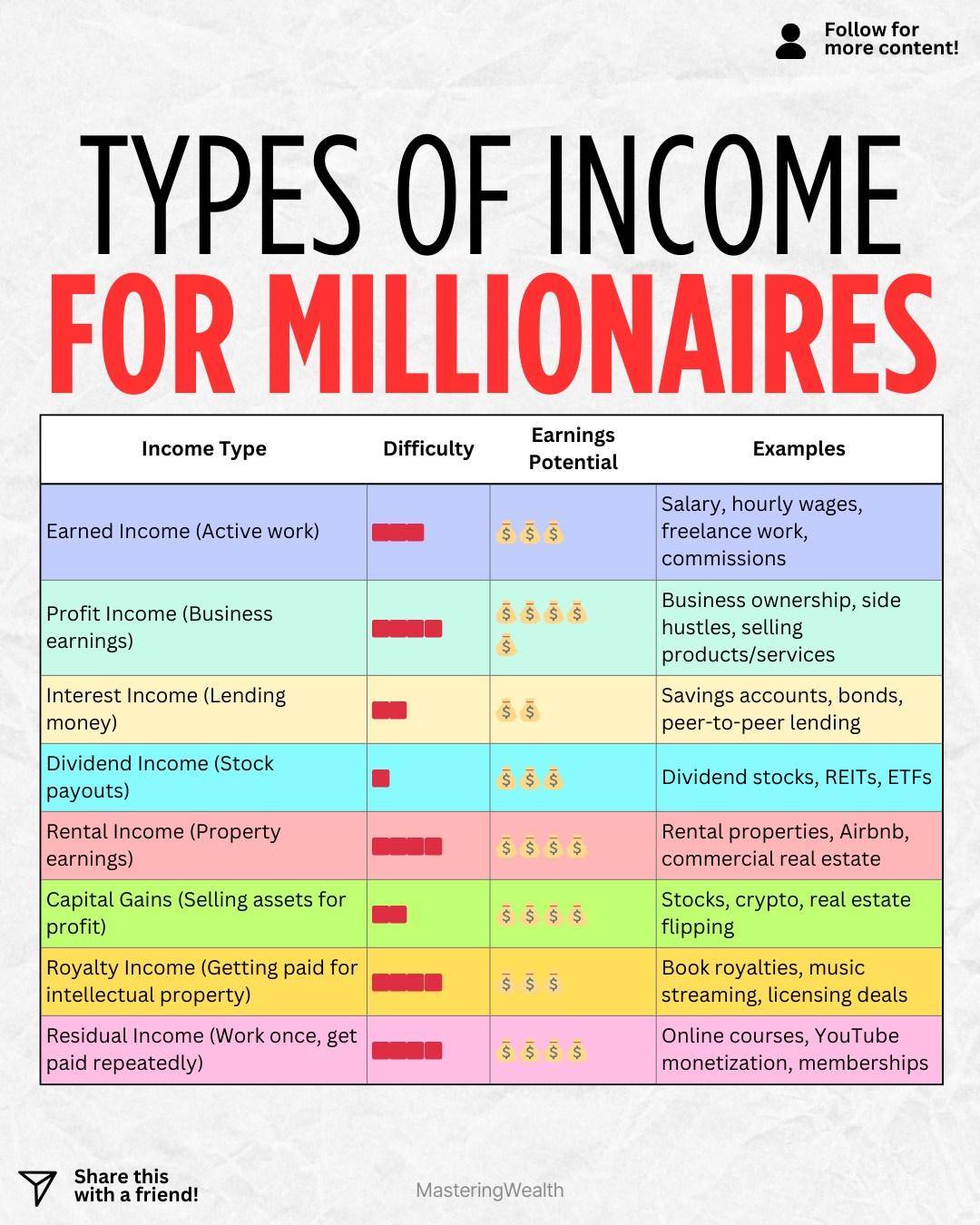

Most people grow up learning only one type of income which is earned income from a job, yet millionaires build wealth by understanding multiple income streams . The chart in this post breaks down nine types of income that wealthy people use to grow their net worth and create long term financial security. When you understand how income works beyond a paycheck, you start seeing opportunities that were invisible before.

Earned income is the most familiar form and includes wages, salary and freelance work. Profit income comes from running a business or selling products or services. These income types require active time and effort, but they also help you gain skills that can lead to higher earnings over time.

Interest income is money earned from lending your money through savings accounts, bonds or peer to peer lending. Dividend income comes from owning shares of companies that pay out cash to shareholders which is one of the most popular passive income streams for long term investors . Rental income is generated from real estate and is powerful because it can scale over time as properties increase in value.

Capital gains income happens when you sell an asset for more than you bought it. R�oyalty income is created by intellectual property such as books, music or licensing agreements. Residual income is built when you create something once and continue getting paid from it like online courses or membership programs.

If you want to see the dividend portfolio I use to generate growing passive income, comment the word Stocks and I will send you the link .

Which income stream do you want to grow the most in the next year and why

If you want more financial education, income growth strategies and wealth building tips, make sure to follow me at MasteringWealth for daily content that helps you move toward financial independence .

This content is for education only and is not financial advice.

Earned income is the most familiar form and includes wages, salary and freelance work. Profit income comes from running a business or selling products or services. These income types require active time and effort, but they also help you gain skills that can lead to higher earnings over time.

Interest income is money earned from lending your money through savings accounts, bonds or peer to peer lending. Dividend income comes from owning shares of companies that pay out cash to shareholders which is one of the most popular passive income streams for long term investors . Rental income is generated from real estate and is powerful because it can scale over time as properties increase in value.

Capital gains income happens when you sell an asset for more than you bought it. R�oyalty income is created by intellectual property such as books, music or licensing agreements. Residual income is built when you create something once and continue getting paid from it like online courses or membership programs.

If you want to see the dividend portfolio I use to generate growing passive income, comment the word Stocks and I will send you the link .

Which income stream do you want to grow the most in the next year and why

If you want more financial education, income growth strategies and wealth building tips, make sure to follow me at MasteringWealth for daily content that helps you move toward financial independence .

This content is for education only and is not financial advice.

Most people grow up learning only one type of income which is earned income from a job, yet millionaires build wealth by understanding multiple income streams 💰🔥. The chart in this post breaks down nine types of income that wealthy people use to grow their net worth and create long term financial security. When you understand how income works beyond a paycheck, you start seeing opportunities that were invisible before.

Earned income is the most familiar form and includes wages, salary and freelance work. Profit income comes from running a business or selling products or services. These income types require active time and effort, but they also help you gain skills that can lead to higher earnings over time.

Interest income is money earned from lending your money through savings accounts, bonds or peer to peer lending. Dividend income comes from owning shares of companies that pay out cash to shareholders which is one of the most popular passive income streams for long term investors 📈. Rental income is generated from real estate and is powerful because it can scale over time as properties increase in value.

Capital gains income happens when you sell an asset for more than you bought it. R�oyalty income is created by intellectual property such as books, music or licensing agreements. Residual income is built when you create something once and continue getting paid from it like online courses or membership programs.

If you want to see the dividend portfolio I use to generate growing passive income, comment the word Stocks and I will send you the link 📬.

Which income stream do you want to grow the most in the next year and why 🤔

If you want more financial education, income growth strategies and wealth building tips, make sure to follow me at MasteringWealth for daily content that helps you move toward financial independence 🌟.

This content is for education only and is not financial advice.

·617 Ansichten

·0 Bewertungen