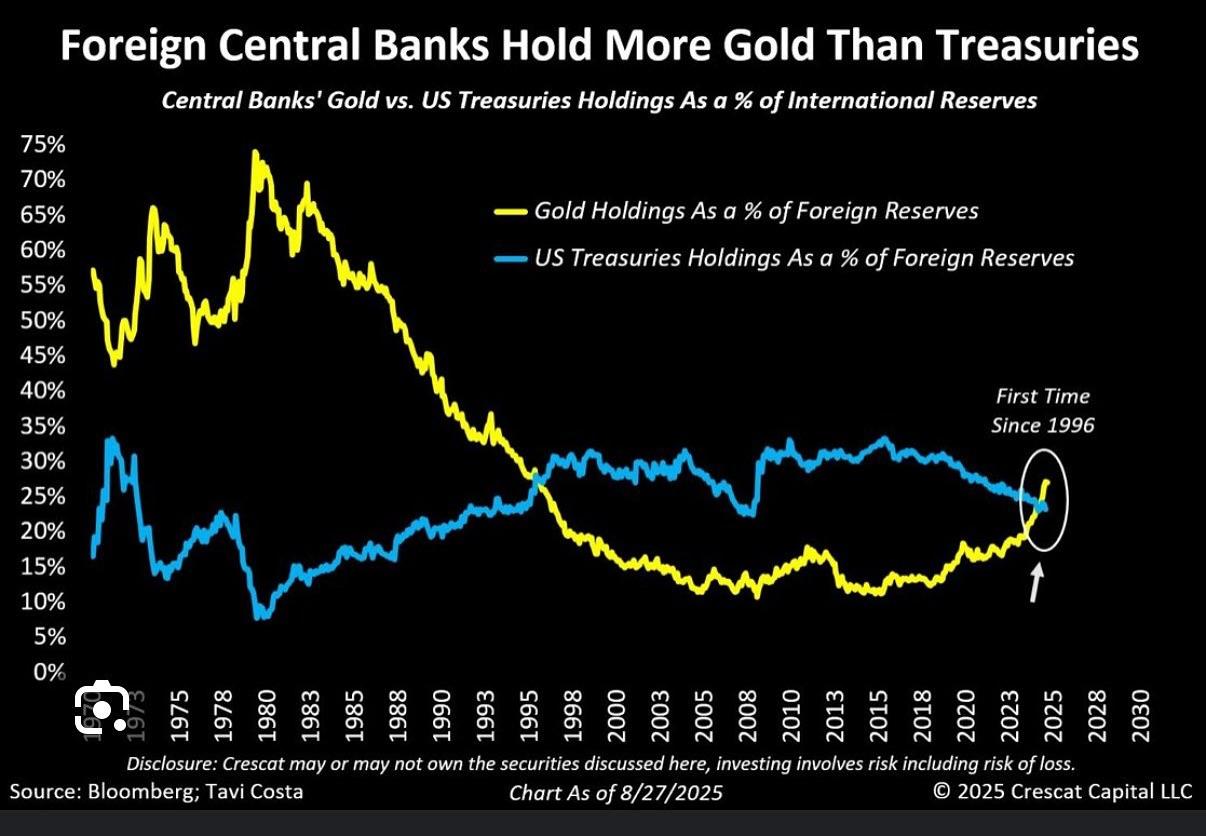

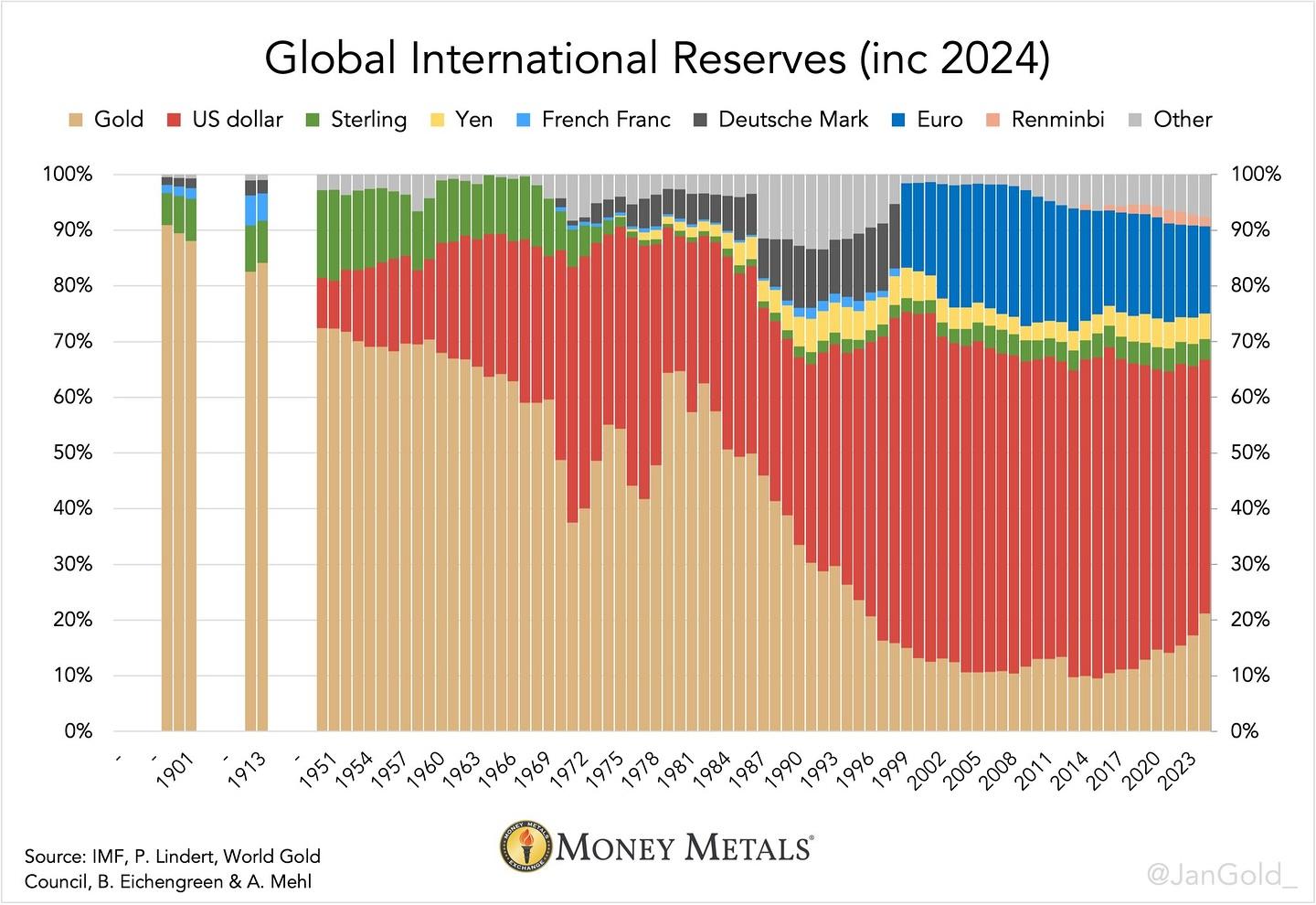

For the first time since 1996, foreign central banks now hold more gold than U.S. Treasuries as a share of their international reserves. This shift marks a profound change in global reserve management, reflecting waning confidence in U.S. debt and a renewed preference for hard assets.

Gold’s appeal as a neutral reserve asset has been rising, while elevated U.S. debt levels, persistent deficits, and geopolitical tensions have put pressure on Treasuries. Central banks are signaling diversification away from dollar-denominated debt and into assets perceived as safer stores of value.

This is not just a technical move it’s a structural shift in how nations are positioning themselves for the long term.

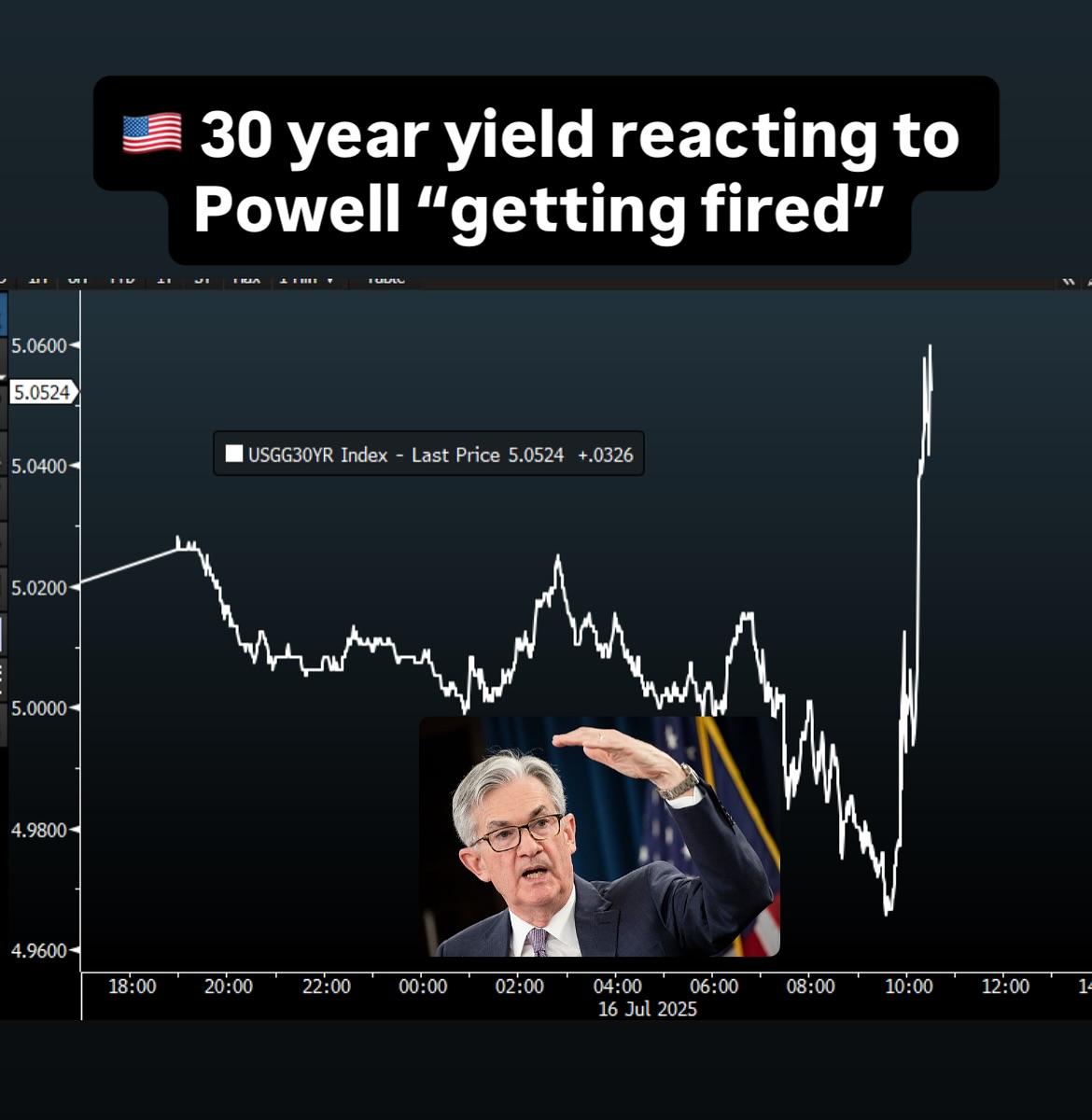

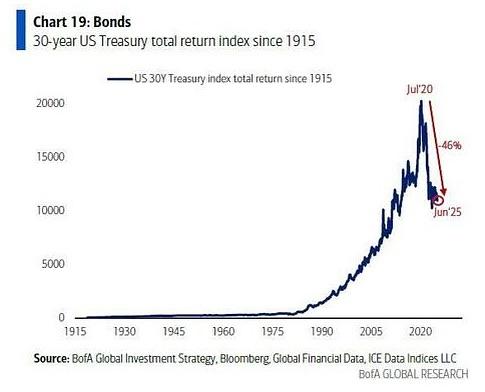

What does this mean for bonds? Probably nothing…

#Gold #USTreasuries #CentralBanks #GlobalEconomy #MacroTrends #MonetaryPolicy #DeDollarization #Commodities #InvestingWisdom #FinancialMarkets

Gold’s appeal as a neutral reserve asset has been rising, while elevated U.S. debt levels, persistent deficits, and geopolitical tensions have put pressure on Treasuries. Central banks are signaling diversification away from dollar-denominated debt and into assets perceived as safer stores of value.

This is not just a technical move it’s a structural shift in how nations are positioning themselves for the long term.

What does this mean for bonds? Probably nothing…

#Gold #USTreasuries #CentralBanks #GlobalEconomy #MacroTrends #MonetaryPolicy #DeDollarization #Commodities #InvestingWisdom #FinancialMarkets

For the first time since 1996, foreign central banks now hold more gold than U.S. Treasuries as a share of their international reserves. This shift marks a profound change in global reserve management, reflecting waning confidence in U.S. debt and a renewed preference for hard assets.

Gold’s appeal as a neutral reserve asset has been rising, while elevated U.S. debt levels, persistent deficits, and geopolitical tensions have put pressure on Treasuries. Central banks are signaling diversification away from dollar-denominated debt and into assets perceived as safer stores of value.

This is not just a technical move it’s a structural shift in how nations are positioning themselves for the long term.

What does this mean for bonds? Probably nothing…

#Gold #USTreasuries #CentralBanks #GlobalEconomy #MacroTrends #MonetaryPolicy #DeDollarization #Commodities #InvestingWisdom #FinancialMarkets

·560 Views

·0 Reviews