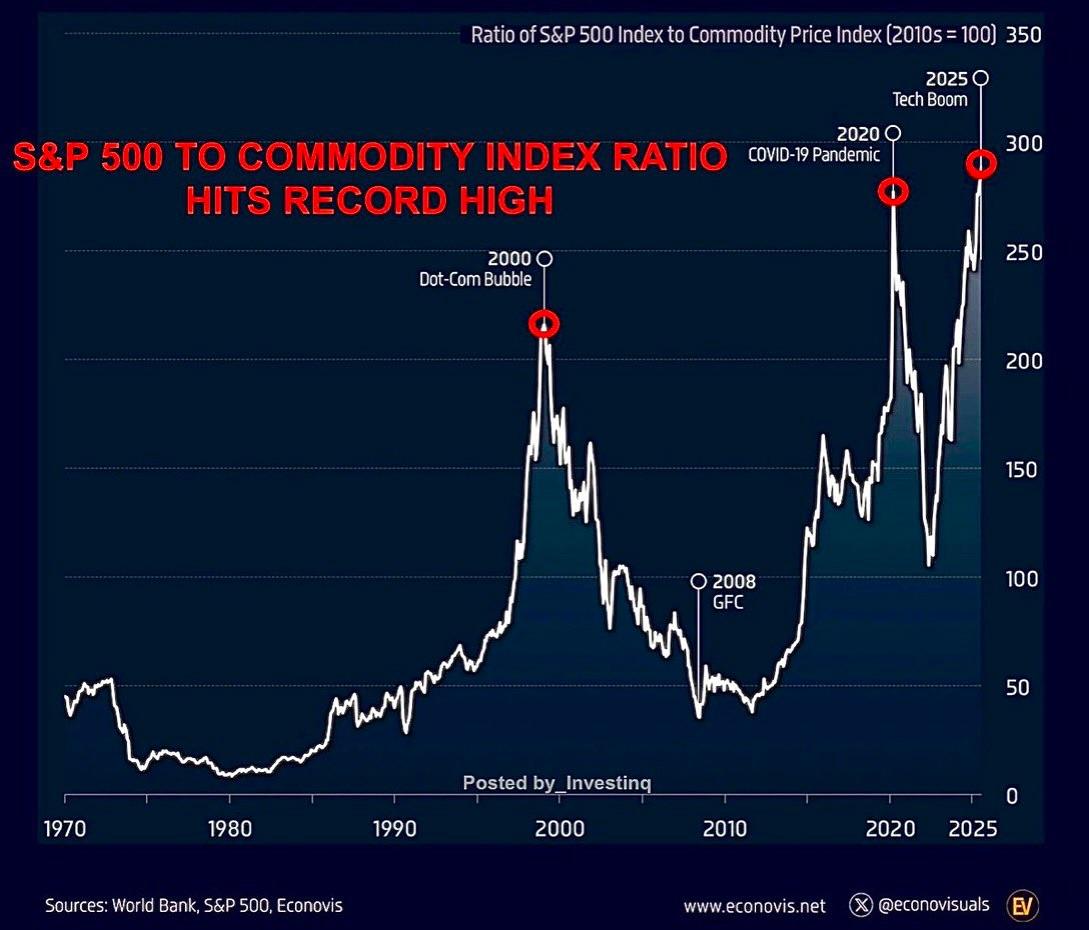

The S&P 500 to Commodity Index ratio has just hit an all-time high surpassing even the peaks of the Dot-Com Bubble and the 2020 surge.

Every spike in this chart tells a story:

2000 was tech euphoria.

2008 was the global financial crisis aftermath.

2020 was extremes.

And now, 2025 another tech-fuelled boom pushing equities far ahead of real assets.

Whenever this ratio stretches too far, history suggests a rebalancing between financial assets and hard commodities isn’t far behind.

#SP500 #Commodities #Markets #Investing #Finance #StockMarket #Macro #Economy #Wealth #FinancialMarkets #Inflation #Assets

Every spike in this chart tells a story:

2000 was tech euphoria.

2008 was the global financial crisis aftermath.

2020 was extremes.

And now, 2025 another tech-fuelled boom pushing equities far ahead of real assets.

Whenever this ratio stretches too far, history suggests a rebalancing between financial assets and hard commodities isn’t far behind.

#SP500 #Commodities #Markets #Investing #Finance #StockMarket #Macro #Economy #Wealth #FinancialMarkets #Inflation #Assets

The S&P 500 to Commodity Index ratio has just hit an all-time high surpassing even the peaks of the Dot-Com Bubble and the 2020 surge.

Every spike in this chart tells a story:

2000 was tech euphoria.

2008 was the global financial crisis aftermath.

2020 was extremes.

And now, 2025 another tech-fuelled boom pushing equities far ahead of real assets.

Whenever this ratio stretches too far, history suggests a rebalancing between financial assets and hard commodities isn’t far behind.

#SP500 #Commodities #Markets #Investing #Finance #StockMarket #Macro #Economy #Wealth #FinancialMarkets #Inflation #Assets

·338 Views

·0 Reviews