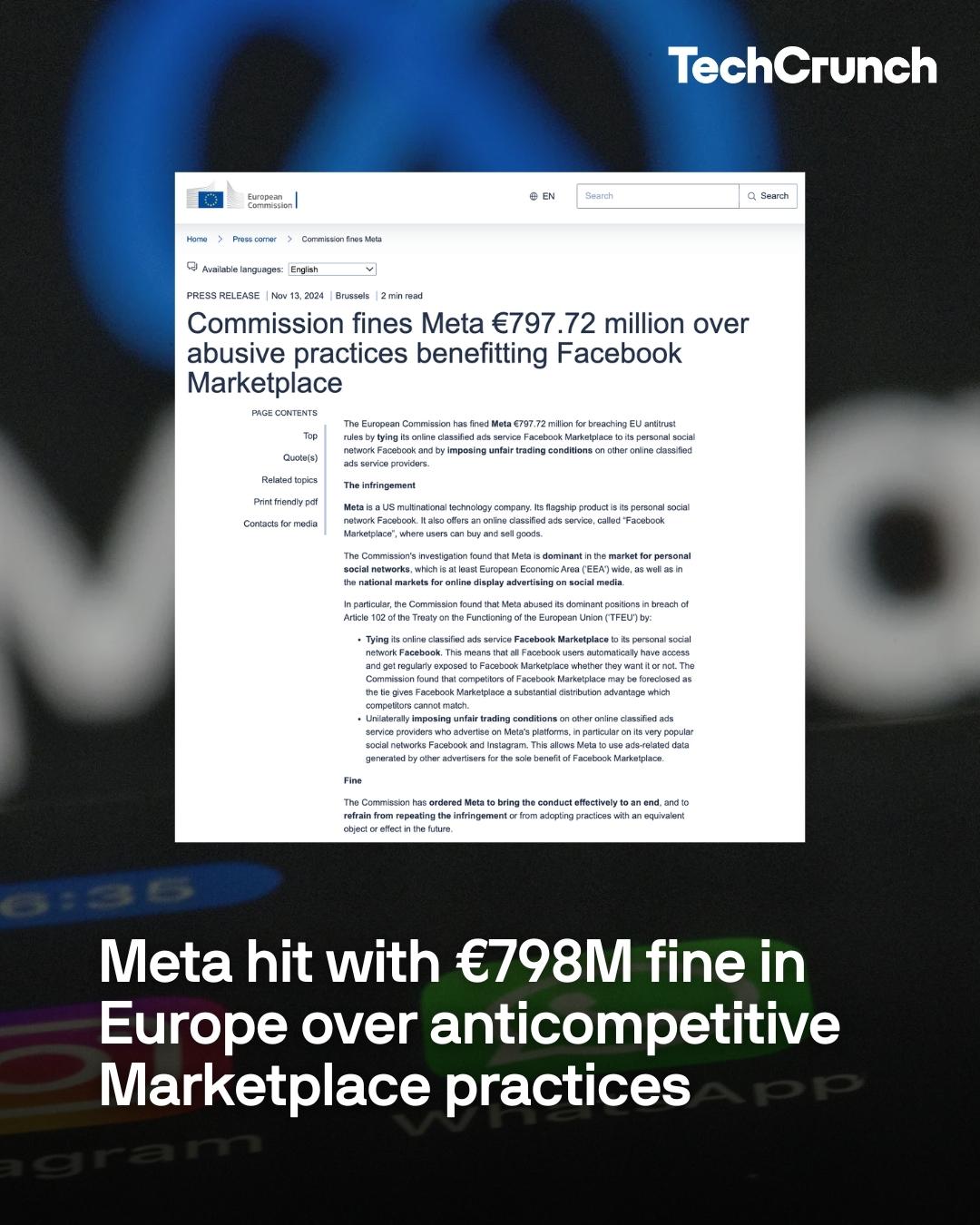

Meta, the parent of Facebook, Instagram and WhatsApp, has been hit with yet another huge regulatory fine in Europe, this time over abusive practices related to Facebook Marketplace.

The European Commission announced that it would fine Meta €797.72 million — nearly $840 million — for breaching EU antitrust rules connected to how it ties its online classified ads service, Facebook Marketplace, to Facebook itself, creating “unfair trading conditions” for other providers of classifieds online.

The fine is the latest installment of a case that dates back to June 2021. In December 2022, the regulators had determined that Facebook Marketplace violated antitrust rules. Today, it’s issuing the penalty for that violation.

Read more on Meta's €798M fine at the link in the bio

Article by Ingrid Lunden

Image Credits: Jens Büttner / picture alliance / Getty Images

#TechCrunch #technews #Meta #MarkZuckerberg #socialmedia

The European Commission announced that it would fine Meta €797.72 million — nearly $840 million — for breaching EU antitrust rules connected to how it ties its online classified ads service, Facebook Marketplace, to Facebook itself, creating “unfair trading conditions” for other providers of classifieds online.

The fine is the latest installment of a case that dates back to June 2021. In December 2022, the regulators had determined that Facebook Marketplace violated antitrust rules. Today, it’s issuing the penalty for that violation.

Read more on Meta's €798M fine at the link in the bio

Article by Ingrid Lunden

Image Credits: Jens Büttner / picture alliance / Getty Images

#TechCrunch #technews #Meta #MarkZuckerberg #socialmedia

Meta, the parent of Facebook, Instagram and WhatsApp, has been hit with yet another huge regulatory fine in Europe, this time over abusive practices related to Facebook Marketplace.

The European Commission announced that it would fine Meta €797.72 million — nearly $840 million — for breaching EU antitrust rules connected to how it ties its online classified ads service, Facebook Marketplace, to Facebook itself, creating “unfair trading conditions” for other providers of classifieds online.

The fine is the latest installment of a case that dates back to June 2021. In December 2022, the regulators had determined that Facebook Marketplace violated antitrust rules. Today, it’s issuing the penalty for that violation.

Read more on Meta's €798M fine at the link in the bio 👆

Article by Ingrid Lunden

Image Credits: Jens Büttner / picture alliance / Getty Images

#TechCrunch #technews #Meta #MarkZuckerberg #socialmedia

·557 Vue

·0 Aperçu