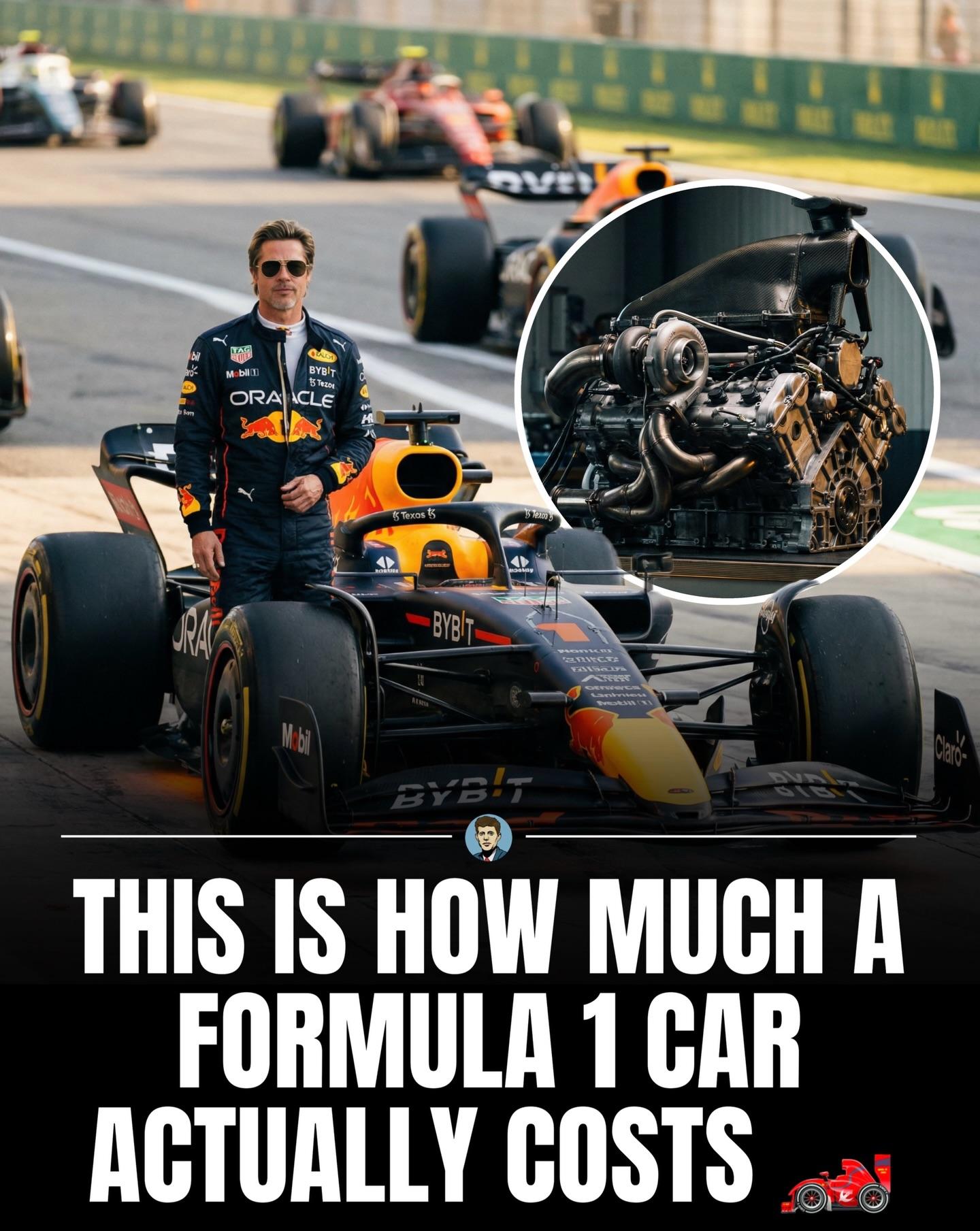

This is how much an F1 car costs: From the driver halo, priced at around $17,000, to the heart of the machine—the turbocharged engine, which can reach an astounding $10,500,000—every part of a Formula 1 car comes with a premium price. The halo protects the driver in high-impact situations, while the engine delivers unmatched performance at speeds exceeding 200 mph.

But the costs don’t stop there. The chassis, crafted from ultra-light carbon fiber, can run into hundreds of thousands of dollars. Each front wing can cost more than some road cars, and teams often bring multiple spares to every race weekend. Even the steering wheel—packed with sensors, displays, and over 20 controls—can cost tens of thousands on its own.

Altogether, an F1 car can exceed tens of millions of dollars, reflecting the incredible engineering, safety systems, and technology that push the limits of modern motorsport.

-

#F1Tech #Formula1 #MotorsportEngineering #RaceCarFacts #F1Costs

But the costs don’t stop there. The chassis, crafted from ultra-light carbon fiber, can run into hundreds of thousands of dollars. Each front wing can cost more than some road cars, and teams often bring multiple spares to every race weekend. Even the steering wheel—packed with sensors, displays, and over 20 controls—can cost tens of thousands on its own.

Altogether, an F1 car can exceed tens of millions of dollars, reflecting the incredible engineering, safety systems, and technology that push the limits of modern motorsport.

-

#F1Tech #Formula1 #MotorsportEngineering #RaceCarFacts #F1Costs

This is how much an F1 car costs: From the driver halo, priced at around $17,000, to the heart of the machine—the turbocharged engine, which can reach an astounding $10,500,000—every part of a Formula 1 car comes with a premium price. The halo protects the driver in high-impact situations, while the engine delivers unmatched performance at speeds exceeding 200 mph.

But the costs don’t stop there. The chassis, crafted from ultra-light carbon fiber, can run into hundreds of thousands of dollars. Each front wing can cost more than some road cars, and teams often bring multiple spares to every race weekend. Even the steering wheel—packed with sensors, displays, and over 20 controls—can cost tens of thousands on its own.

Altogether, an F1 car can exceed tens of millions of dollars, reflecting the incredible engineering, safety systems, and technology that push the limits of modern motorsport.

-

#F1Tech #Formula1 #MotorsportEngineering #RaceCarFacts #F1Costs

·113 مشاهدة

·0 معاينة