People say simplicity is a choice — and here’s living proof.

In a heartfelt post on X, user Rajiv Mehta shared a video that quietly went viral. In it, an elderly man in a rural village—clad in modest, traditional attire—revealed something astonishing:

An elderly man in a rural village, dressed in the most modest attire, lives a life free of luxuries. No cars. No fancy houses. No flex.

But when a casual conversation with him went viral online, the world was shocked.

He revealed he holds shares worth over ₹100 crore!

His portfolio:

• ₹80 Cr in L&T

• ₹21 Cr in Ultratech Cement

• ₹1 Cr in Karnataka Bank

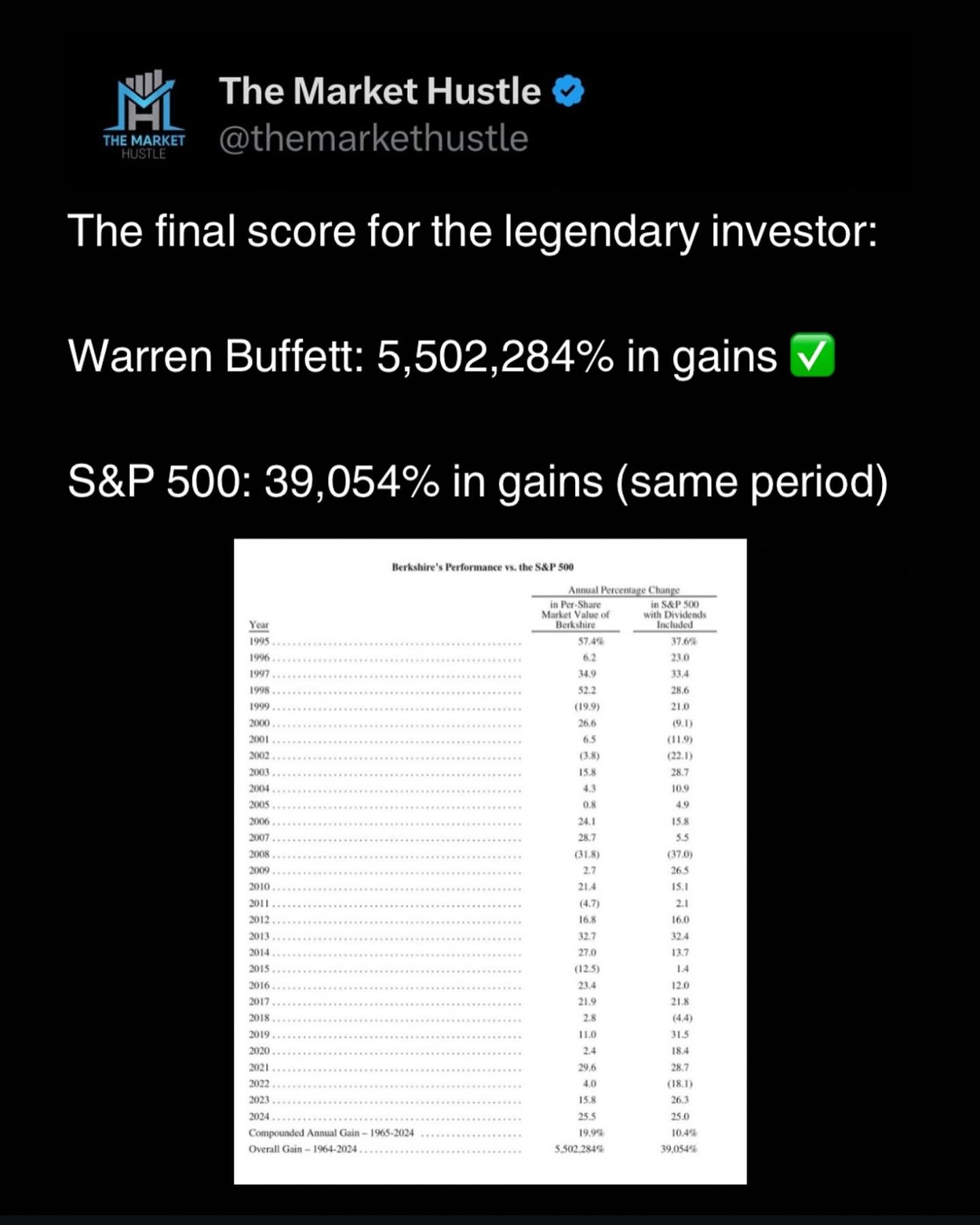

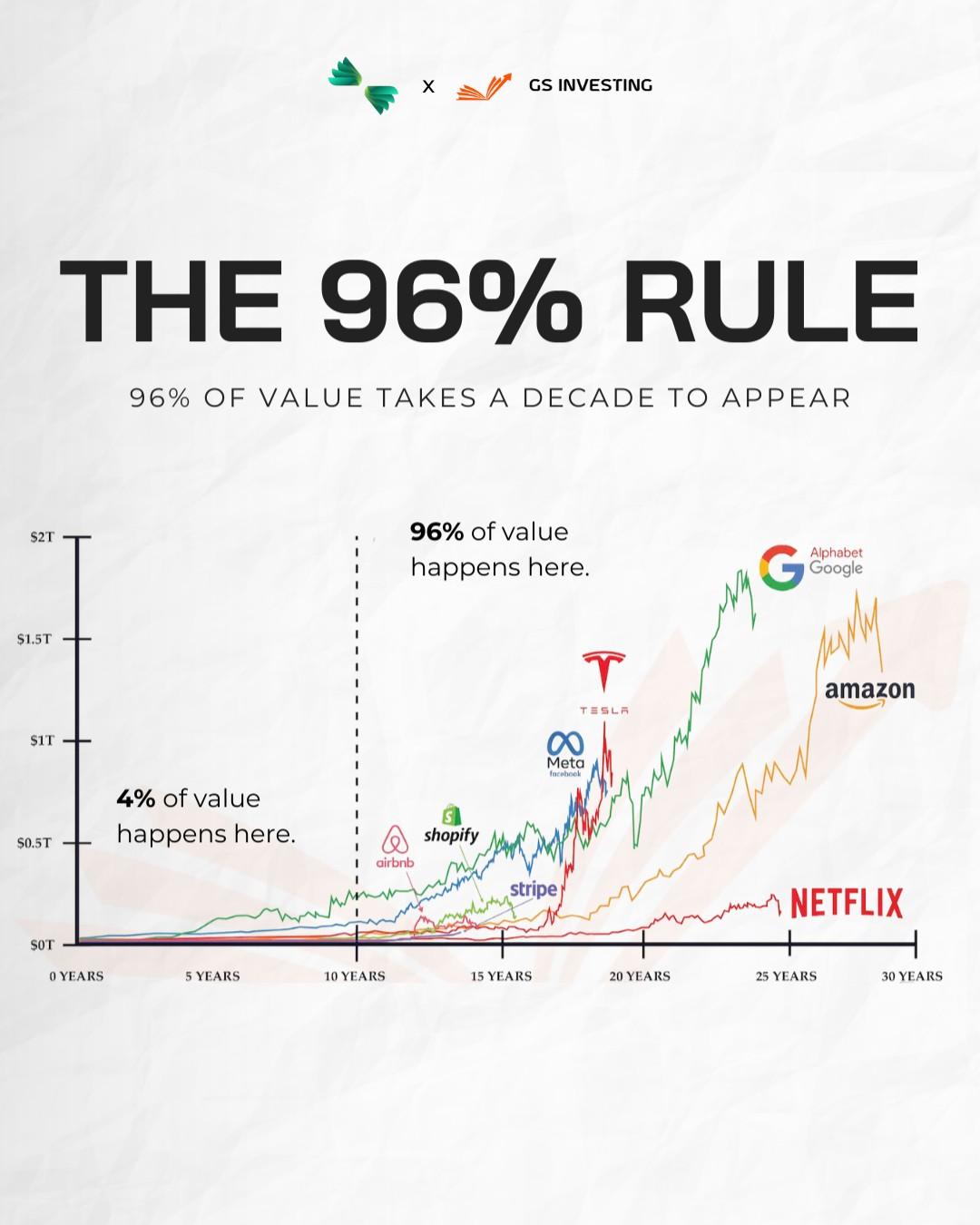

No expensive lifestyle. No big show-off. Just discipline, patience, and the magic of compounding.

The lesson?

True wealth isn’t always visible. Sometimes, the richest people live the simplest lives.

Would you choose simplicity if you had ₹100 crore?

Follow @marketing.growmatics for more

#SimpleLiving #WealthWisdom #InvestingLessons #ViralStory #StockMarketIndia #CompoundingMagic #FinancialFreedom #IndiaRising #Simplicity #InvestSmart #MarketingGrowmaticsPeople say simplicity is a choice — and here’s living proof.

In a heartfelt post on X, user Rajiv Mehta shared a video that quietly went viral. In it, an elderly man in a rural village—clad in modest, traditional attire—revealed something astonishing:

An elderly man in a rural village, dressed in the most modest attire, lives a life free of luxuries. No cars. No fancy houses. No flex.

But when a casual conversation with him went viral online, the world was shocked.

👉 He revealed he holds shares worth over ₹100 crore!

His portfolio:

• ₹80 Cr in L&T

• ₹21 Cr in Ultratech Cement

• ₹1 Cr in Karnataka Bank

No expensive lifestyle. No big show-off. Just discipline, patience, and the magic of compounding. 🌱

💭 The lesson?

True wealth isn’t always visible. Sometimes, the richest people live the simplest lives.

Would you choose simplicity if you had ₹100 crore? 👀

Follow @marketing.growmatics for more

#SimpleLiving #WealthWisdom #InvestingLessons #ViralStory #StockMarketIndia #CompoundingMagic #FinancialFreedom #IndiaRising #Simplicity #InvestSmart #MarketingGrowmatics