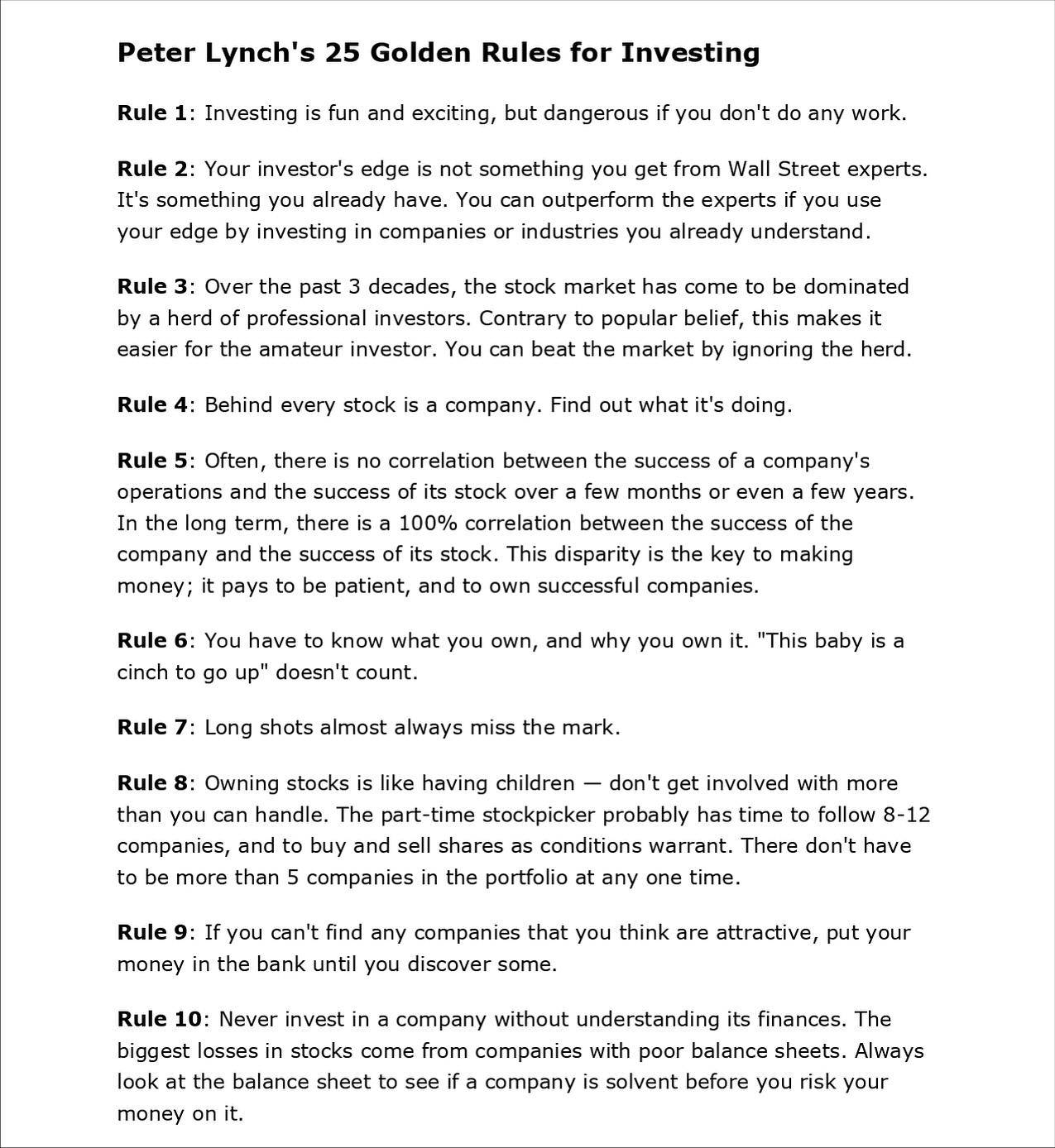

Timeless investing wisdom from one of the greatest Peter Lynch.

These 25 rules don’t just teach you how to invest,

they teach you how to think about investing.

The lesson that never fades:

You don’t need to outsmart Wall Street.

You just need to understand what you own,

be patient longer than others,

and stay calm when everyone else panics.

Because in the long run, the market rewards clarity, not noise.

#PeterLynch #InvestingWisdom #ValueInvesting #LongTermInvestor #FinancialEducation #StockMarketTips #InvestingMindset #WealthBuilding #FinanceCommunity #MarketPsychology

These 25 rules don’t just teach you how to invest,

they teach you how to think about investing.

The lesson that never fades:

You don’t need to outsmart Wall Street.

You just need to understand what you own,

be patient longer than others,

and stay calm when everyone else panics.

Because in the long run, the market rewards clarity, not noise.

#PeterLynch #InvestingWisdom #ValueInvesting #LongTermInvestor #FinancialEducation #StockMarketTips #InvestingMindset #WealthBuilding #FinanceCommunity #MarketPsychology

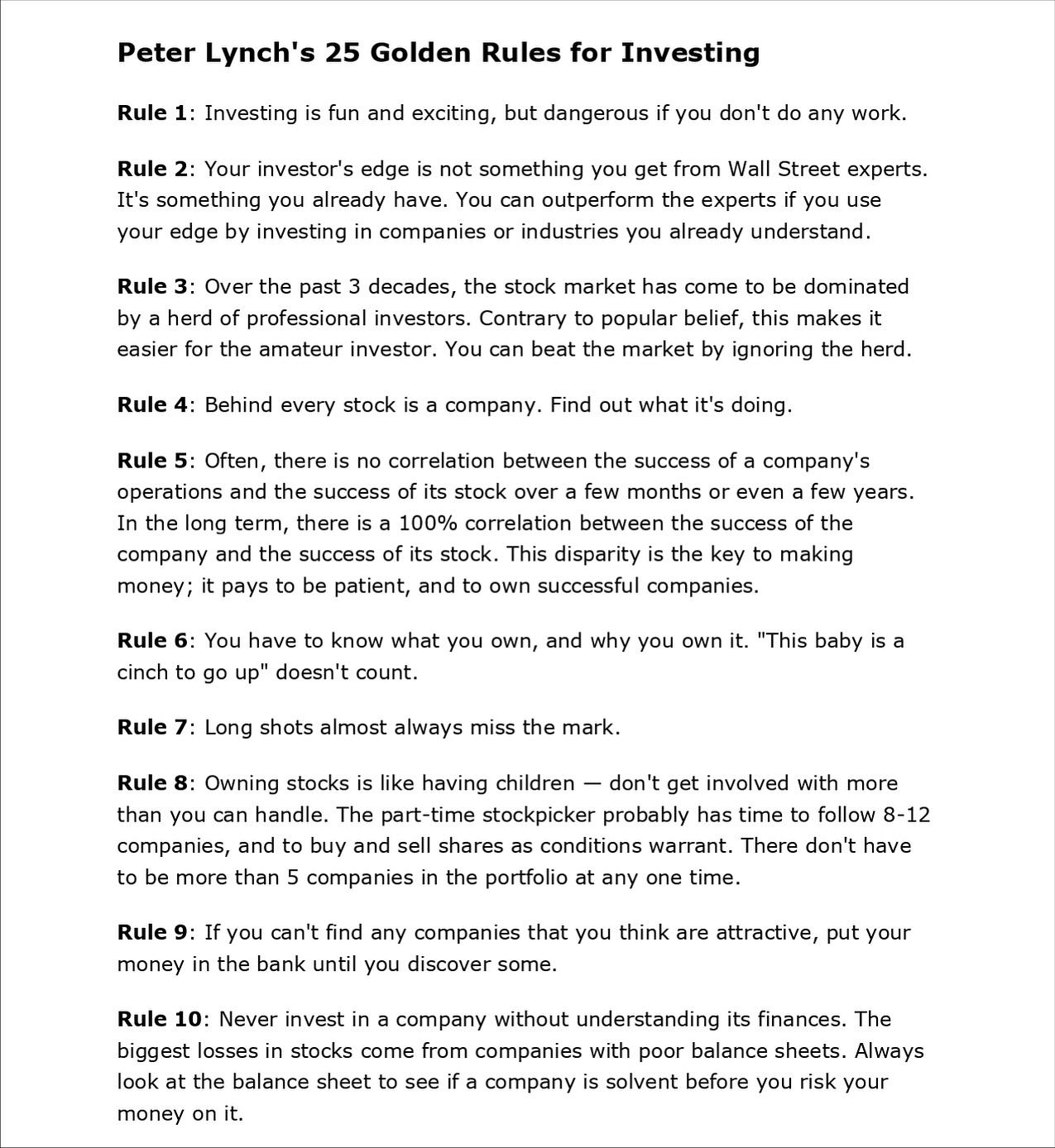

Timeless investing wisdom from one of the greatest Peter Lynch.

These 25 rules don’t just teach you how to invest,

they teach you how to think about investing.

The lesson that never fades:

You don’t need to outsmart Wall Street.

You just need to understand what you own,

be patient longer than others,

and stay calm when everyone else panics.

Because in the long run, the market rewards clarity, not noise.

#PeterLynch #InvestingWisdom #ValueInvesting #LongTermInvestor #FinancialEducation #StockMarketTips #InvestingMindset #WealthBuilding #FinanceCommunity #MarketPsychology

·162 Views

·0 Vista previa