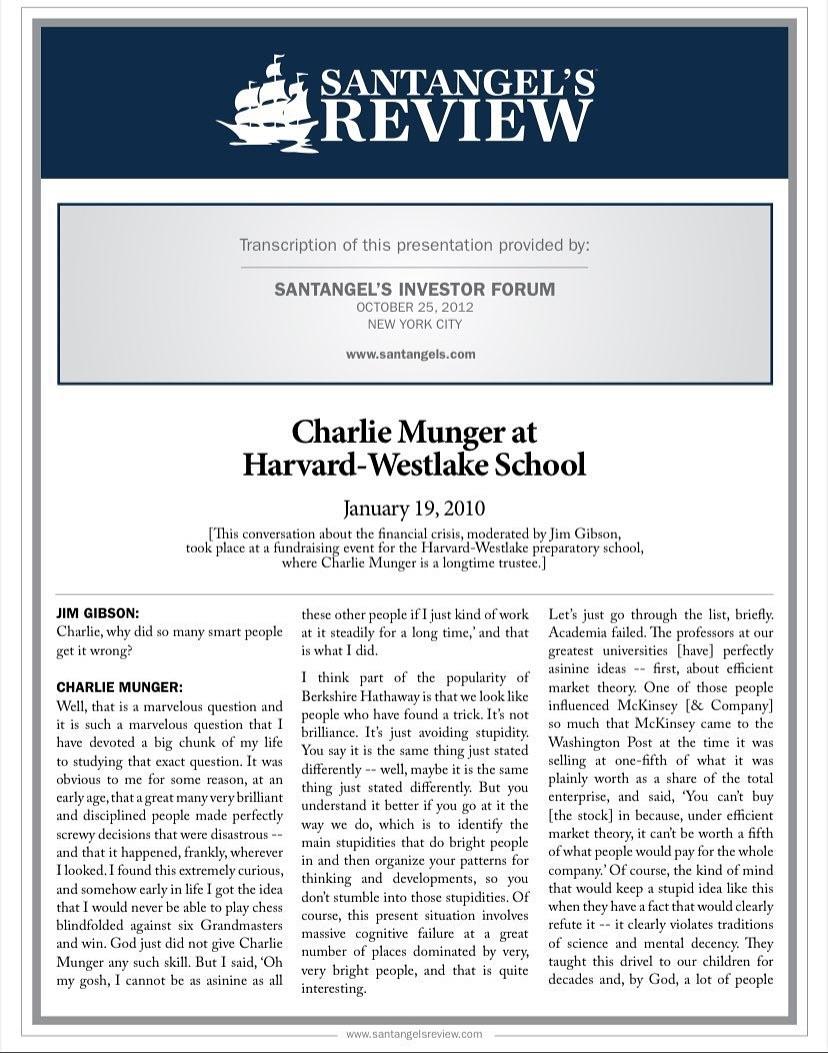

Charlie Munger’s timeless wisdom still as sharp today as it was in 2010.

In this conversation at Harvard-Westlake, Munger dissected why even the smartest people make terrible decisions, how academia can lead entire generations astray, and why true investing success comes from independent thinking and avoiding stupidity rather than chasing brilliance.

His clarity on markets, psychology, and human behavior remains unmatched a reminder that wisdom often lies in simplicity and discipline.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestorMindset #FinancialWisdom #BehavioralFinance #InvestmentPhilosophy #LongTermThinking #SantangelsReview

In this conversation at Harvard-Westlake, Munger dissected why even the smartest people make terrible decisions, how academia can lead entire generations astray, and why true investing success comes from independent thinking and avoiding stupidity rather than chasing brilliance.

His clarity on markets, psychology, and human behavior remains unmatched a reminder that wisdom often lies in simplicity and discipline.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestorMindset #FinancialWisdom #BehavioralFinance #InvestmentPhilosophy #LongTermThinking #SantangelsReview

Charlie Munger’s timeless wisdom still as sharp today as it was in 2010.

In this conversation at Harvard-Westlake, Munger dissected why even the smartest people make terrible decisions, how academia can lead entire generations astray, and why true investing success comes from independent thinking and avoiding stupidity rather than chasing brilliance.

His clarity on markets, psychology, and human behavior remains unmatched a reminder that wisdom often lies in simplicity and discipline.

#CharlieMunger #ValueInvesting #WarrenBuffett #InvestorMindset #FinancialWisdom #BehavioralFinance #InvestmentPhilosophy #LongTermThinking #SantangelsReview

·158 Views

·0 previzualizare