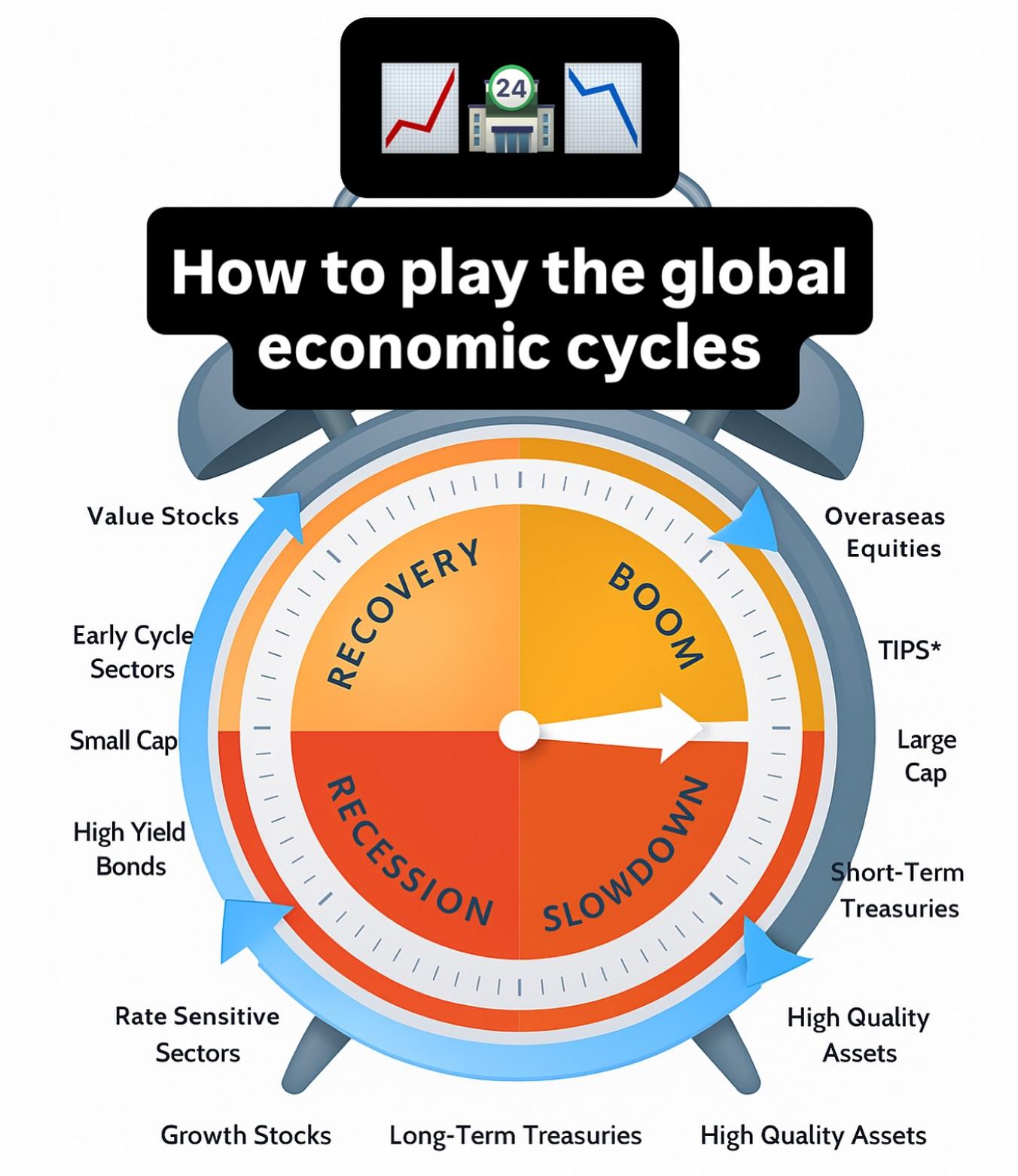

a simplified yet strategic view of how investors might align their portfolios with different phases of the global economic cycle. Each stage—recession, recovery, boom, and slowdown—tends to favor certain asset classes based on macro conditions and capital flows.

During a recession, when growth contracts and uncertainty is high, investors often rotate into long-term treasuries and high-quality assets that offer stability. Growth stocks can also be favored as markets begin to anticipate recovery and future earnings potential.

As the economy shifts into recovery, risk appetite begins to return. Value stocks, early-cycle sectors, small caps, and high-yield bonds typically outperform as confidence builds and monetary policy remains supportive.

In the boom phase, economic activity is strong and earnings growth broad-based. Investors tend to favor large caps, TIPS (inflation-protected securities), and overseas equities, which benefit from global demand and reflation.

As the cycle enters a slowdown, caution returns. Capital tends to rotate back into short-term treasuries and high-quality assets, which are better positioned to weather declining growth or margin pressures.

The cyclical rotation shown here underscores the value of staying flexible and understanding how macro trends shape relative performance across asset classes.

#stockmarket #macroeconomics #hedgefunds #nasdaq #qqq #moneymarket #stocktrading #GlobalMarkets #AssetAllocation #InvestmentStrategy #MarketCycles #MacroInsights #EconomicOutlook #PortfolioManagement

During a recession, when growth contracts and uncertainty is high, investors often rotate into long-term treasuries and high-quality assets that offer stability. Growth stocks can also be favored as markets begin to anticipate recovery and future earnings potential.

As the economy shifts into recovery, risk appetite begins to return. Value stocks, early-cycle sectors, small caps, and high-yield bonds typically outperform as confidence builds and monetary policy remains supportive.

In the boom phase, economic activity is strong and earnings growth broad-based. Investors tend to favor large caps, TIPS (inflation-protected securities), and overseas equities, which benefit from global demand and reflation.

As the cycle enters a slowdown, caution returns. Capital tends to rotate back into short-term treasuries and high-quality assets, which are better positioned to weather declining growth or margin pressures.

The cyclical rotation shown here underscores the value of staying flexible and understanding how macro trends shape relative performance across asset classes.

#stockmarket #macroeconomics #hedgefunds #nasdaq #qqq #moneymarket #stocktrading #GlobalMarkets #AssetAllocation #InvestmentStrategy #MarketCycles #MacroInsights #EconomicOutlook #PortfolioManagement

a simplified yet strategic view of how investors might align their portfolios with different phases of the global economic cycle. Each stage—recession, recovery, boom, and slowdown—tends to favor certain asset classes based on macro conditions and capital flows.

During a recession, when growth contracts and uncertainty is high, investors often rotate into long-term treasuries and high-quality assets that offer stability. Growth stocks can also be favored as markets begin to anticipate recovery and future earnings potential.

As the economy shifts into recovery, risk appetite begins to return. Value stocks, early-cycle sectors, small caps, and high-yield bonds typically outperform as confidence builds and monetary policy remains supportive.

In the boom phase, economic activity is strong and earnings growth broad-based. Investors tend to favor large caps, TIPS (inflation-protected securities), and overseas equities, which benefit from global demand and reflation.

As the cycle enters a slowdown, caution returns. Capital tends to rotate back into short-term treasuries and high-quality assets, which are better positioned to weather declining growth or margin pressures.

The cyclical rotation shown here underscores the value of staying flexible and understanding how macro trends shape relative performance across asset classes.

#stockmarket #macroeconomics #hedgefunds #nasdaq #qqq #moneymarket #stocktrading #GlobalMarkets #AssetAllocation #InvestmentStrategy #MarketCycles #MacroInsights #EconomicOutlook #PortfolioManagement

·1K Views

·0 Reviews