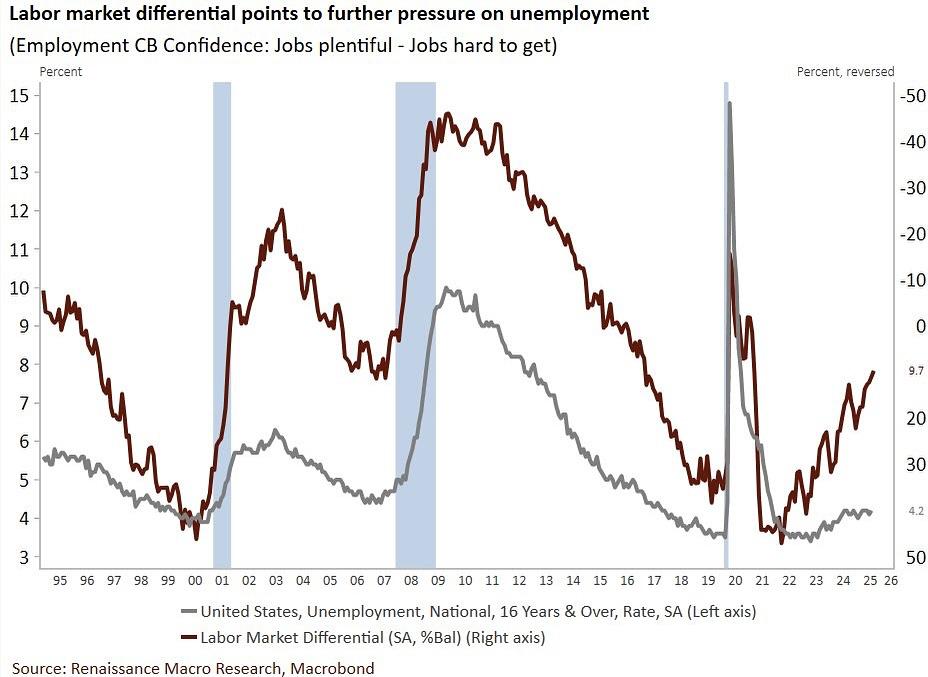

Consumers are turning more cautious on the labour market. The Labor Differential, which measures the gap between those saying “jobs are plentiful” versus “jobs are hard to get,” dropped to just 9.7 in August its lowest reading in years. The shift reflects a growing sense that the market is softening, with more people now reporting that finding work is getting tougher.

This matters because the Labor Differential has historically been a leading indicator for unemployment trends. With consumer sentiment weakening, pressure on the broader jobs market could build further in the months ahead, challenging the resilience of the economy.

#JobsReport #Unemployment #LaborMarket #Economy #Recession #Macro #Markets #Employment #JobMarket #EconomicOutlook

This matters because the Labor Differential has historically been a leading indicator for unemployment trends. With consumer sentiment weakening, pressure on the broader jobs market could build further in the months ahead, challenging the resilience of the economy.

#JobsReport #Unemployment #LaborMarket #Economy #Recession #Macro #Markets #Employment #JobMarket #EconomicOutlook

Consumers are turning more cautious on the labour market. The Labor Differential, which measures the gap between those saying “jobs are plentiful” versus “jobs are hard to get,” dropped to just 9.7 in August its lowest reading in years. The shift reflects a growing sense that the market is softening, with more people now reporting that finding work is getting tougher.

This matters because the Labor Differential has historically been a leading indicator for unemployment trends. With consumer sentiment weakening, pressure on the broader jobs market could build further in the months ahead, challenging the resilience of the economy.

#JobsReport #Unemployment #LaborMarket #Economy #Recession #Macro #Markets #Employment #JobMarket #EconomicOutlook

·299 Vue

·0 Aperçu