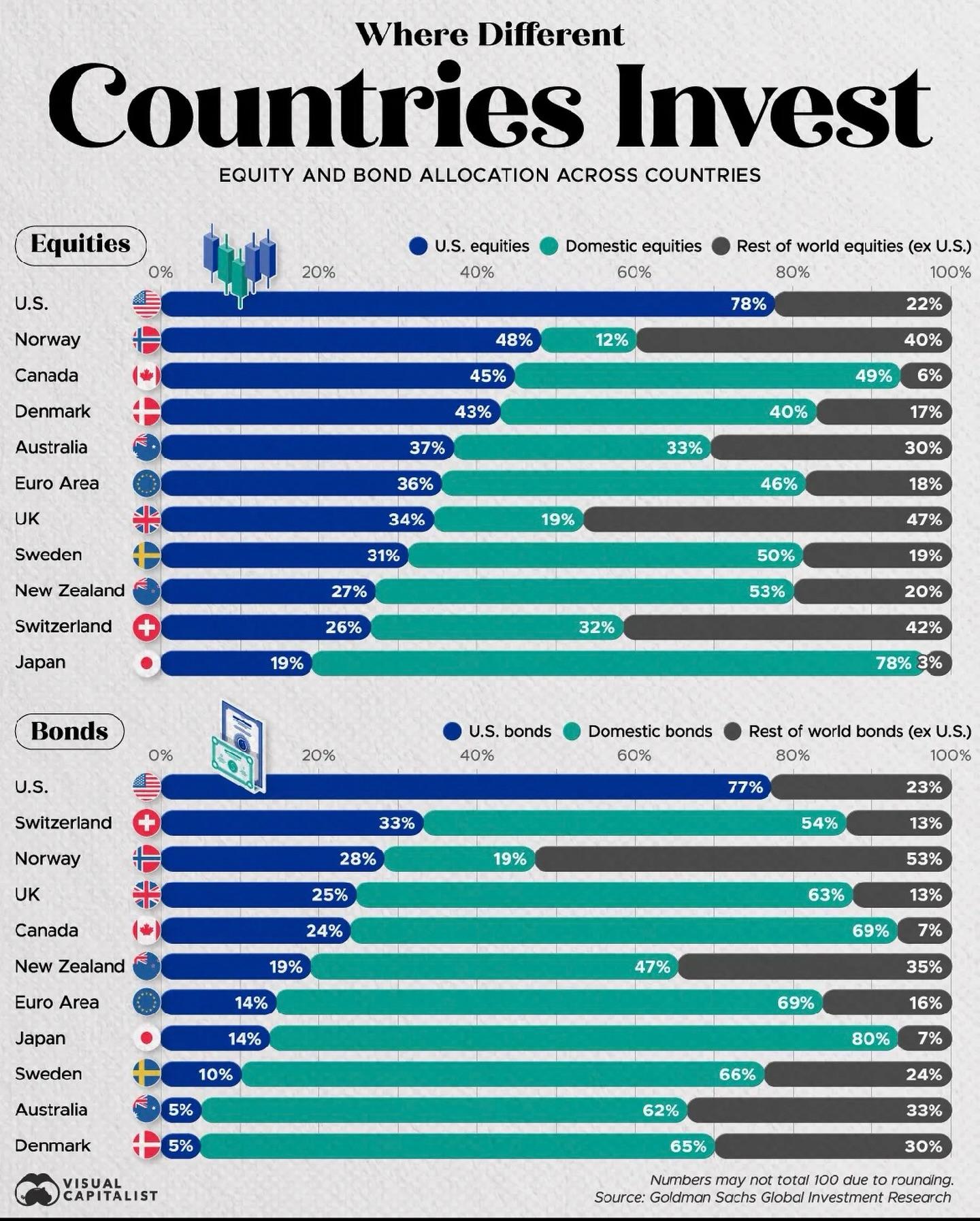

Americans invest almost exclusively in America.

In equities, U.S. investors keep 78% of their exposure at home. Norway, Canada, Denmark, Switzerland, Japan all far more diversified across the world.

But the real story is in bonds.

Look at the bottom half of the chart:

The U.S. owns 77% U.S. bonds and barely any foreign debt.

Meanwhile:

Switzerland holds 54% domestic bonds and spreads the rest internationally.

Norway holds 53% foreign bonds.

Japan allocates 80% abroad.

America is the most concentrated bond investor on earth.

Why?

Because the U.S. doesn’t need foreign bonds.

It is the bond market.

The dollar is the world’s reserve currency.

U.S. Treasuries are the safest collateral in the global system.

Every crisis eventually forces capital to flee back to the American bond market.

European pension funds, Asian institutions, oil sovereign funds, Latin America they all hedge their risk using U.S. debt.

That creates a feedback loop: foreign demand keeps Treasuries liquid, deep, and stable.

But here’s the paradox:

This is the privilege that makes American investors lazy.

Most countries are forced to diversify internationally.

They don’t trust their own central banks, governments, or currencies to protect capital in a downturn.

The U.S. investor never had to learn that lesson.

So they build portfolios that only work if the last 40 years repeat.

If interest rates change structurally…

If debt burdens force fiscal tightening…

If the dollar loses some share of global trade settlement…

If other bond markets become viable alternatives…

That concentration risk finally matters.

Diversification isn’t about chasing foreign alpha.

It’s about not betting your entire future on one country’s political system, monetary policy, and demographic trajectory.

You never hedge when you’re comfortable.

You hedge when you realize you might not always be.

#Investing #GlobalMarkets #FixedIncome #Bonds #Equities #Diversification #Portfolio #Wealth #Finance #Macro #USMarkets

In equities, U.S. investors keep 78% of their exposure at home. Norway, Canada, Denmark, Switzerland, Japan all far more diversified across the world.

But the real story is in bonds.

Look at the bottom half of the chart:

The U.S. owns 77% U.S. bonds and barely any foreign debt.

Meanwhile:

Switzerland holds 54% domestic bonds and spreads the rest internationally.

Norway holds 53% foreign bonds.

Japan allocates 80% abroad.

America is the most concentrated bond investor on earth.

Why?

Because the U.S. doesn’t need foreign bonds.

It is the bond market.

The dollar is the world’s reserve currency.

U.S. Treasuries are the safest collateral in the global system.

Every crisis eventually forces capital to flee back to the American bond market.

European pension funds, Asian institutions, oil sovereign funds, Latin America they all hedge their risk using U.S. debt.

That creates a feedback loop: foreign demand keeps Treasuries liquid, deep, and stable.

But here’s the paradox:

This is the privilege that makes American investors lazy.

Most countries are forced to diversify internationally.

They don’t trust their own central banks, governments, or currencies to protect capital in a downturn.

The U.S. investor never had to learn that lesson.

So they build portfolios that only work if the last 40 years repeat.

If interest rates change structurally…

If debt burdens force fiscal tightening…

If the dollar loses some share of global trade settlement…

If other bond markets become viable alternatives…

That concentration risk finally matters.

Diversification isn’t about chasing foreign alpha.

It’s about not betting your entire future on one country’s political system, monetary policy, and demographic trajectory.

You never hedge when you’re comfortable.

You hedge when you realize you might not always be.

#Investing #GlobalMarkets #FixedIncome #Bonds #Equities #Diversification #Portfolio #Wealth #Finance #Macro #USMarkets

Americans invest almost exclusively in America.

In equities, U.S. investors keep 78% of their exposure at home. Norway, Canada, Denmark, Switzerland, Japan all far more diversified across the world.

But the real story is in bonds.

Look at the bottom half of the chart:

The U.S. owns 77% U.S. bonds and barely any foreign debt.

Meanwhile:

🇨🇭 Switzerland holds 54% domestic bonds and spreads the rest internationally.

🇳🇴 Norway holds 53% foreign bonds.

🇯🇵 Japan allocates 80% abroad.

America is the most concentrated bond investor on earth.

Why?

Because the U.S. doesn’t need foreign bonds.

It is the bond market.

The dollar is the world’s reserve currency.

U.S. Treasuries are the safest collateral in the global system.

Every crisis eventually forces capital to flee back to the American bond market.

European pension funds, Asian institutions, oil sovereign funds, Latin America they all hedge their risk using U.S. debt.

That creates a feedback loop: foreign demand keeps Treasuries liquid, deep, and stable.

But here’s the paradox:

This is the privilege that makes American investors lazy.

Most countries are forced to diversify internationally.

They don’t trust their own central banks, governments, or currencies to protect capital in a downturn.

The U.S. investor never had to learn that lesson.

So they build portfolios that only work if the last 40 years repeat.

If interest rates change structurally…

If debt burdens force fiscal tightening…

If the dollar loses some share of global trade settlement…

If other bond markets become viable alternatives…

That concentration risk finally matters.

Diversification isn’t about chasing foreign alpha.

It’s about not betting your entire future on one country’s political system, monetary policy, and demographic trajectory.

You never hedge when you’re comfortable.

You hedge when you realize you might not always be.

#Investing #GlobalMarkets #FixedIncome #Bonds #Equities #Diversification #Portfolio #Wealth #Finance #Macro #USMarkets

·12 Views

·0 önizleme