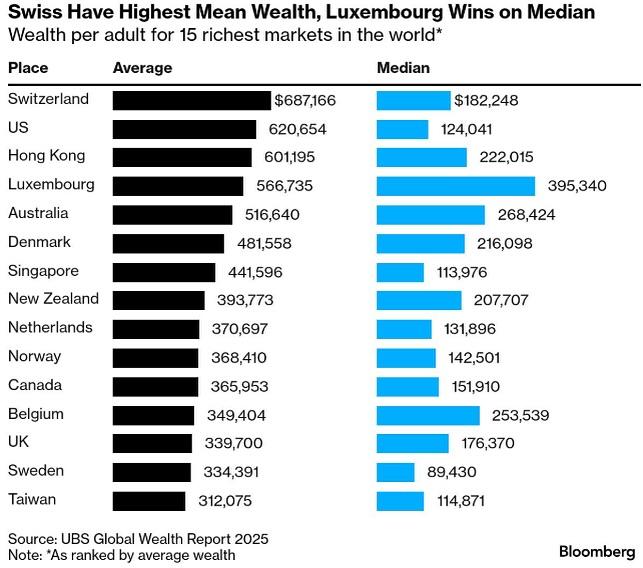

One out of 14 U.S. adults is now a millionaire

The U.S. counts almost 24 million adults with $1 million+ net worth. That’s about 40% of the world’s millionaires and more than Western Europe and Greater China combined.

Wealth continues to cluster in America, with more than 1,000 new U.S. millionaires emerging each day last year.

#Wealth #Millionaires #UnitedStates #Economy #Markets #PersonalFinance

The U.S. counts almost 24 million adults with $1 million+ net worth. That’s about 40% of the world’s millionaires and more than Western Europe and Greater China combined.

Wealth continues to cluster in America, with more than 1,000 new U.S. millionaires emerging each day last year.

#Wealth #Millionaires #UnitedStates #Economy #Markets #PersonalFinance

One out of 14 U.S. adults is now a millionaire 💰

The U.S. counts almost 24 million adults with $1 million+ net worth. That’s about 40% of the world’s millionaires and more than Western Europe and Greater China combined.

Wealth continues to cluster in America, with more than 1,000 new U.S. millionaires emerging each day last year.

#Wealth #Millionaires #UnitedStates #Economy #Markets #PersonalFinance

·152 Views

·0 Vista previa